Ahead Today

G3: US: initial jobless claims, S&P PMI survey, existing home sales; euro area PMI survey and consumer confidence

Asia: Malaysia CPI, India PMI, BOK policy rate decision

Market Highlights

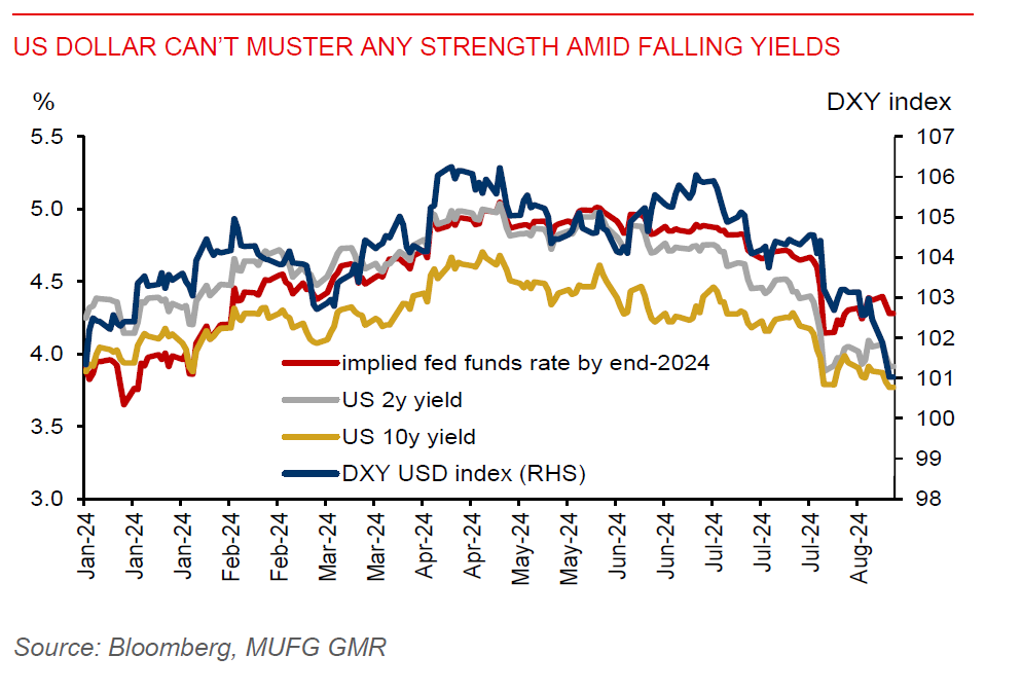

The DXY US dollar index has extended its decline, while the US 2-year and 10-year yields have also fallen by about 14bps and 11bps this week, respectively, to trade below the 4%-level. Bond traders are putting record bets on a Treasury rally which has been fuelled by US rate-cut expectations.

Preliminary data show US nonfarm payroll growth being revised down by 818,000 jobs or 68,000 jobs per month for the period from April 2023 to March 2024. This would mark the largest downward revision since 2009, suggesting more moderate employment growth ahead and policy rate cuts are likely to start in September. Prior to the revision, initial nonfarm payroll averaged 242,000 per month. But the revised pace is more likely to be around 174,000 jobs being added per month. This still shows a healthy rate of hiring in the US economy, but not as strong as initially thought.

Meanwhile, the FOMC minutes for the July meeting was dovish, with a vast majority of members seeing a September rate cut as likely. Some of them even saw the case for rate cuts in July. The balance of risks has also shifted towards the labour market, with policymakers seeing growing downside risks to employment while almost all of them expect disinflation to continue.

Regional FX

Asian currencies have held on to their recent strength amid continuing weakness in the US dollar, with the THB (+2%) leading gains in the region thus far this week. Gains of more than 1% against the US dollar were also seen in the MYR, PHP, IDR, TWD, and KRW. The Bank of Korea will be announcing its policy rate decision today. We expect the BoK to keep its policy rate unchanged, as policymakers are concerned about the renewed rise in household debt growth. Rising chip exports will bode well for growth, allowing BoK to remain patient on rate cuts. South Korea’s early trade data show exports rising by 18.5%yoy in the first 20 days of August, with chip exports particularly jumping by 42.5%yoy.