Ahead Today

G3: US mortgage applications, FOMC meeting minutes

Asia: Bank of Thailand and Bank of Indonesia policy meetings

Market Highlights

The DXY US dollar index has fallen by about 1% to the 101.50-level this week, erasing its year-to-date gains as US yields have continued to move lower. EURUSD has pushed higher above the 1.1100 handle, GBP is above 1.3000 per US dollar, while the yen has strengthened towards the 145.00-level against the US dollar, a level that is consistent with what the US-Japan yield differential would suggest.

Markets still expect about 4 US rate cuts in 2024, starting from September, as they remain concerned that labour market softness could be a harbinger of more significant weakness. The Bureau of Labour Statistics could revise lower the nonfarm payroll employment by about 300,000 to 1 million jobs over the period from April 2023 to March 2024. So, the labour market may not have been as strong. The New York Fed’s edition of Labor Market Survey has also recently showed that the share of individuals who are jobseekers in the past four weeks rose to 28.4% in July, reaching the highest level since March 2014. The average expected likelihood of becoming unemployed also rose to 4.4%, the highest since the series started in July 2014.

The latest FOMC meeting minutes will be released later today, which could provide clues of when the Fed may stop unwinding its balance sheet and the rate path.

Regional FX

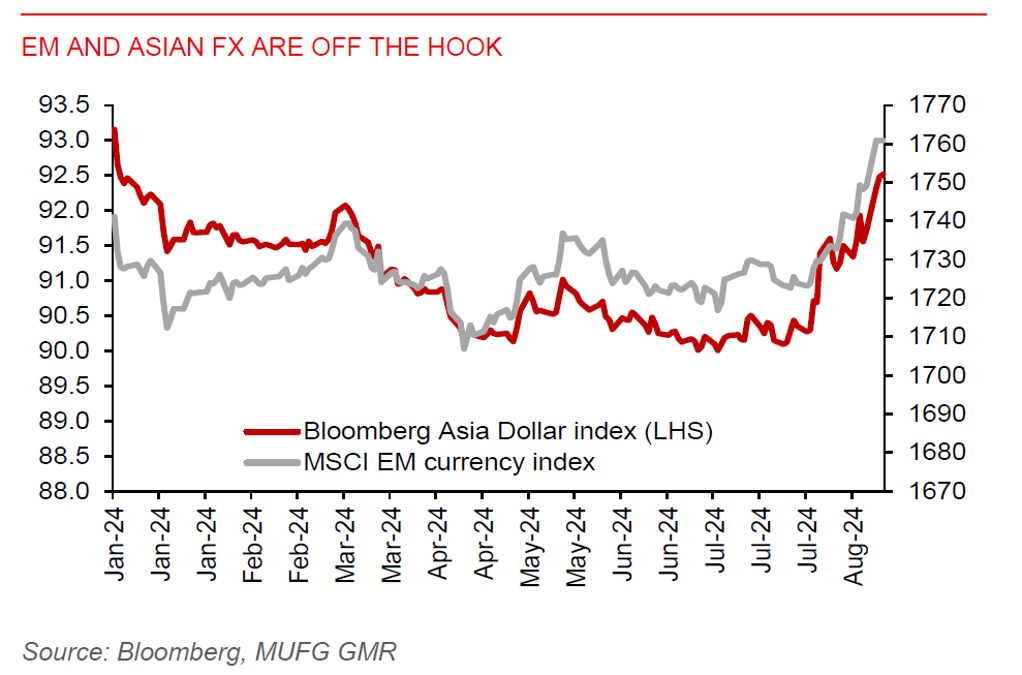

Asian currencies have extended their gains against the US dollar, led by the THB (+2.3%), IDR (+1.6%), and PHP (+1.2%) this week. Notably, the recent rally in the THB and IDR has almost erased losses this year, while the ringgit was up by 4.6% year to date. Bank of Thailand (BoT) and Bank of Indonesia (BI) will be announcing their policy rate decisions today. We expect both central banks to keep their policy rates unchanged. Thailand has a recent change in Prime Minister, and so the fate of the THB500bn digital wallet program currently remains unclear. We think BoT will continue with its neutral policy stance today while monitoring fiscal developments. And despite rupiah strength, we think BI will still hold rates at 6.25% today, as it will likely wait for the Fed to cut rates first before it considers doing so. Nonetheless, markets will look for any dovish shift in their policy statements or post-meeting press conferences.