Ahead Today

G3: US: 3rd reading for GDP and core PCE in Q1, initial jobless claims, durable goods order, 1st round of presidential debate; eurozone consumer confidence; Japan retail sales

Asia: China industrial profits, policy rate decision from Philippines

Market Highlights

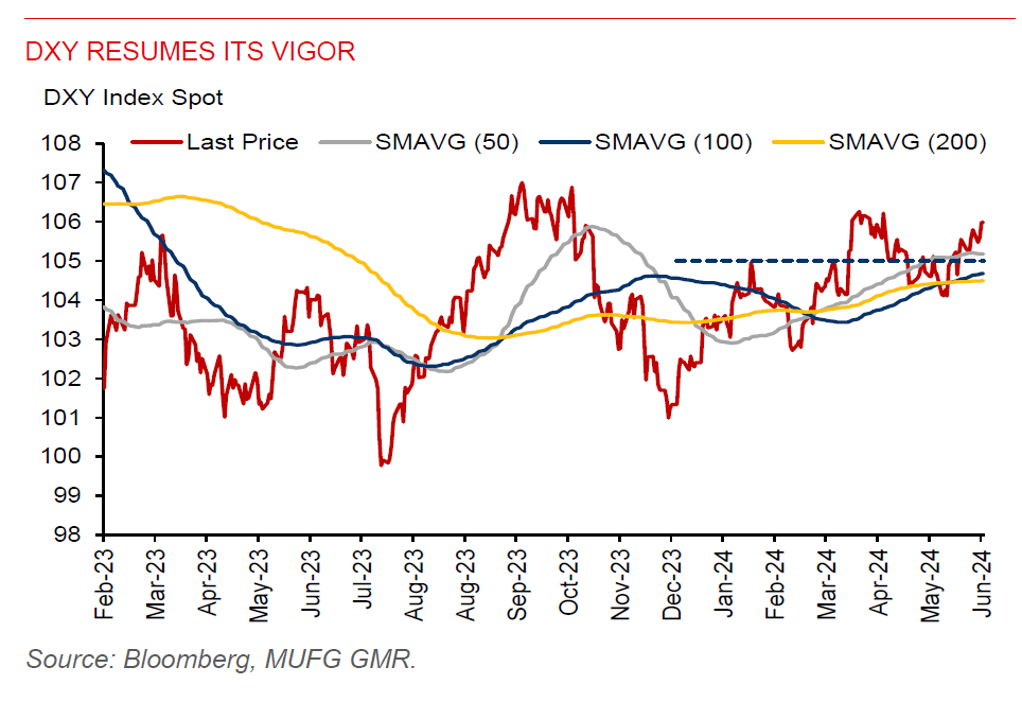

The DXY USD index has moved back above the 106 level. Momentum continues to favor a stronger USD for now. Near-term USD strength could also be supported by several factors. The US economy remains largely resilient. Market expectations for US rate cuts are more dovish than the Fed. A hawkish Fed also diverges from the policy rate cuts seen in other major central banks (e.g. SNB, BOC, ECB). Election risks in France have hurt the euro, while more euro downside could be in store. Notably, the USDJPY has traded beyond the 160 level, which will have negative implications for Asian currencies.

The key data highlight for the US today is the third estimate of Q1 GDP and core PCE. Markets expect only a slight upward revision of Q1 GDP to 1.4%qoq annualized vs 1.3% previously, while no revision is expected for core PCE, which stays at 3.6%qoq. A bigger highlight, due tomorrow, is the core PCE deflator. Price pressures in the US have showed signs of cooling, with CPI and PPI slowing in May. As such, the PCE core deflator for May will likely also show further softening. Still, we think the Fed will wait for more inflation data before deciding to cut rates. The Fed’s latest median dot plot only shows 1 rate cut for this year.

Regional FX

Asian FX remains under huge pressure amid high for longer US interest rates. A reversal of fortunes for regional currencies does not appear to be on the cards yet. China’s 10y bond yields have fallen to 2.22%, the lowest level since mid-2002, as markets stay cautious on China’s economy, despite recent policy positives. Markets also expect PBOC monetary easing, while the US presidential elections could throw up negative narratives about China. USDCNH revisited 7.3000 level, and a move higher to the next resistance level at 7.3500 seems plausible, with less than 5 months left to the US elections and yen weakness persisting. Another key highlight for Asia is the policy rate decision from the BSP. We expect BSP to stand pat at this meeting, given building inflation pressures and ongoing PHP weakness. The focus will also be the forward guidance on the BSP rate path ahead. BSP governor has signaled willingness to cut rates before the Fed, and possibly easing in August. A decidedly dovish BSP could lead to PHP falling as low as 60 against the US dollar.