Ahead Today

G3: ECB, US GDP 4Q, US Initial Jobless Claims

Asia:

Market Highlights

China’s central bank governor Pan Gongsheng said that China will cut the reserve requirement ratio for banks by 0.5pp within two weeks, and also hinted at more measures to come. This would release 1 trillion yuan of liquidity to the market. In addition, PBOC and the National Financial Regulatory Administration will allow property developers to pay down bonds and other loans using bank loans pledged against commercial property collateral, which could help ease liquidity constraints faced by developers.

Outside of China, Eurozone’s manufacturing PMIs somewhat stronger than expected at 46.6 (vs consensus 44.7), although it remained in contractionary territory. Meanwhile, the US S&P PMIs surprised on the upside at 52.3 (vs consensus of 51.0).

Overall, the Dollar weakened by 0.3%, Europe and China equity markets rose by more than 2% on the back of stimulus measures by China, while commodity prices such as Brent oil picked up to US$80/bbl.

Regional FX

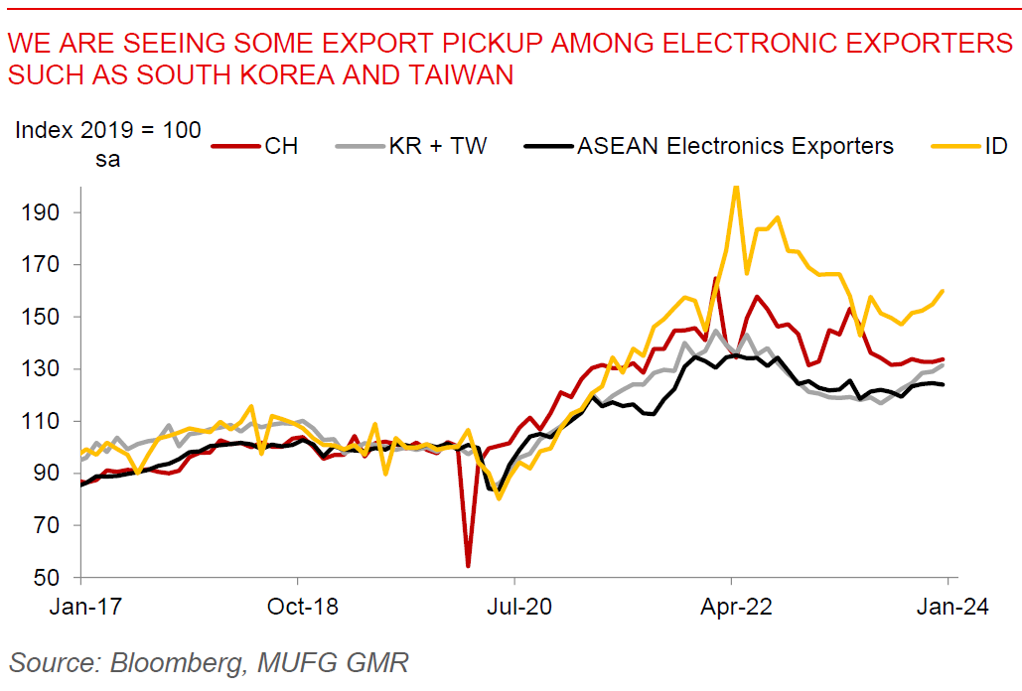

Asian FX was mixed against the Dollar on the back of the announcement around Chinese authorities’ support. USDCNH remained around 7.165, while IDR underperformed (-0.5%). Bank Negara Malaysia left its key policy rate unchanged but continued to signal uncertainty on the inflation outlook given upcoming changes to subsidies and price controls. Meanwhile, South Korea’s 4Q GDP rose slightly more than expected to 2.2%yoy (vs consensus 2.1%yoy), helped by a pickup in manufacturing activity. On that note, SK Hynix, one of the key memory chip producers in South Korea, reported a surprise operating profit boosted by strong sales of high-end memory chips for AI applications.