Ahead Today

G3: US mortgage applications, FOMC meeting minutes, euro area consumer confidence, Japan machine tool orders

Asia: Bank Indonesia policy meeting

Market Highlights

The US leading index fell 0.4%mom in January, marking a faster pace of decline than the revised -0.2% in December and analyst estimates of -0.3%. However, on a 6-month annualized basis, the pace of decline for the index has eased and the Conference Board no longer sees a US recession this year. Meanwhile, markets are awaiting the January 30-31 FOMC meeting minutes this week. The US dollar index fell 0.2%.

The ECB has published its euro-area indicator of negotiated wage rate. Negotiated pay decelerated to 4.5%yoy in 4Q, from 4.7% in 3Q, though remaining at a relatively fast pace of increase.

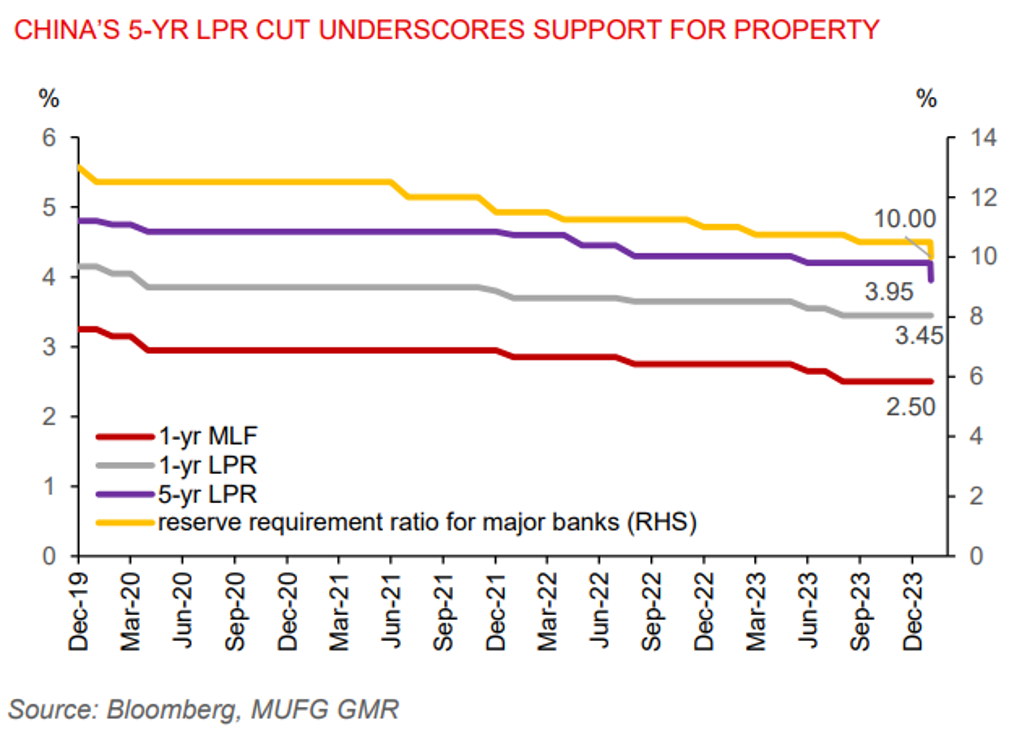

China lowered its 5-year loan prime rate (LPR) by 25bp to 3.95% yesterday, from 4.2%, the largest cut on record to support the property sector, which has been a major drag on China’s economy. This will allow more Chinese cities to ease their minimum mortgage rates to help spur more demand for residential properties. But this may still not offer much of a boost, given subdued sentiment, unfinished housing, and the high level of housing inventories. Meanwhile, the 1-year LPR was left unchanged at 3.45% yesterday, while the 1-year MLF rate was kept at 2.5% on 18 February.

Regional FX

The Malaysian ringgit and Thai baht have remained under depreciatory pressures.

USDMYR traded near the 4.80 level. The MYR was down by 4.4% year-to-date against the US dollar. The decline in the ringgit against the US dollar has sparked a verbal response from BNM. A narrowing trade surplus won’t be supportive of the MYR amid ongoing external pressures. Malaysia’s exports rose 8.7%yoy in January, the first increase in 11 months. Export growth was mainly driven by shipments to ASEAN economies, notably Indonesia and Vietnam. By products, refined petroleum, machinery, and equipment have helped drive the growth in exports. However, import growth of 18.8%yoy in January outpaced export growth, resulting in the trade surplus narrowing to US$10.1bn, from US$18.1bn a year ago.

USDTHB traded above the 36-handle. The THB was down by 5.5% year-to-date against the US dollar. Thai prime Minister Srettha has piled on the pressure on the Bank of Thailand (BoT) to cut policy rates following a disappointing Q4 GDP, which fell 0.6%qoq sa (1.7%yoy). Notably, PM Srettha has asked the BoT to hold an off-cycle policy meeting to implement emergency rate cut. The next official BoT policy meeting is scheduled for April 10.

Bank Indonesia will meet later today, where we expect no change to the policy rate of 6%.