Ahead Today

G3: US leading index

Asia: China 1y and 5y loan prime rates, South Korea’s 20-day trade data, Malaysia Q3 GDP, Taiwan exports

Market Highlights

Fed’s Bostic has said that he prefers to stay patient in lowering interest rates to the neutral level, which he estimates it to lie between 3.0%-3.5%. US inflation is still above the Fed’s 2% target, so he prefers that monetary policy stays restrictive for long enough to bring inflation back to 2%. Moreover, the US economy has stayed resilient, although a potential slowdown in consumer spending could weigh on growth. The New York Fed’s Q3 US GDP growth nowcast was at 3.0% last week, slightly lower than the 3.1% in the prior week, while the Q4 nowcast was at 2.6%. A slower Fed rate cut than what markets currently expect (140bps cut through 2025) would be supportive of the US dollar. Moreover, ECB has already cut rates by 75bps while markets are expecting another 150bps cut through 2025 amid a weaker growth outlook, dragging on the euro.

In Japan, Prime Minister Ishiba has pledged to improve real wage growth heading into the 27 October general election. Japan’s largest labour union group, Rengo, has also called for wage growth of at least 5% in 2025 versus the 5.1% pace in 2024. Sustained wage gains and an attendant rise in inflation and inflation expectations will hold the key to further policy rate normalization in Japan. Real wage growth was -0.6%yoy in August, after only turning positive in the prior 2 months. The JPY gained 0.5% to 149.53 per US dollar last Friday, but still 6% weaker from end-2023.

Regional FX

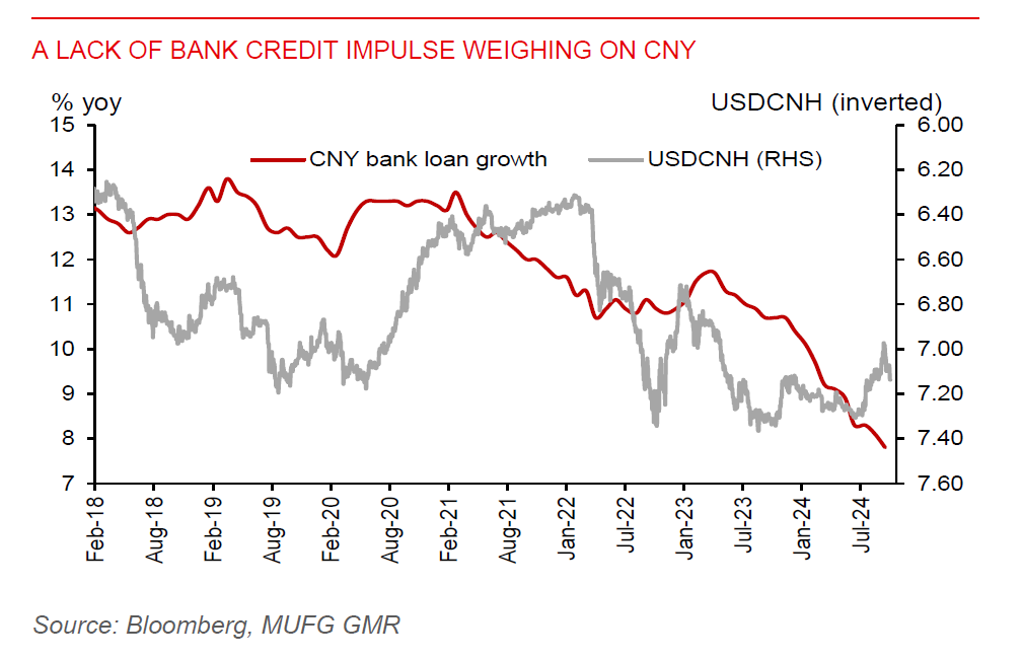

Asia ex-Japan currencies gained against the US dollar last Friday, with CNY strengthening by 0.3%. China’s GDP growth slowed to 4.6%yoy, from 4.7%yoy in Q2, though slightly beating Bloomberg consensus for a 4.5% increase. Bank credit growth has also been decelerating, reflecting subdued domestic demand. However, a pickup in September economic activity, along with several policy stimulus measures, may offer some hope of stabilization. Retail sales growth rebounded to 3.2%yoy in September from 2.1%yoy in August, industrial production grew 5.4%yoy from 4.5% in August, while urban fixed asset investment stabilized at 3.4% year-to-date. The surveyed unemployment rate fell to 5.1% from 5.3% in August. Following the 20bps cut to the 7-day reverse repo rate, we look for the 1-year and 5-year loan prime rates to be lowered by 20bps to 3.15% and 3.65%, respectively, later today.

In Malaysia, Prime Minister and finance minister Anwar unveiled the 2025 budget last Friday, which shows that the government remains committed to fiscal consolidation. This should bode well for the ringgit outlook in 2025, which we forecast it will strengthen to MYR4.00/USD with upside risk. The government plans to narrow the budget deficit to 3.8% of GDP in 2025 via rolling back subsidies and social assistance (to MYR52.6bn from MYR61.4bn in 2024) while improving the fiscal revenue. Budget spending will rise by 3.3% to MYR421bn in 2025, while fiscal revenue is targeted to increase by 5.5% to MYR339.1bn. In addition to the diesel price rationalisation on 10 June, blanket assistance for the widely used RON95 fuel will end from mid-2025. On the revenue front, the government plans to widen the scope of its sales and services tax to cover commercial services from May 2025 but stops short of re-instating the goods and services tax. A 2% tax on dividend income that exceeds MYR100k will also be introduced from the year of assessment 2025. To attract more foreign direct investment, the government will set up an infrastructure facilitation fund for the Johor-Singapore special economic zone and the development of Silver Valley Tech Park 1 in northern Perak state. Elsewhere, the government will impose carbon tax on iron, steel, and energy industry by 2026, raise the minimum wage to MYR1,700 from MYR1,500 in February 2025, increase excise duty for sugary drinks, and plans to make it mandatory for foreign workers to contribute to EPF, the largest state pension fund.

In Indonesia, Prabowo was inaugurated as the new President on 20 October. He has pledged to continue the policies of his predecessor, Jokowi, which include nickel downstreaming and developing a new capital city Nusantara in East Kalimantan. His cabinet of 109 ministers is the largest since Suharto's administration. The bigger news is that Sri Mulyani will be staying on as finance minister, which could support investor confidence in Indonesia's fiscal outlook in the face of his US$30bn free school lunch programme. Prabowo has also created an investment and downstreaming ministry, which will be helmed by Rosan Roeslani (former investment minister). Rosan is tasked to expand downstreaming policy to other commodities beyond minerals.