Ahead Today

G3: Spain unemployment change

Asia: -

Market Highlights

The US ISM manufacturing index fell to 47.8 in February from 49.1 in January, dragged down by weaker new orders, while the ISM prices-paid index nudged lower to 52.5 from 52.9 in January, indicating a slower pace of price increases. Markets will closely monitor the February inflation data for evidence of further disinflation. Meanwhile, the University of Michigan consumer sentiment index also edged lower to 76.9 in February from 79.6 in the month before. Fed Chair Powell will deliver his semiannual monetary policy testimony to Congress this week, and we expect no surprises regarding his stance of no rush for rate cuts. Most Asian central banks have thus far followed the Fed in keeping rates steady, except for the PBOC, where the 5-yr LPR was lowered by 25bps.

Meanwhile, Brent prices will likely be supported by an extension of OPEC+ oil supply cuts till June amid ongoing conflict in the Middle East. But downside risks from China’s growth outlook remain.

The broad US dollar index fell 0.3% last Friday, while USDJPY traded around the 150 level.

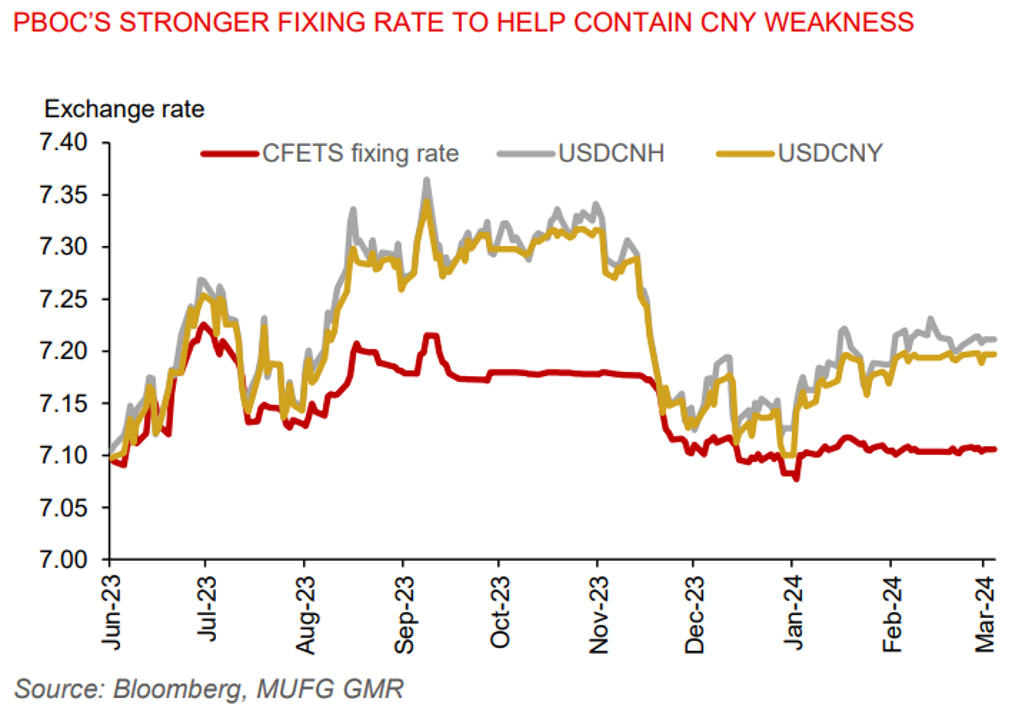

Regional FX

USDCNY traded below 7.20 while USDCNH was at 7.21. With the PBOC keeping a stronger CFETS fixing rate for the Chinese yuan, we believe depreciatory pressures on the currency will be contained ahead of the National People’s Congress on March 5. A growth target of around 5% for 2024 could be announced, including economic policy directions for the year. We believe more supportive macro policies will likely be needed, along with an improved external environment, for China to keep growth at the 5% mark this year. China’s official manufacturing PMI stood at 49.1 in February, remaining in contractionary territory (<50).

Meanwhile, India’s manufacturing PMI was 56.9 in February, suggesting solid economic growth momentum seen in Q4 2023 (GDP grew 8.4%yoy) will likely be carried forward to this year.

In Southeast Asia, the IDR (+0.1%), PHP (+0.3%), and SGD (+0.1%) were stronger against the US dollar, but not for the MYR (-0.1%) and THB (-0.2%). Factory activity continued to expand in Singapore, Philippines, and Vietnam. But it remained in contraction in Thailand and Malaysia.