Ahead Today

G3: US ADP Employment, US 3Q advance GDP

Asia: Thailand Manufacturing Capacity, India Infrastructure Index

Market Highlights

China is weighing approving over 10 trillion yuan (US$1.4 trillion) in additional borrowing in the next few years to shore up the economy and address local government debt risks, according to a Reuters news report. In addition, the package could be larger if Donald Trump wins the US Election. Nonetheless the details of how the borrowing will be used will also be crucial for the impact to China’s economy and as such ultimately markets. The news said that around 6 trillion yuan will be raised over three years including 2024 to address local government debt risks, with another 4 trillion yuan earmarked for idle land and property purchases through local government special bonds over the next five years. Meanwhile, China is also considering approving at least 1 trillion yuan of stimulus such as for consumption boost including trade-in and renewal of consumer goods, with another 1 trillion yuan potentially raised via special treasury bonds for capital injection into large state banks. It remains to be seen how effectively these measures will boost the economy, but with most of these reported borrowing going into resolving local government debt risks, the direct impact and flow through to the economy is smaller than the headline number suggests. Nonetheless, resolving the burden of local government debt should still go some way to relieve some of the short-term fiscal tightening afflicting the Chinese economy given how revenue and cash strapped some local governments are.

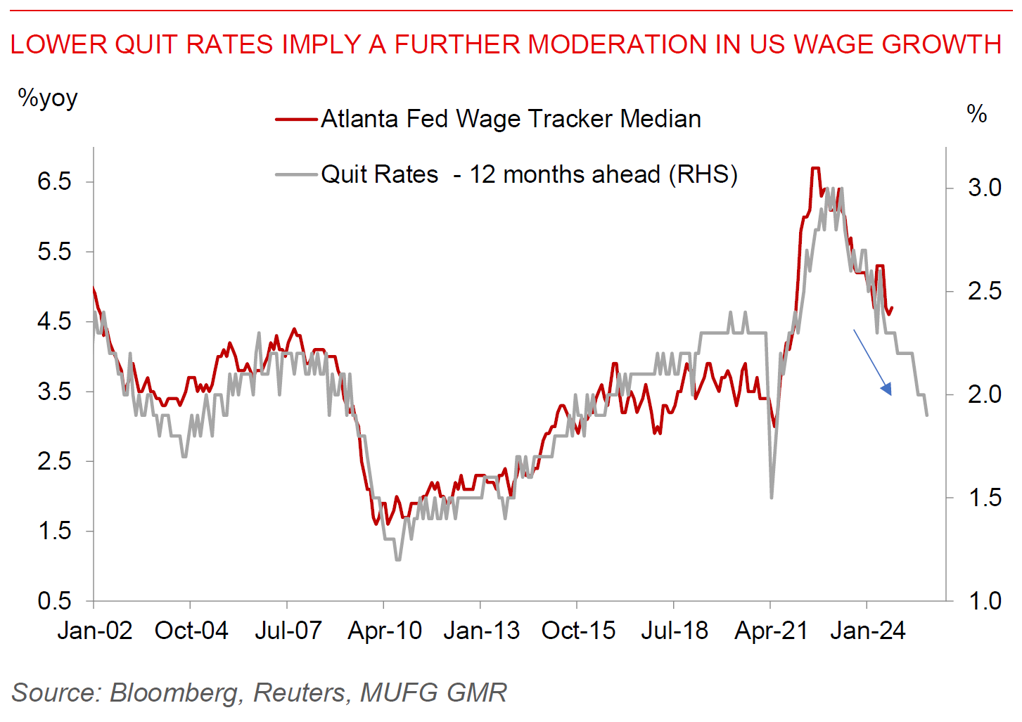

Meanwhile, the US JOLTS data released yesterday showed a larger moderation in job openings than expected to 7.4mn from 7.9mn. More importantly for the Fed, the details such as quit rates and job vacancy rates moderated further to 1.9% and 4.5% respectively. The quit rate has a good leading relationship with wage growth, while a 4.5% job vacancy rate has been cited by Fed Governor Waller as the key tipping point when unemployment rate could rise more substantially. All these imply that the US labour market looks to be normalizing further and with that should give the Fed further confidence to cut rates notwithstanding uncertainty around the US elections.

Regional FX

Asian FX markets saw some reprieve on the back of a slightly weaker Dollar coupled with lower US yields. USD/CNH reached 7.142, while KRW (+0.15%), THB (+0.18%), MYR (+0.18%) strengthened slightly. In India, a rise in defaults by over-leveraged small borrowers seem to be hitting India’s banks, with bank executives and analysts expecting higher levels of stress in the personal loans and micro-credit segments over the next year. This also comes on the back of the RBI’s moves to tighten macroprudential measures on unsecured consumer loans such as through raising risk weights, while also monitoring the lending practices of non-bank financial corporations more specifically. We have been expecting some modest further slowdown in India’s growth, in part arising from RBI’s macroprudential measures and also some delay in government spending pickup post the Lok Sabha Elections (see IndiaPulse – bringing forward the 1st RBI rate cut). We think that RBI will likely use different tools for different objectives – macroprudential measures to maintain financial stability, while allowing changes in policy rates as inflation moderates (see India – RBI policy Oct 2024 opening the door to rate cuts). We continue to expect the RBI to cut rates from December, notwithstanding the recent food induced spike in inflation coupled with possible changes in the central bank’s monetary policy committee with RBI Governor Das’ term up in December.