Ahead Today

G3: US new home sales

Asia: Malaysia CPI, Singapore CPI, Taiwan industrial production

Market Highlights

The US dollar has strengthened, and will likely remain firm, after several major central banks have become less hawkish. The Bank of Japan (BoJ) exited negative interest rate policy last week, yet there’s no policy signal of further tightening ahead. The Bank of England (BoE) kept the policy rate unchanged, but two members dropped their votes to hike. And the Swiss National Bank (SNB) surprised markets by cutting its policy rate by 25bps.

The US Fed stuck to its outlook for 3 rate cuts this year during the March FOMC meeting, but its stronger outlook for economic growth (2.1% in 2024 from 1.4% previously) suggests the US economy does not need insurance rate cuts for now. Plus, the PCE core deflator for February, which will be out later this week, could rise 0.3%mom, following a 0.4%mom increase in January. This implies the index would show an acceleration on a 6-month annualized basis. Over the weekend, Atlanta Fed President Bostic said he sees only one US rate cut this year, down from two cuts previously, while he’s getting less confident about the inflation path.

Regional FX

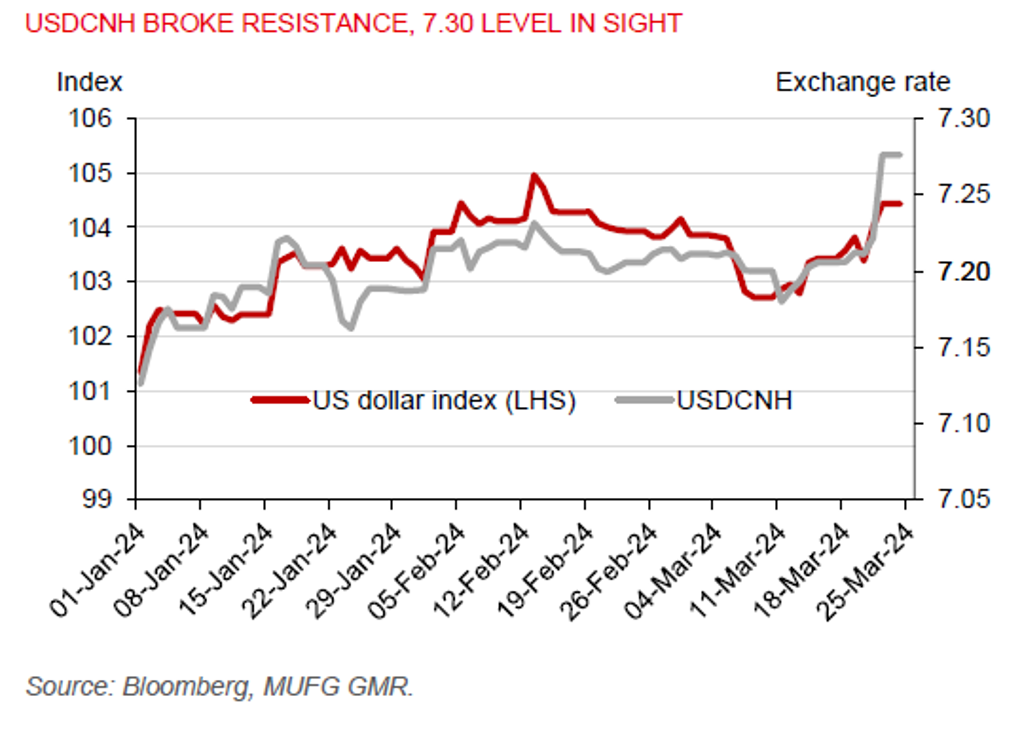

CNH broke support and weakened 0.8% to 7.2760 versus the US dollar on 22 March, on the back of a stronger dollar and a slightly weaker onshore yuan fixing rate. Markets appear to be pricing for the PBOC to have greater tolerance for a weaker currency to support the Chinese economy. Weakness in the Chinese yuan has weighed heavily on regional sentiment, particularly the Korean won (-1.2%) and Thai baht (-0.9%) versus the US dollar.

Meanwhile, Malaysia’s headline inflation will likely remain steady at 1.5%yoy in February. But plans by the government to implement targeted subsidies, along with higher services tax starting in March, could lead to inflation picking up in the coming months.