Ahead Today

G3: US core PCE inflation, University of Michigan consumer sentiment, eurozone CPI and unemployment rate, France Q2 GDP

Asia: India Q2 GDP, Thailand current account

Market Highlights

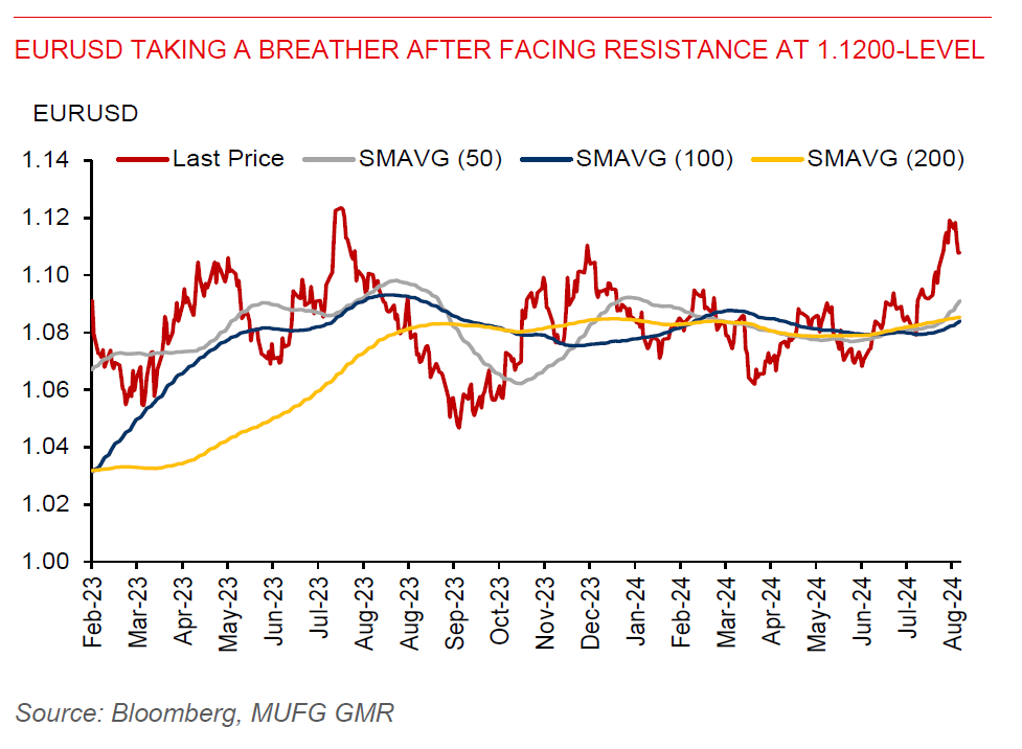

The US dollar rebound has continued for a second day. This has partly been driven by euro weakness following softer than expected German inflation. Indeed, Germany’s CPI eased to 2.0%yoy in August, from 2.6% in July and below market expectation of 2.2%. EURUSD fell 0.4%, while USDJPY rose 0.3% yesterday.

The latest US macro data also shows the economy still largely holding up. The second estimate for US GDP shows growth picking up to 3%yoy, from 2.8% previously and higher than market expectation of 2.8%. Personal consumption was up 2.9%yoy, from 2.3%yoy in Q1. Initial jobless claim was still relatively low at 231k, roughly in line with market expectation of 232k, suggesting the labour market is generally holding up. Seasonally adjusted core PCE inflation also eased somewhat to 2.8%qoq annualized in Q2, from 2.9% in Q1, reflecting ongoing disinflation. Recent fears of US recession are likely overblown for now. Moreover, we have yet to see one quarter of sequential contraction in US GDP, though the risk of a US recession remains amid tight monetary conditions.

Meanwhile, Fed’s Bostic thinks it may be time to cut rates. But he has sounded less dovish, cautioning about loosening policy too early for fear that inflation would pick up again. He would still like to see more data to justify lowering rates in September.

Regional FX

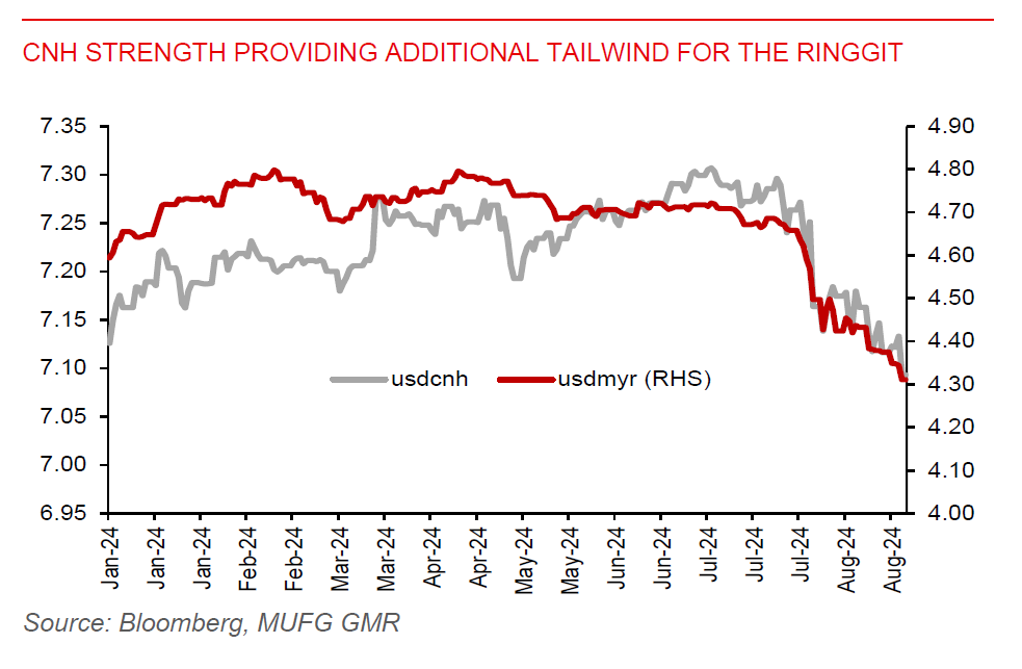

Several Asian currencies have been overbought following recent appreciation. Yet, they have made further gains. USDCNH fell 0.5%, breaking the 7.1000-level. This has likely fuelled further gains in regional currencies, particularly the ringgit (+0.8%), which has led gains in the region. News about the Malaysian government mulling to reinstate goods and services tax, rather than rationalizing RON95 fuel prices, will also bode well for fiscal consolidation efforts, sustaining the appeal of its currency among investors. Assuming a 6% GST rate will be announced for Budget 2025 in October, we estimate that Malaysia’s fiscal deficit of 5% of GDP in 2023 could be halved by next year.