Ahead Today

G3: US: initial jobless claims, housing starts, industrial production; Japan industrial production

Asia: BSP policy rate decision

Market Highlights

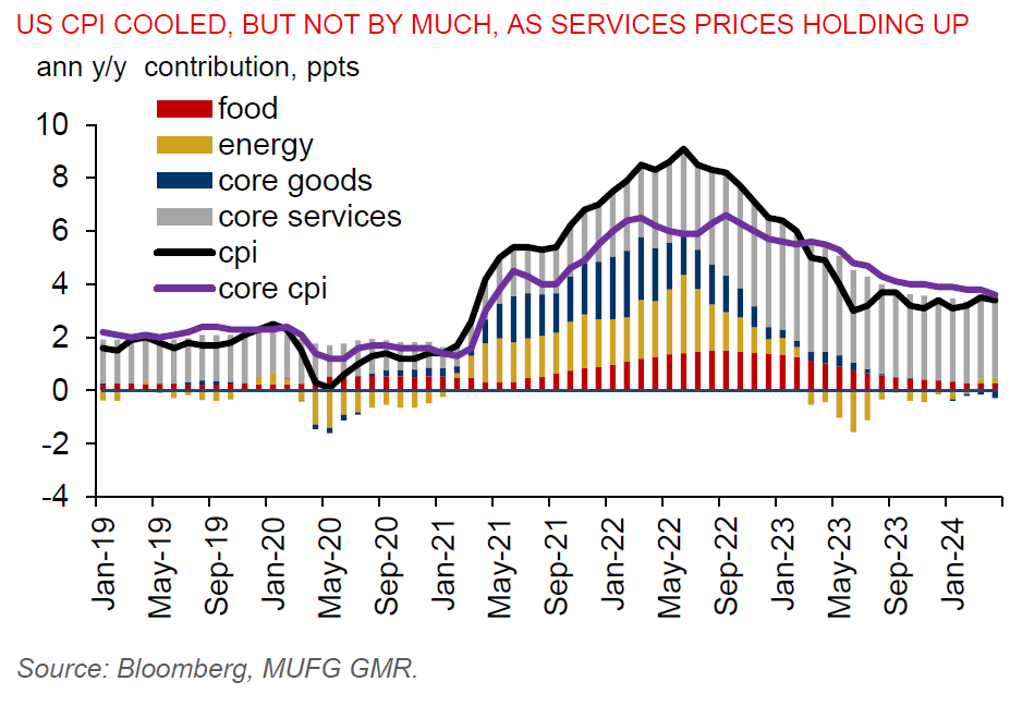

US headline CPI rose 0.3%mom in April, slower than market expectation for +0.4%mom. This brings down the annual rate to 3.4%, from 3.5% in March. Shelter - the biggest component in services - and energy accounted for slightly more than 70% of the increase. Shelter prices rose 0.4%mom for the third straight month. Meanwhile, the core inflation measure rose 0.3%mom in April, cooling for the first time in six months. This is in line with market consensus and brings the annual rate to 3.6% from 3.8% in March.

Another report showed US retail sales stagnated in April, slowing from +0.6% in March and weaker than the Bloomberg consensus of a 0.4% increase. This adds to signs of softening consumption amid high borrowing costs and growing consumer debt.

Treasuries rallied and US equities rose as the latest macro data points give markets some confidence that the US Fed can lower policy rate soon. Markets have boosted the odds that the Fed will start cutting rates in September, while the DXY US dollar index broke key technical support level at 105 and fell 0.6%.

Elsewhere, Bank of France governor Villeroy said the ECB is very likely to cut rates in June. Japan’s GDP fell 2%qoq annualized in Q1, after flat growth in Q4 2023, as consumers and firms cut spending. This is weaker than market expectations of -1.2%.

Regional FX

Asian currencies strengthened against the US dollar on the back of broad US dollar weakness. JPY and KRW were major outperformers, gaining 1.5% and 1.2% against the US dollar, respectively. CNH also gained 0.4% against the US dollar, seemingly unaffected by the imposition of US tariff on $18b Chinese goods imports and a barrage of criticism from Chinese authorities over latest US tariffs.

The PBOC kept the 1y MLF rate unchanged at 2.50% yesterday. There’s no net liquidity injection in the banking system, as the RMB125bn worth of maturing 1y MLF loans in May were rolled over. China is also considering getting local government to buy houses from distressed property developers at steep discounts to clear large housing stocks and support a revival of the sector.

Bangko Sentral ng Pilipinas (BSP) will announce its latest policy rate decision later today. We think the BSP will hold its policy rate at 6.50% to protect the value of the PHP and contain inflationary pressures. A BSP rate cut is unlikely to materialize this year, with growth still robust, inflation rising (though still within the 2%-4% target), and PHP still under depreciatory pressures.