Ahead Today

G3: Germany PPI, ECB’s Nagel speaks

Asia: Malaysia trade, Thailand international reserves, Philippines BOP

Market Highlights

Authorities in Japan and South Korea have raised serious concerns about the sharp depreciation of their currencies during a meeting with US Treasury Secretary Janet Yellen. And Yellen has responded by acknowledging those concerns. A coordinated FX intervention could be a possibility, which may slow the pace of currency depreciation. But sustained gains in the JPY and KRW may still have to wait until US interest rates come down. Year to date, US 10-year yields have risen 70bps to 4.6% year to date, while the broad US dollar index (DXY) has strengthened by 4.5%.

Meanwhile, US initial jobless claims were 212k in the week ending 13 April, little changed from 211k in the prior week. This suggests the US labour market has been resilient. Fed’s Williams has briefly mentioned about the possibility of US rate hikes.

Japan’s national CPI was 2.7%yoy in March, slightly slower than the 2.8% pace in February, while core CPI (ex-fresh food and energy) was 2.9%yoy, down from 3.2%yoy in February. Still, the recent strong wage growth negotiation outcome could help sustain higher prices, which could give the BOJ the room to raise interest rates one more time this year.

Regional FX

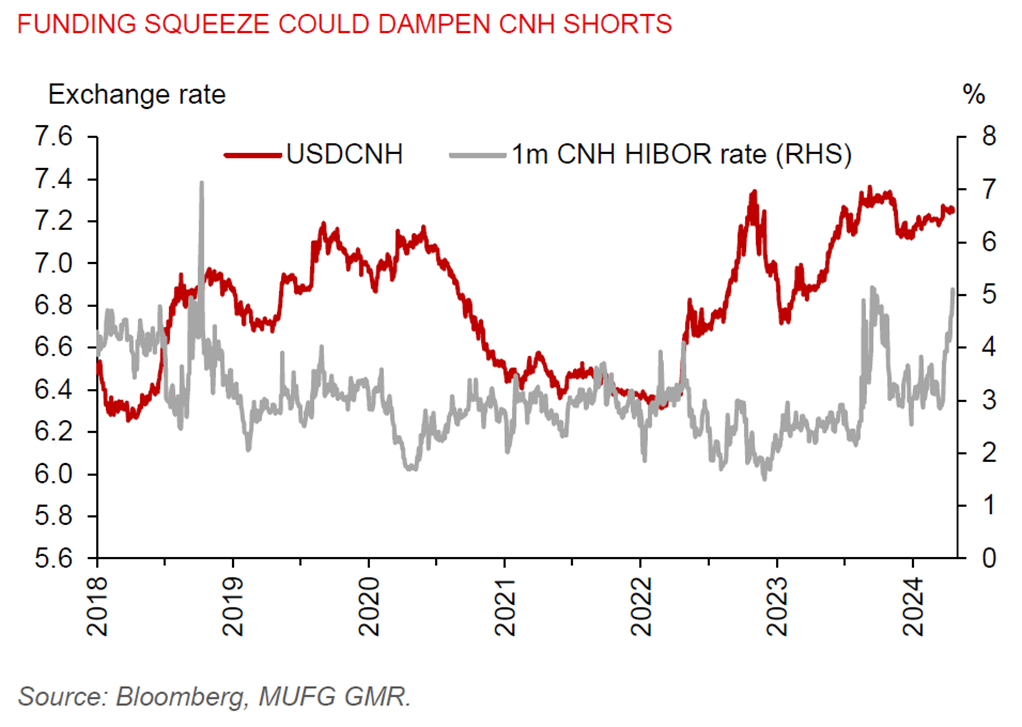

Offshore yuan funding costs have climbed in Hong Kong, amid PBOC’s pledge to prevent one-sided FX moves. This could help dampen the appeal of putting additional shorts on the Chinese yuan. The 1-month CNH HIBOR has jumped above 5% for the first time since September 2023.

Notably, the KRW gained 1% versus the US dollar yesterday, after recently touching 1400 for the first time since 2022. The IDR also gained 0.3% versus the US dollar, on the back of Bank Indonesia’s FX intervention, but still trading above the 16000 level. The risk is that a further sharper increase in global risk premium resulting from escalating geopolitical tensions in the Middle East could have negative implications for regional FX.