Ahead Today

G3: Europe Services PMI, US S&P Services PMI, US ISM Services PMI, US Durable Goods Orders

Asia: Thailand CPI, China Caixin Services PMI, India Services PMI

Market Highlights

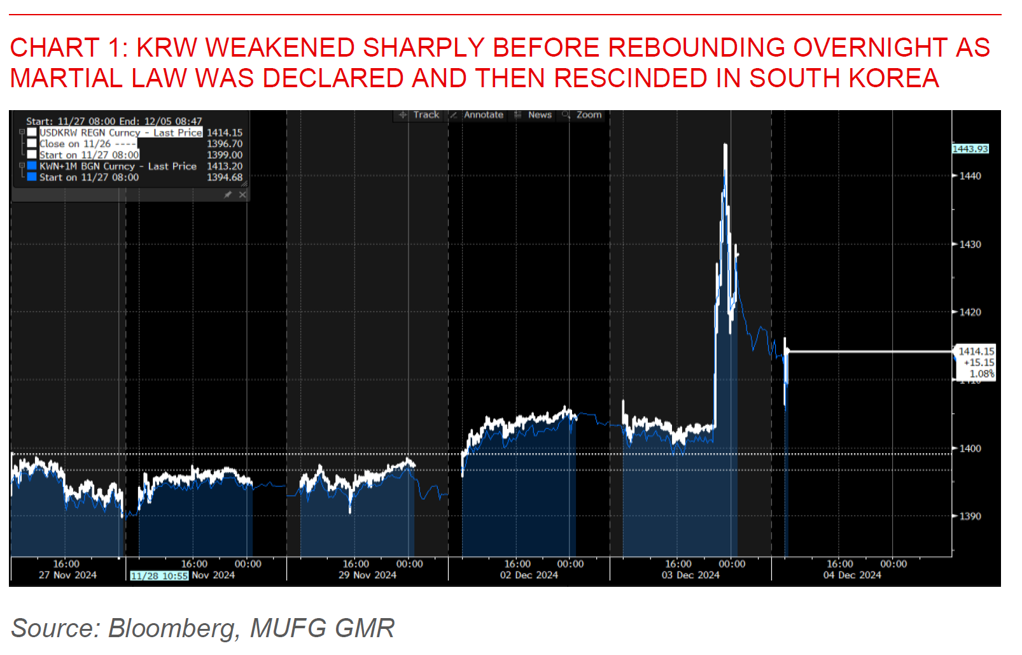

If 2024 was the year of Elections and political surprises, it certainly did not attempt to end the year with a whimper. South Korea’s President Yoon Suk Yeol declared Martial Law overnight, in a move that caught markets, residents and politicians even of the President’s own party alike by surprise. Martial law was just as quickly rescinded after 190 out of 300 lawmakers voted to end it, but this was not before the army and police were already deployed across a range of places including the National Assembly. Markets whiplashed with KRW 1-month NDFs weakening sharply close to 3% intra-day against the Dollar to above 1440 levels, before paring losses to 1413 as martial law was lifted and Korean authorities promised unlimited liquidity to stabilize markets. It is hard to understate just how unprecedented this move was in South Korea, with martial law last imposed in 1979 before democracy was established.

While the worst negative economic impact to South Korea including on tourism and domestic activity may have been averted in the near-term, political uncertainty could still remain. The opposition party may propose President Yoon’s impeachment motion today, and with the President’s approval ratings at rock bottom levels his time in office looks to be running out. From a macro perspective, South Korea was already one of the more vulnerable countries to the impact of Trump’s proposed tariffs, and this recent development could raise some further risk premium on the currency at least until we get clarity on political stability. We are currently forecasting USD/KRW at 1450 by 2Q2025 and for the Bank of Korea to cut rates further in 2025.

Regional FX

Asian currencies were weaker overnight led to some extent by developments in South Korea even as the broader Dollar traded with a mixed tone. IDR (-0.6%), MYR (-0.5%), and CNH (-0.2%) underperformed, while the Japanese Yen strengthened to 149.63 levels against the Dollar. Apart from South Korea, risk sentiment was actually quite decent. This was helped to some extent by reports Chinese authorities will hold its Central Economic Work Conference (CEWC) from 11-12 December, to map out the plans for economic targets and stimulus plans ahead. While there will unlikely to be official announcements on exact targets from the meeting, the readout could contain clues on the direction of fiscal deficit and with that also the extent of economic support expected in 2025. Last night, US JOLTS jobs opening data picked up more than expected to 7744k from 7443k the previous month, with layoffs rates remained low with some improvement in quit rates as well. Markets will look closely at the labour data and non-farm payrolls out later this week.