Ahead Today

G3, UK: Germany factory orders, UK general election

Asia: Hong Kong PMI

Market Highlights

A huge downside surprise in the US ISM services index, along with a string of soft US labour market data, have led to a move lower in the US dollar and US yields. But there’s notably little change in market pricing for US rate cuts this year, which still stands at almost 2 cuts. The ISM services index fell to 48.8 in June vs. 53.8 in May and market expectation of 52.7. ADP employment was marginally smaller at 150k vs. 152k in May. Initial jobless claims rose to 238k vs. 233k prior, recurring jobless claims rose to 1858k vs. 1839k prior, while factory orders fell 0.5%mom in May vs. +0.7% in April. The latest FOMC minutes also show a vast majority of officials assessing that the US economy is gradually cooling, though officials were divided on their monetary policy outlook. Some officials said the Fed should stand ready to respond to economic weakness, some urged for patience, while some left rate-hike option on the table.

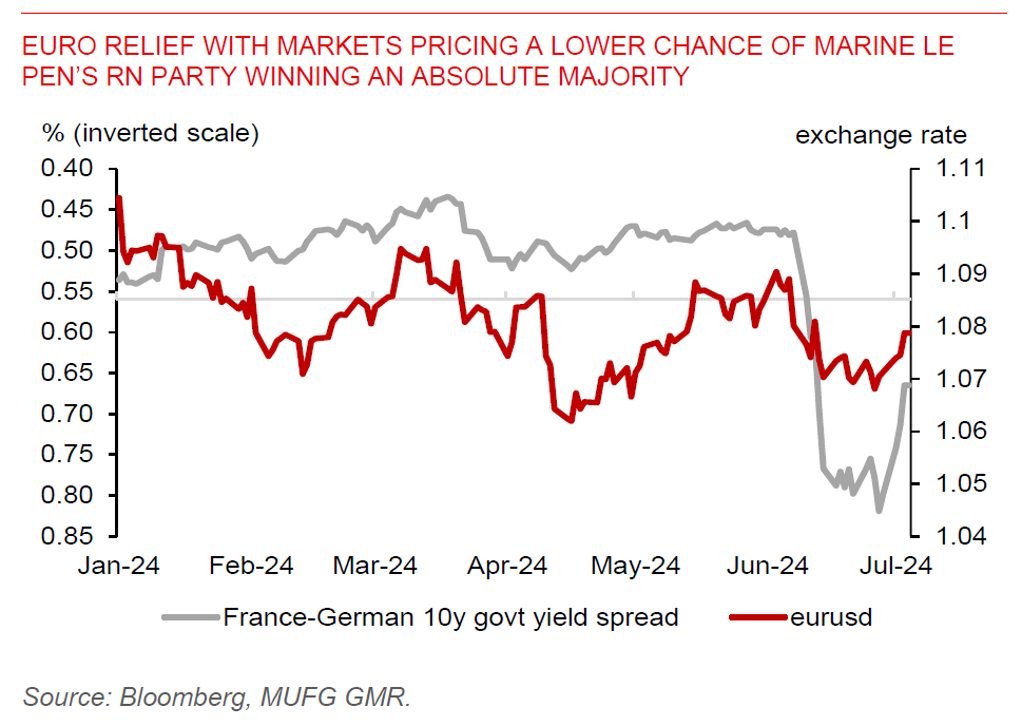

Meanwhile, the euro has been lifted by a weaker US dollar, and possibly due to market pricing for a much lower likelihood of Marine Le Pen’s National Rally (RN) party winning an absolute majority in the 7 July election run-off. But it remains to be seen if the euro relief rally is sustainable. And the UK will hold a general election today. A YouGov survey shows the Labour party will win a large majority in the House of Commons.

Regional FX

While the US dollar has softened against G10 currencies to start H2, it has stayed firm versus Asian currencies, with the Korean won (-0.6%) and Taiwan dollar (-0.6%) being the notable underperformer in the Asia region. The depreciatory pressure on the won could persist or even intensify, driven by cross currents of persistent weakness in the yen and Chinese yuan, Middle East tensions, and potential escalation of US-China tensions before and in the aftermath of US presidential elections in November. Even the recent euro weakness driven by election uncertainty in France has not helped the won. Moreover, credit default risks for real estate project financing in South Korea have risen, posing a risk to the country’s financial system.