Ahead Today

G3: Japan industrial production, New York Fed inflation expectations, US Empire Manufacturing, Germany ZEW Expectations

Asia: Indonesia trade, Philippines remittances

Market Highlights

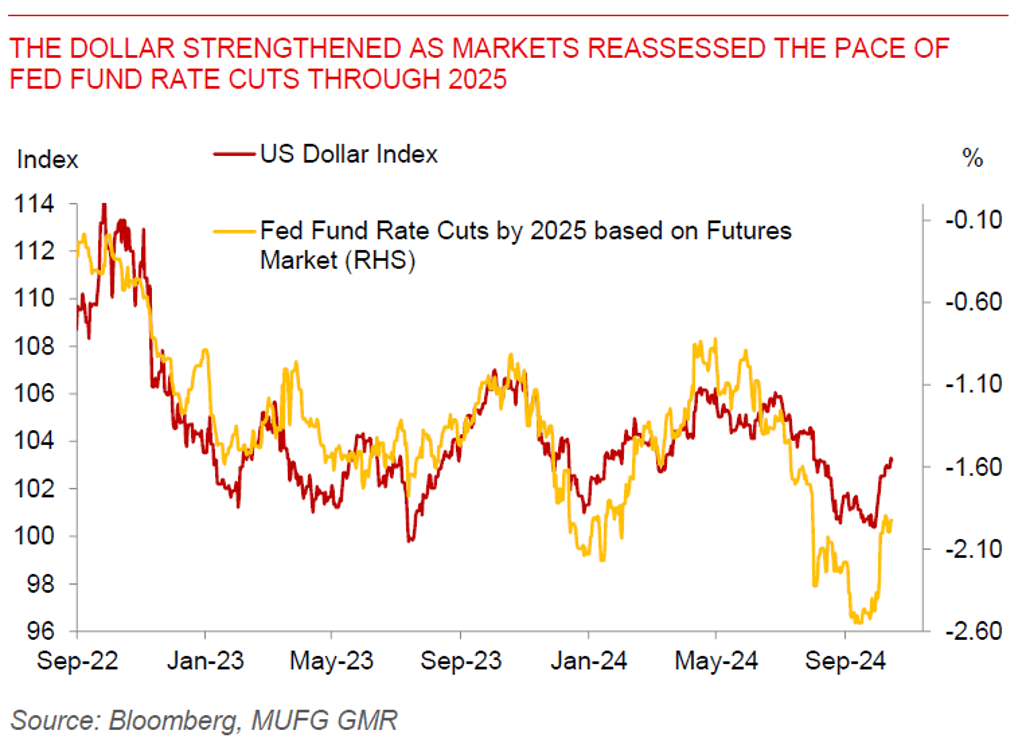

Global risk appetite picked up, the Dollar strengthened, while oil prices fell, as Fed speakers guided for deliberate and cautious reductions in rates while news reports suggest that Israel’s response to Iran may be confined to military sites. Fed Governor Christopher Waller said recent economic data signals policymakers can approach subsequent rate reductions with less urgency, and if current economic conditions continue, the Fed can proceed with moving policy towards neutral at a “deliberate pace”. Meanwhile, Neel Kashkari expects further modest reductions in the coming quarters, and it’s “unclear” just how restrictive current policy settings are. Even as geopolitical risks remain elevated all over the world, yesterday’s report by the Washington Post that Israel Prime Minister Benjamin Netanyahu is willing to strike Iran’s military rather than oil or nuclear facilities helped to send oil prices lower.

China may raise RMB6 trillion (US$846bn) from ultra-long special government bonds over three years to support the economy, according to Caixin. The funds will be partly used to help local governments relieve their debt burden, given that China’s property market weakness has weighed down on local government revenues and also resulted in fiscal tightening including revenue grabs and administrative fines. Markets are looking to the National People’s Standing Committee on fiscal deficit approval.

Regional FX

Asian FX markets were mixed and remained on the backfoot with a stronger Dollar. PHP (-0.25%), KRW (-0.25%) and MYR (-0.18%) underperformed while USD/CNH rose closer to the 7.0938 levels. The recent announcements by China’s Ministry of Finance were incrementally positive but certainly disappointed offshore investors salivating for a headline number that could move markets with a big bang, with CNH also impacted by broader Dollar trends as such. India’s September CPI rose faster than expected at 5.5%yoy from 3.65%yoy the previous month, and above consensus expectations for a 5.1%yoy rise. Nonetheless, with the key driver being food prices in the near-term, our expectation is that the good monsoon coupled with decent Kharif sowing would moving forward help cap food prices. While the CPI print is a disappointment, we think that the incremental softness in urban consumption would still tilt the balance for a RBI to start trimming rates by 50bps in total, starting December. Meanwhile, the Monetary Authority of Singapore left its policy settings unchanged in its October quarterly meeting, with 3Q advance GDP also picking up strongly and surprising on the upside at 2.1%qoq and 4.1%yoy. We maintain our outlook for MAS to start loosening policy at the Jan 2025 meeting by reducing slightly the slope of the S$NEER band, given that core inflation is likely to step down further in 4Q below 2%, with labour market tightness also easing (see Singapore: MAS to start policy easing in Jan 2025).