Ahead Today

G3: Eurozone Manufacturing and Services PMIs, US University of Michigan Sentiment, US S&P PMIs

Asia: Malaysia CPI

Market Highlights

The Dollar strengthened overnight with EUR/USD breaking below 1.050 levels. Interest rate differentials and geopolitical concerns in the Russia Ukraine war continued to work in favour of the Dollar, with US 10-year yields rising to 4.42% while in Europe this fell to 2.3%. Nonetheless, all these was offset by decent risk sentiment with the S&P advancing, Nvidia closing shy of fresh record and gold rising. In terms of macro data, US existing home sales rose to 3.96mn up from 3.83mn the previous month, while initial jobless claims fell to 213k from 219k previously but this came with a pickup in continuing claims to 1908k indicating some uncertainties still about the strength of the US labour market. Meanwhile, Japan’s national CPI ex fresh food rose a touch more than expected at 2.3%yoy (vs consensus for a 2.2%yoy print). Bank of Japan Governor Ueda said in recent remarks that the December meeting could be live and that the BOJ will seriously assess the impact of the JPY on inflation and the economy and the Yen will be a key factor in inflation forecasts. Overall, this led USD/JPY to outperform to some extent with the Japanese Yen strengthening to 154.03 as of Asia time this morning. Overall, markets will look ahead to Eurozone and US PMIs, together with University of Michigan sentiment data today to get a sense of direction.

Regional FX

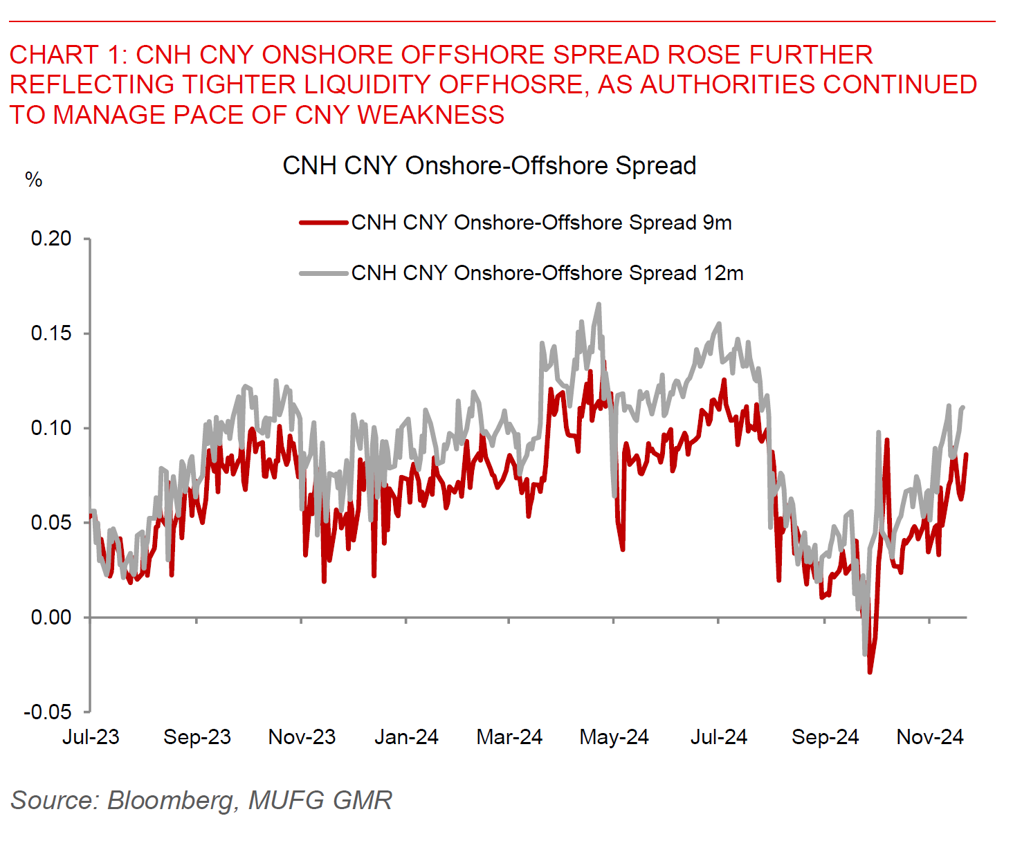

Asian currencies were weaker on the back of a stronger Dollar and geopolitical concerns in the Russia Ukraine war. IDR (-0.6%), TWD (-0.4%) and PHP(-0.3%) underperformed, while USDCNH rose to 7.256. The PBOC has been keeping the daily USD/CNY fixing relatively stable recently at 7.193 against a stronger Dollar, and as such keeping the maximum upside for onshore USD/CNY at around 7.34 levels. To some extent, this could indicate that authorities do not want further sharp moves in USD/CNY, with onshore-offshore CNH CNY spread also rising to some extent given tighter liquidity offshore. Meanwhile, Singapore’s 3Q final GDP rose more than expected by 5.4%yoy up from 4.1%yoy the previous quarter, while rising 3.2% qoq sa. The strength in Singapore’s growth was helped by a 13.5%qoq surge in manufacturing activity, with technology services and professional services also contributing to the strength. We continue to see MAS recalibrating its tight exchange rate policy by reducing slightly the slope of the band in the January meeting as we see inflation moving to the Singapore central bank’s target.