Ahead Today

G3: Germany Zew expectations, US Small Business NFIB Survey

Asia: India CPI, India Industrial Production

Market Highlights

The Dollar strengthened and USDCNH rose above 7.200 overnight, and this also had some negative impact on Asian currencies. The macro catalyst was not clear cut in terms of macro data. Overall, we attribute the moves to the broader trend of a resumption of Trump trades and with that a stronger US Dollar given the host of policies such as tariffs and immigration, all of which should support the USD in the near-term. In addition, it looks like US House Republicans are on the brink of clinching unified GOP control awaiting wins in just four out of the remaining 18 uncalled races. Importantly, these market moves have also come on the back of decent risk sentiment at least in US equity markets.

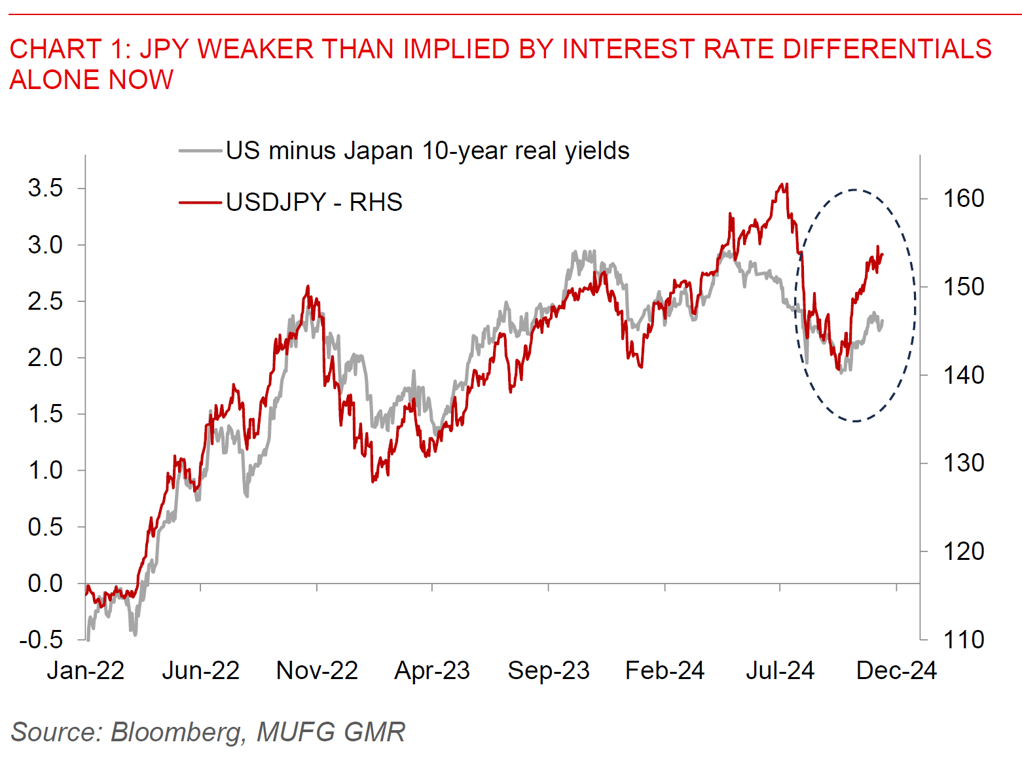

China released credit and money data yesterday, which was a touch weaker than the consensus expectations for new yuan loans. The details suggest that underlying credit demand by households and corporates were weak given that quite a bit of it was driven by bond sales and refinancing. Meanwhile, Japan’s Prime Minister Ishiba stayed on as Prime Minister in a vote in Parliament although he will now be leading a Minority government and will need support from key parties such as the Democratic Party for the People (DPP) to push through key legislation. We still think the path of least resistance for the Bank of Japan is to hike rates gradually despite political uncertainty.

Regional FX

With the Dollar strengthening and resumption of Trump trades, Asian currencies were also on the backfoot with MYR (-0.7%), SGD (-0.6%), and THB (-1.3%) underperforming. India will release its CPI numbers for October, which is expected to show a spike to 5.9%yoy from 5.5%yoy the previous month. This is in part driven by sharp increases in volatile vegetable prices such as onions, with also some increases in edible oil prices due to palm oil import duties. If right, this print will likely lower the probability of a RBI rate cut in December, even as growth looks to be slowing modestly over the past few months. Nonetheless, we think that the door for RBI rate cuts remain open, in part because expectations for good Kharif and Rabi crops should help temper food prices over the medium-term. We expect RBI to remain in the FX market to cap USD/INR volatility, even as it is likely to allow some gradual rise in line with broader Asian currency weakness over time.