Ahead Today

G3: US New Home Sales, US Mortgage Applications

Asia: Bank of Thailand policy decision, Taiwan GDP, Singapore industrial production

Market Highlights

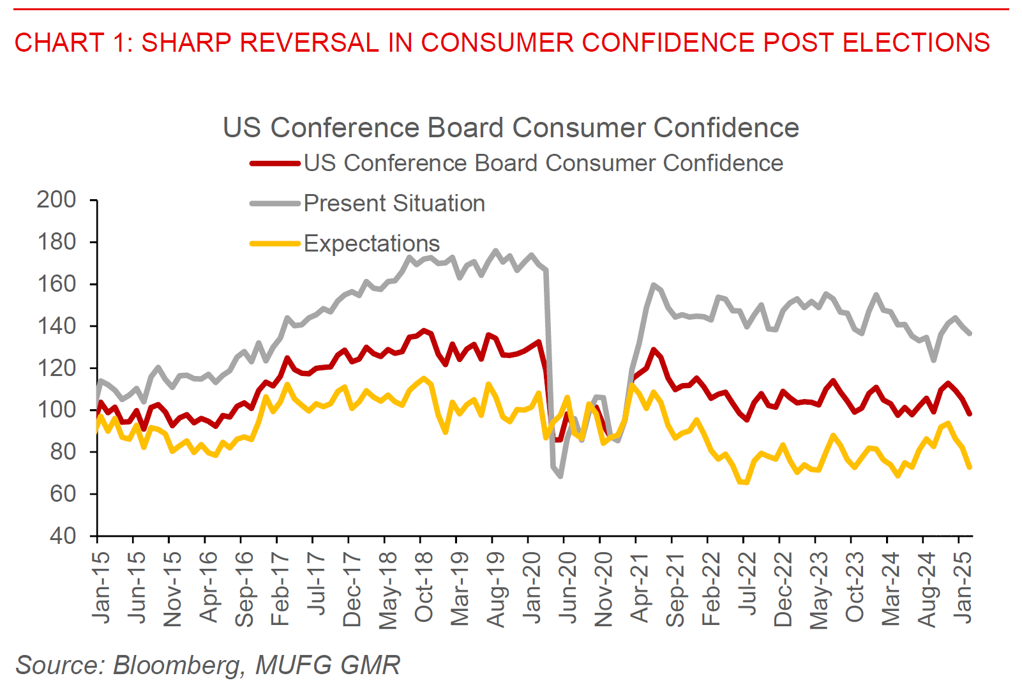

US Consumer Confidence fell to its weakest since June 2024, as some of the post-election related optimism faded, coupled with increasing concerns about the economic and inflationary impact of tariffs from the Trump 2.0 administration. In particular, while the present situation sub-component held up better, expectations for the future fell meaningfully. Taken more broadly, this data point fits in with increasing signals that policy uncertainty is having a meaningful impact on consumer and business sentiment, and is likely to have a real economic impact down the line on investment and growth.

From an FX perspective, what matters is not just absolutes but also relatives – in other words how the US is doing relative to other countries and not just US and global growth by themselves. On that front, risk sentiment has been quite strong in absolute terms in Europe and China this year, and perhaps for good reason given the prospects of increased defence spending in Europe and AI related optimism in China. We are nonetheless skeptical that this can continue to the same extent given the plethora of tariffs down the line. Beyond tariffs, the Trump 2.0 administration is also sketching out tougher versions of US semiconductor curbs and also pressuring countries such as Japan and Netherlands to escalate their restrictions on China’s chip industry. This also comes on the back of a recent FT report highlighting Huawei has significantly improved the yield on production of advanced AI chips, even if not at the frontier yet.

Regional FX

Asian currencies traded with a mixed to negative bias with USD/CNH rising to 7.2535, while THB (-0.6%), INR (%-0.6%) and IDR (-0.4%) underperformed. The Bank of Korea cut policy rates by 25bps to 2.75% from 3.00%, in line with consensus and our expectations. The central bank signaled more policy easing to come although the pace and exact easing was also left to be determined especially given external factors. In particular, BOK further downgraded its forecast for economic growth to 1.5% for 2025, down from 1.6-1.7%, with expectations for growth at 1.8% for 2026. Meanwhile BOK Governor Rhee Chang-yong said that market expectations of two to three cuts this year were in line with views at the BOK, while the 2.75% policy rate is in the upper range of the neutral rate and not in the mid-range, some of his first indications of the longer-term outlook of policy rates. Meanwhile, 2 out of 6 BOK board members were open to rate cuts in the next 3 months, with BOK saying it needs to remain cautious on household debt rebound and concerns about FX markets will remain. Our team continues to forecast another 50bps of rate cuts (on top of the 25bps cut delivered), bringing the policy rate to 2.25% by end-2025. From an FX perspective, KRW is getting some reprieve on the back of both global and also local factors, with the Constitutional Court ruling on President Yoon impeachment expected in two weeks’ time.

Meanwhile, the Reserve Bank of India relaxed some, but not all, of its macroprudential measures. In particular, it restored banks’ risk weights given to non-banking financial companies effective 1 April 2025, and also rolled back additional risk weights on microfinance loans for consumer credit with immediate effect. Nonetheless, additional risk weights of 25 percentage points imposed in November on banks’ own unsecured lending has not been lifted yet. We had previously highlighted RBI Governor Sanjay Malhotra’s view that RBI’s macroprudential measures loan growth had achieved the desired policy objective of slowing loan growth in the latest RBI policy decision, with a preference to change the pace of implementation going forward (see India RBI Feb 2025). The clear message is a continued pivot towards growth by RBI, and a clear dovish bias from the new governor. While this can help engender some portfolio inflows into India’s equity markets, longer-term it remains to be seen whether there will be sacrifice from a financial stability perspective. Overall, we think INR should still continue with a weakening bias with the pivot towards rate cuts and increasing liquidity by the RBI, and we continue to forecast USD/INR at 88.50 by year and with another 50bps of rate cuts by RBI by end FY2025/26