Ahead Today

G3: US Non-Farm Payrolls, UK Election Results (5 July), France Election Results (8 July)

Asia: Philippines CPI, Thailand CPI, Taiwan CPI, Singapore Retail sales

Market Highlights

The Euro rallied and the Dollar weakened, as latest polls show Marine Le Pen’s National Rally party will fall well short of an absolute majority in the second round of the French elections held on Sunday. Four surveys show that the far-right group will win between 190 and 250 of the 577 seats, and below the 289-majority mark. This comes as other alliances have pulled candidates strategically to reduce the number of three-way contestations. If the polls eventually prove accurate, this would mean the more extreme policies of fiscal expansion and immigration curbs are unlikely to pass, even as policy gridlock looks more likely than before the elections.

Whether the rally in EURUSD and Dollar weakness ultimately proves lasting is subject to many factors. In the near-term, there will be the US non-farm payrolls print tonight to contend with, and markets will watch for any signs of labour market deterioration in the US. In addition, while election polls out of France have a good track record so far, elections in India and Mexico remind us that polls can at many times be inaccurate.

Regional FX

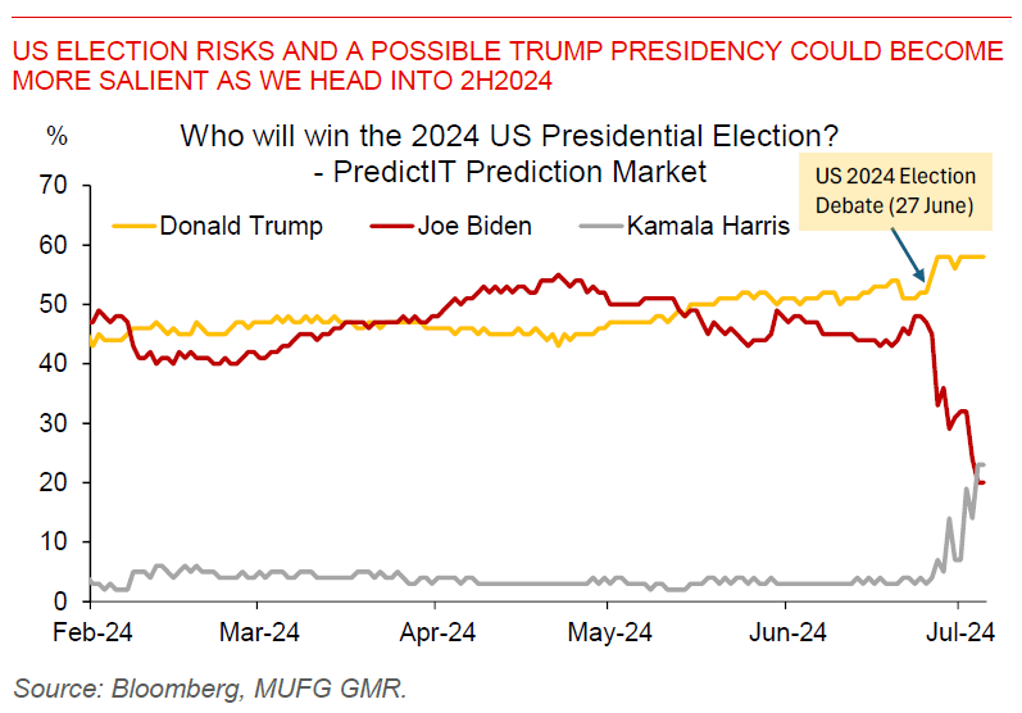

Over the medium-term, US election risks and a possible Trump presidency are likely to become more salient to markets, and the market reaction post the 1st debate with a modest rise in US yields, breakevens, and equities albeit with mixed trends in the Dollar could be a harbinger of things to come. We still think that the Dollar should weaken from here, with the Fed having the space to cut rates as the labour market softens further. However, those worried about the FX and Dollar impact of US Elections could view any Dollar softening as perhaps a good chance to hedge against Election risks.

Apart from the non-farm payrolls, the UK’s 4 July Election results will also be out today and the Labour Party is expected to win with a strong mandate based on exit polls. Our global team thinks that the Pound should be resilient on political stability.

Regional FX

Asian FX markets were stronger as they digested the developments in France, and also perhaps with some position adjustments ahead of non-farm payrolls. Currencies such as KRW (+0.6%), IDR (+0.4%) and TWD (+0.5%) outperformed, while USDCNH fell below the 7.30 level. In Asia, markets will focus on inflation prints out of the Philippines, Thailand and Taiwan. In particular, June CPI in the Philippines is likely to remain capped at around 3.9%yoy from 3.9%yoy the previous month. The recent rice import tariff cuts took effect on 20 June, and so the full impact to rice prices in the Philippines is unlikely to be fully felt. More broadly, the rice tariff cuts has given the BSP more confidence in its trajectory to cut rates and also support growth, and we continue to forecast the 1st BSP rate cut starting August. While a more dovish BSP is one key driver for our forecast for PHP FX underperformance, we are not overly bearish on PHP at current levels given offsetting supports such as rising FDI, growth improvement, coupled with a manageable current account deficit.