Ahead Today

G3: US NFIB Small Business Survey

Asia: Philippines Trade

Market Highlights

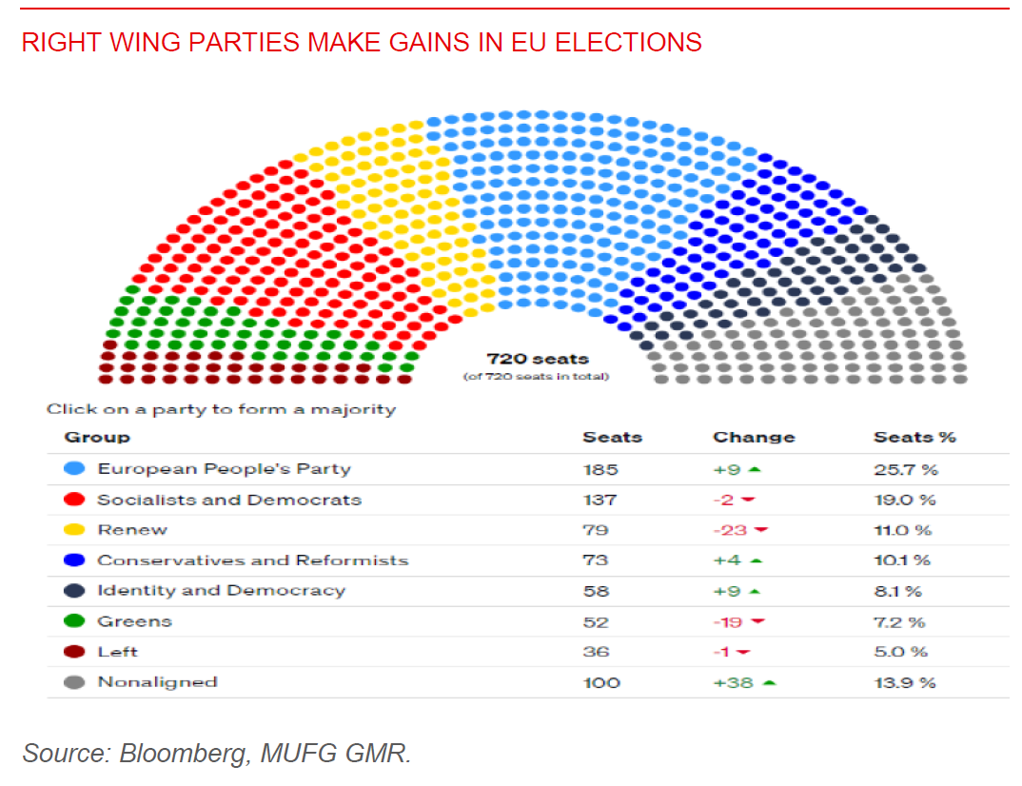

Election driven volatility continues in markets ahead of key central bank meetings and the US CPI data. The biggest shockwave was certainly French President Emmanuel Macron’s surprise decision to call a snap legislative election. The results could affect his ability to push through legislation, and choose a like-minded Prime Minister and thus the ability to implement policies, even as the Presidential election is nearly three years away. Our G10 FX team sees the possibility of EURUSD testing the bottom of the 1.0500 to 1.1000 trading range in the run up to the 1st round of elections on 30th June as markets price in greater political risk premium, even as the team sees a scenario of policy grid-lock with Marine Le Pen’s RN party falling short of forming a majority as the most likely scenario (see FX Focus – Macron’s bold move). Meanwhile in the UK, the latest composite polls by Bloomberg suggests that UK Prime Minister Rishi Sunak’s party failed to make any dent in campaigning so far, with Labour still holding onto a comfortable lead. Our G10 team notes that EURGBP has broken lower past key technical levels of 0.8500, and moving forward will likely be impacted by the results of both these elections.

Last but not least MXN fell further after President-elect Claudia Sheinbaum said a proposed reform of the nation’s judicial system would be among the first to be discussed in Congress. Markets will watch closely for key risk events including US CPI, Fed and BOJ policy meetings later this week.

Regional FX

Regional FX

Asian FX markets were weaker on the back of lower EURUSD and the surprise snap election in France, and with that a stronger US dollar. KRW (-0.85%), THB (-0.72%) and MYR (-0.59%) underperformed. The election driven moves out of EUR and MXN were somewhat in contrast to what we have seen in India’s General Election results thus far. The result was certainly a surprise, but the incremental information since then have been reasonably positive, with key regional parties throwing their support unequivocally behind PM Modi and his BJP party. In addition, the cabinet minister list has a good mix of continuity in key positions such as Finance, Defence, and Roads, adding some seasoned hands for policy priorities such as agriculture, health and welfare, while also incorporating key allies in a modest way in the cabinet. Overall, these developments fit in with our view that while there will be policy shifts to support consumption and the lower income, we should still see broad policy continuity under the new government (see India Elections: Major shockwave).