Ahead Today

G3: US NY Fed Inflation expectations

Asia: China trade

Market Highlights

Over the weekend, the Trump administration issued important tariff exemptions on the imports of smartphones, semiconductors, and other key electronics items from reciprocal tariffs and the additional 125% tariffs on China, at first glance providing meaningful relief to consumers and the electronics sector alike. Nonetheless, this was yet another example of a policy announcement which sowed significant confusion among market participants and companies alike, with President Trump pledging to eventually apply a separate sectoral tariff rate to all these products.

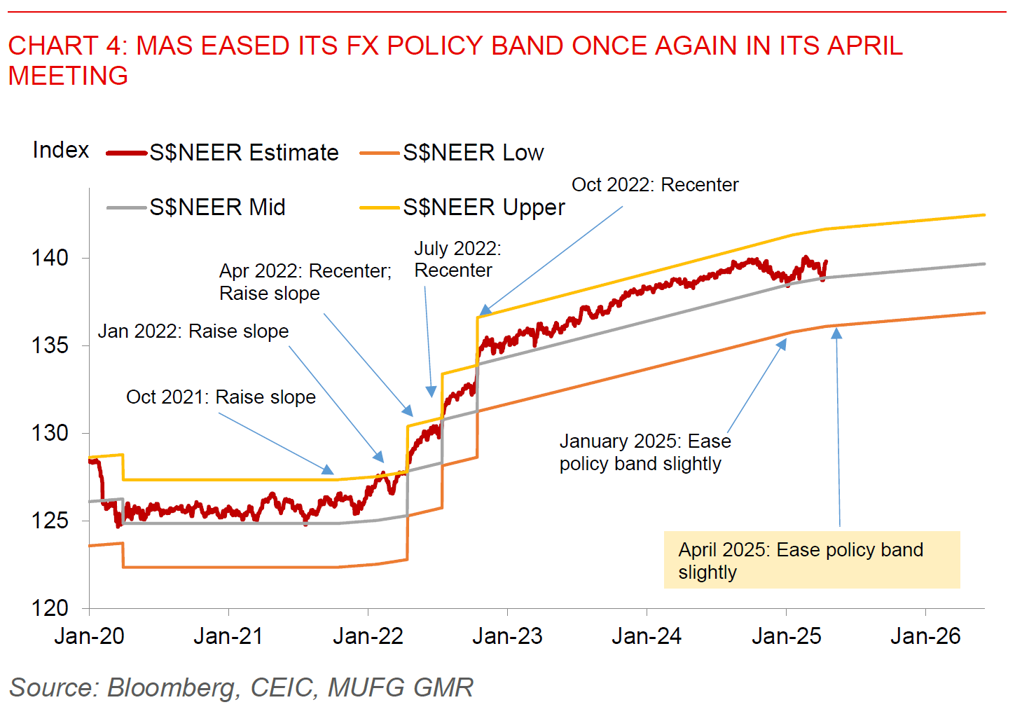

Our calculations suggest that Asian markets would receive the greatest benefit from these exemptions, temporary as they may be, with the exemptions expanding from the previous list of US$45bn focused on semiconductors to now more than US$380bn.

The likes of Taiwan for instance will see an additional 53% of its export basket exempted, followed by 28% for Thailand and Vietnam, 26% for the Philippines, and 25% for Malaysia. For China, this move would exempt around 22% of its exports to the US, and is significant for the US consumer both because the exorbitant 125% rates on China will not apply and also because China is a dominant producer for many electronics products with a lack of substitutes across countries and within the US in its domestic production capacity.

The product mix also varies by market as well, with computer and data related exports forming the bulk of exemptions in Taiwan, and to a smaller extent the Philippines. Smartphone-related exemptions are more prominent for China, India and Vietnam, and for good reasons given these countries’ importance in mobile assembly and production. Meanwhile, there are also exemptions on flat panel displays out of the likes of South Korea, Vietnam and China.

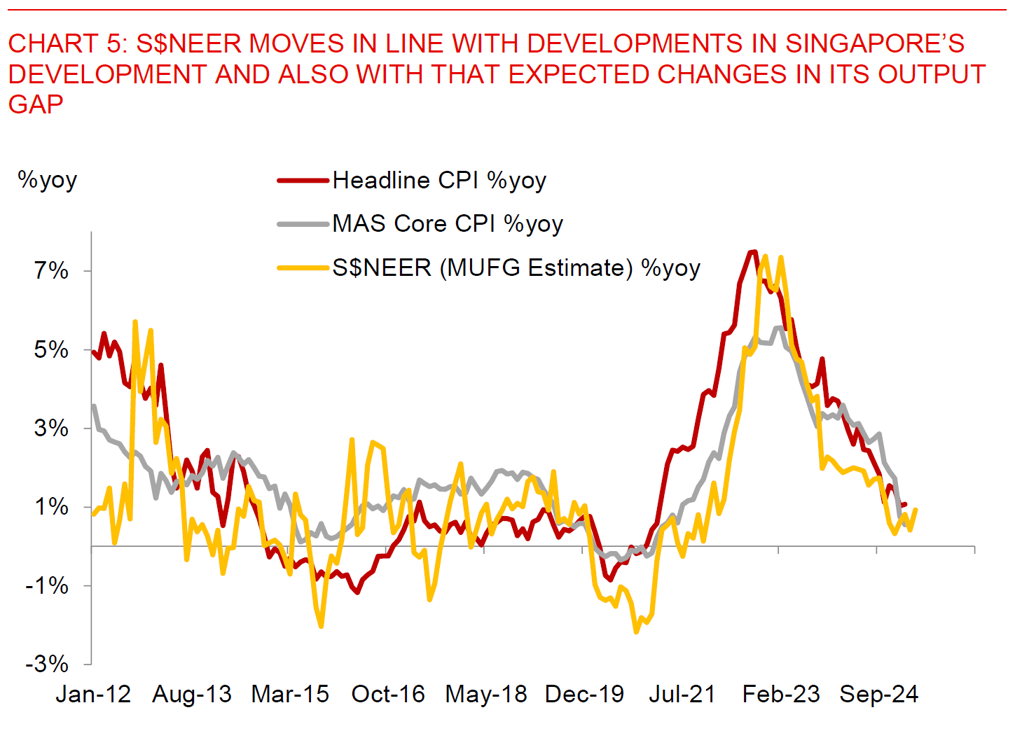

With these exemptions, we calculate that average effective tariff rates by the US dropped to around 22% from 26% previously.

This move could also have meaningful distribution impact across Asian countries of course depending on how the semiconductor and electronics sector tariffs are imposed subsequently. Assuming there is a 25% flat tariff on these electronics products, the likes of Taiwan, Malaysia, and the Philippines could see higher tariff rates relative to China compared to the tariff exemption pause announced over the weekend.

Regional fx

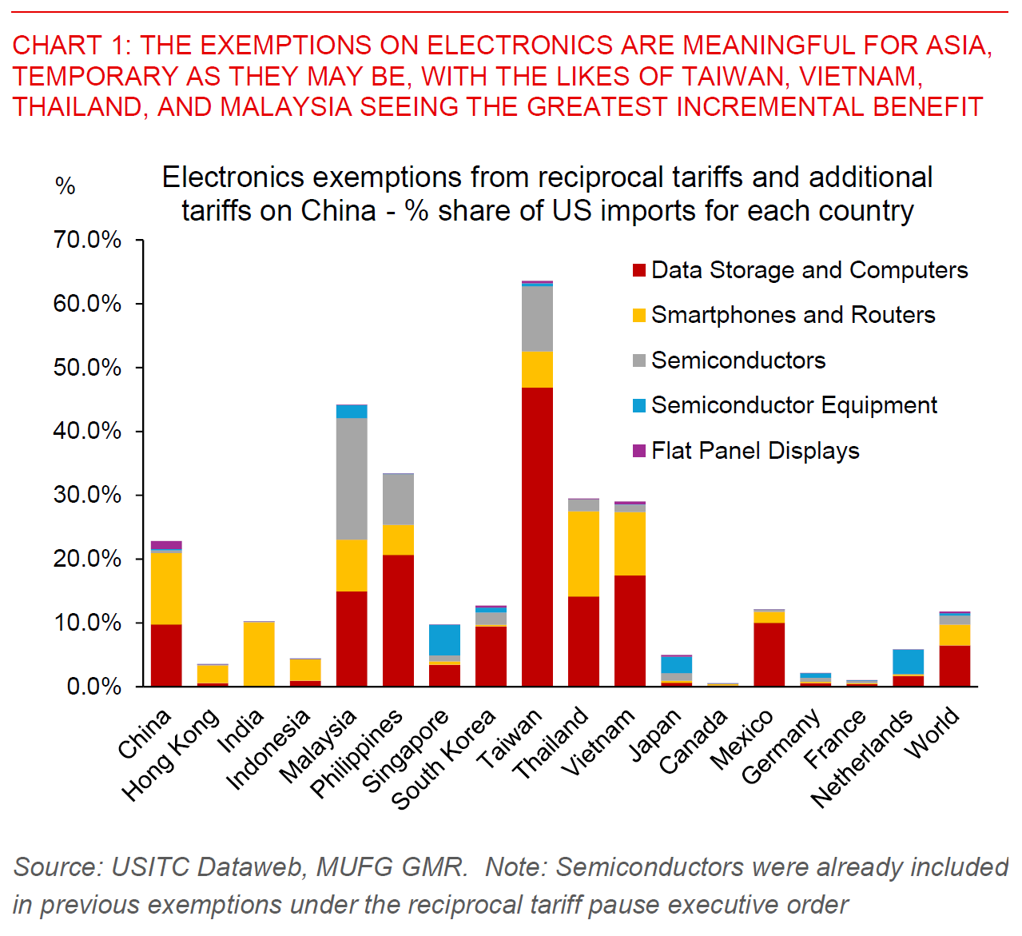

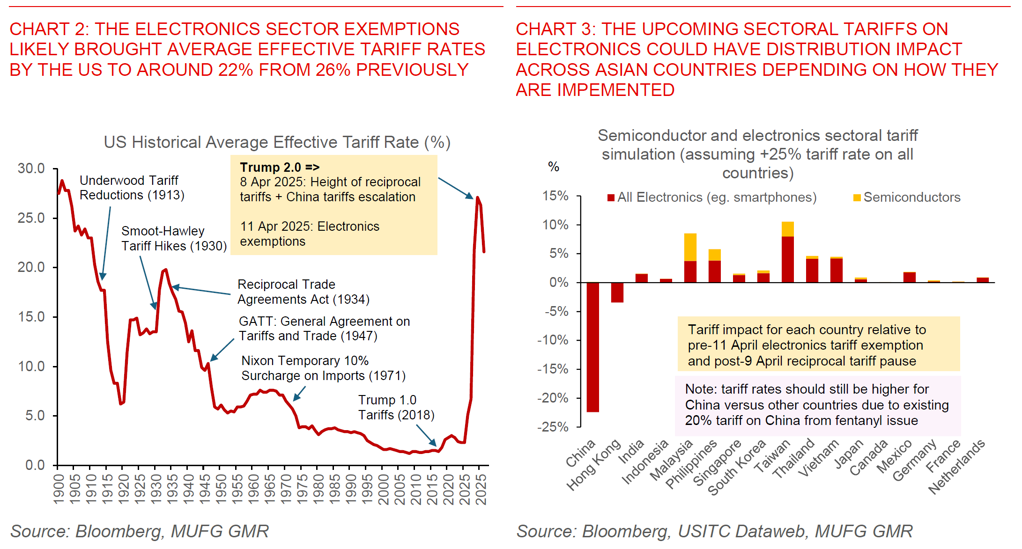

Singapore’s central bank announced its exchange rate policy decision, easing the slope of its policy band likely bringing it to 0.5% per annum from an estimated 1% currently, while maintaining the width and the level at which it is centered unchanged. This was in line with our forecast and also the consensus (see MAS preview – More policy easing). The guidance from the MAS was also dovish, indicating that Singapore’s output gap will turn negative, with the central bank also indicating that the risks to inflation are tilted towards the downside. Meanwhile, the MAS cut both its headline inflation and MAS core inflation forecast to 0.5-1.5% (down from 1.5-2.5% and 1-2% previously), with the government also lowering its 2025 GDP forecast to 0-2% from 1-3%. Overall, the impact from an FX perspective was relatively muted with S$NEER remaining around 0.7% above mid-point by our estimates, and with the S$NEER bouncing around the mid level for some time. We note that the path moving forward for S$NEER will also depending on the extent of Singapore’s inflation and growth slowdown from here beyond policy decisions, with tariff risks raising meaningful left tail risks to the economy.