Ahead Today

G3: US mortgage applications, FOMC minutes

Asia: RBI policy rate decision

Market Highlights

The global trade war has continued to escalate, with Asian economies bearing the brunt of President Trump’s reciprocal tariffs. This will continue to weigh on the outlook of Asian economies and currencies, with varying impact depending on size of tariff hikes and their trade exposure. US President Trump has further threatened to impose an additional 50% import tax on China if China does not withdraw its 34% retaliatory tariffs on all US goods. This would bring total tariff hikes on China to 104%. China has vowed to “fight to the end” if US raises tariffs further. It’s clear that China has changed tact, departing from its more measured response earlier. This has raised the risk of a full-blown global trade war. Other major trading partners such as the European Union are also considering retaliatory tariffs on US.

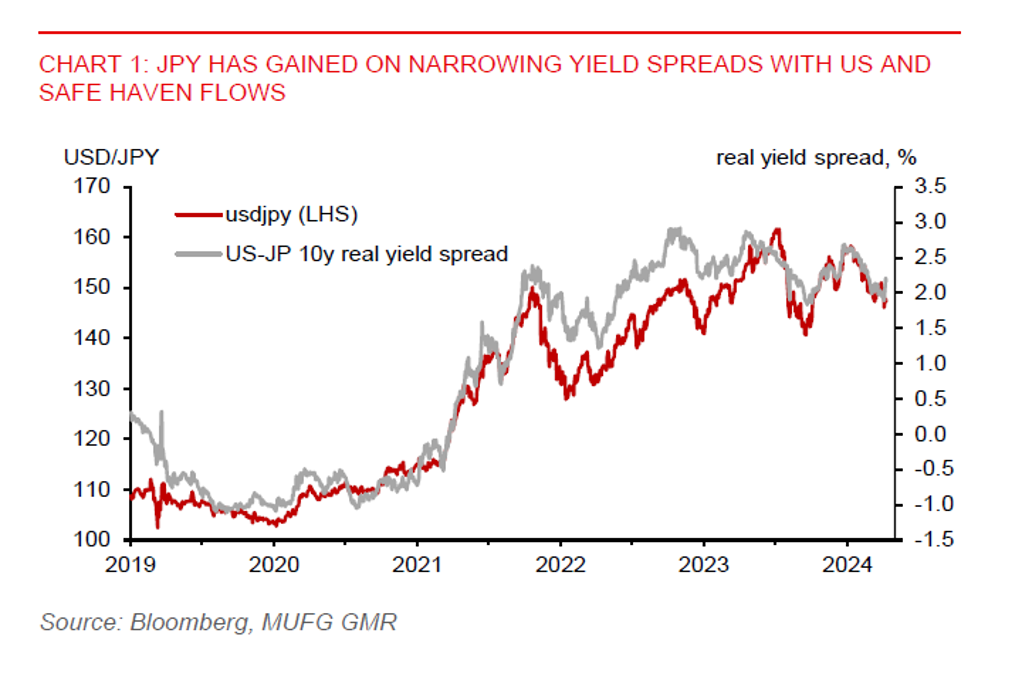

Clashing tariff comments between the US and China, along with China’s tariff retaliation, have led to significant volatilities in financial market, which could have negative implications for the global economy. Elevated global trade uncertainty also has had a negative impact on FDI inflows to China and South Korea in the first two months of 2025. Markets have priced in more policy rate cuts in the Asia region this year to support economic growth, particularly China and Thailand. Meanwhile, US small business optimism index fell to 97.4 in March from 100.7 in February, missing market expectation of 99. USDJPY fell 0.6%, with JPY benefitting from safe-haven flows.

Regional FX

Asia ex-Japan currencies have broadly weakened against the US dollar. The PBOC has set a higher USDCNY daily fixing rate of 7.2038 yesterday, with the upper bound of the policy band at 7.3479, signalling it will allow for further yuan depreciation to partially offset tariff impact. USDCNH broke the 7.3750 high, bringing the pair to unchartered territory. This will continue to have spillover effects on regional currencies. Notably, IDR (-1.8%) and THB (-1.8%) have led losses in the region, followed by VND (-0.9%). We look for further depreciation of regional currencies ahead.

The key highlight today is the RBI policy meeting. We look for a 25bps rate cut, with RBI focusing on supporting growth.

Elsewhere, Indonesia’s headline inflation was subdued at 1.0%yoy in March, with well contained food and fuel prices, while core inflation steadied at 2.5%yoy. Despite this, rupiah underperformance relative to regional peers could keep the BI on hold in April. Both rupiah volatility and credit default swaps have also surged.

Meanwhile, Taiwan’s headline inflation picked up to 2.3%yoy in March from 1.6% in February. However, rising growth risks due to a 32% US reciprocal tariff hike could tilt Taiwan’s central bank to cut the policy rate in the next quarterly meeting in June.