Ahead Today

G3: US housing starts

Asia: China Q3 GDP and Sept activity indicators, Malaysia 2025 budget and trade

Market Highlights

The DXY US dollar index extended its gains by 0.2% on Thursday’s session, while the US 10-year yield rose 7bps. The ECB cut rates by 25bps to 3.25%, and said that disinflation remains intact, but warned about the euro-area economy being weaker than expected. Markets are now pricing for the possibility of a jumbo 50bps rate cut by the ECB in December. In addition, USDJPY has risen above the 150.00-level again BoJ board member Seiji Adachi has stressed the need to take a gradual approach to raising the policy rate, while keeping financial conditions accommodative enough for the price trend to get to 2%. Japan’s exports fell 1.7%yoy, led by cars, fuels, and construction machinery, the first contraction since November 2023. Japan’s national CPI also eased to 2.5%yoy from 3%yoy in August.

Meanwhile, there remains no strong argument yet for a US recession. US consumer spending appears to be resilient, with retail sales ex-auto and gas rising 0.7%mom in September, from 0.2%mom in August. Initial jobless claims fell to 241k in the week ending 12 October, from 258k in the prior week. While industrial production fell 0.3%mom in September, from a 0.8% rise in August, this was likely due to disruption from 2 hurricanes and a Boeing strike.

In China, authorities have announced to double the loan quota to RMB4 trillion to ensure completion of unfinished homes, avoid another mortgage boycott, and stabilize the housing sector.

Regional FX

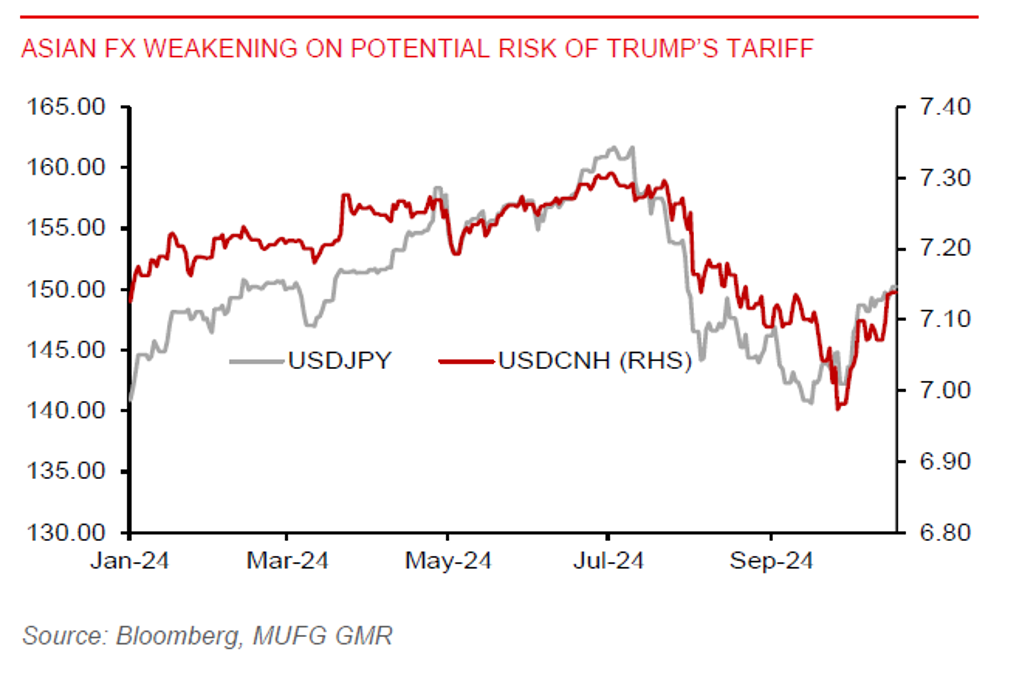

Asia ex-Japan currencies broadly weakened against the US dollar, with VND (-0.8%) and KRW (-0.6%) leading losses across the Asia region. With markets starting to price in the risk of Donald Trump becoming US president again, we remain cautious on Asian currencies. Indeed, Trump has proposed to impose 60% tariffs on all China imports and 10% on everyone else, which would have huge implications for Asian economies. The key highlights for Asia today include China’s Q3 GDP and activity indicators (retail sales, industrial production, and fixed asset investment) for September, as well as Malaysia’s 2025 budget. China’s GDP is likely to have slowed further to 4.5%yoy in Q3 from 4.7% in Q2, with real estate investment remaining a key constraint on growth. There have also been no signs of housing price stabilization yet. In Malaysia, the 2025 budget may be focused on tackling the high cost of living while laying out measures for fiscal consolidation, which could include RON95 fuel subsidy rationalisation.