Ahead Today

G3: FOMC meeting, eurozone CPI, BoJ policy rate decision, Japan industrial production

Asia: Bank Indonesia policy rate decision

Market Highlights

A Wall Street Journal report on tariffs shows that the US will consider value added tax when setting reciprocal tariff rates. At one point, authorities have considered implementing a three-tier system of tariffs on all trading partners, which does not include any “no tariff” tier. But this idea has been dropped and authorities are now debating over how best to implement an individualized tariff rate for each trading partner, such that true reciprocity can be achieved. The reciprocal tariff plan is set to be announced or implemented on 2 April, along with an additional 25% sectoral tariffs on autos, semiconductors, and pharmaceuticals. Canadian authorities were being told that tariffs will be virtually certain on 2 April.

Meanwhile, the Fed will have to brace for a larger and more pervasive trade war 2.0, which could hurt US economy while pushing up inflation. For the upcoming FOMC meeting, the Fed is likely to keep the policy rate on hold, with Fed Chair Powell recently saying that the cost of staying patient with rate cuts is very, very low. He could also reiterate that the US economy is still largely fine, but acknowledging increasing economic uncertainty.

In Japan, we expect the BoJ to keep the policy rate unchanged, while markets will watch for any guidance on the pace of rate hikes. According to the first round of responses compiled by Japan’s trade unions for the spring wage negotiations, the average wage increase is 5.46%, larger than the 5.28% last year. This will be a tailwind for further BoJ policy rate normalization in the coming months, which would be supportive of the yen.

Meanwhile, in Germany, the parliament has approved plans for massive defense spending, buoying the euro at the US dollar’s expense.

Regional FX

Asia ex-Japan currencies were relatively muted against the US dollar ahead of the upcoming FOMC and BOJ policy meetings. A notable exception to this is the 0.6% drop in KRW versus the US dollar.

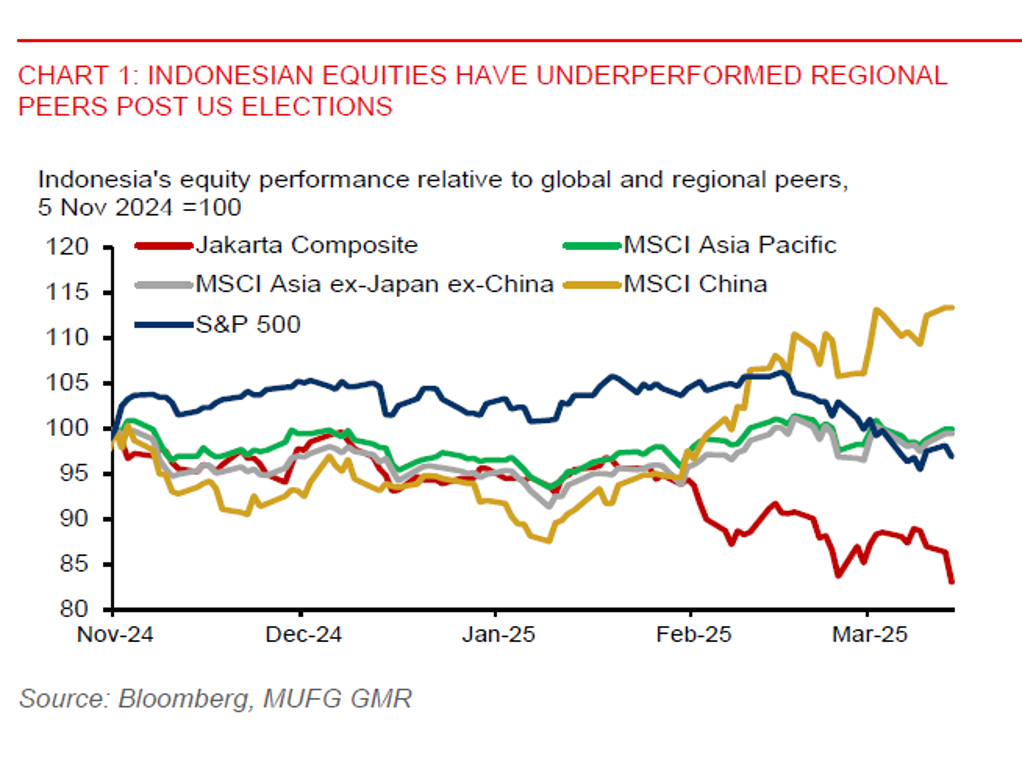

In Indonesia, there has been a simultaneous sell-off in equities, bonds, and the rupiah. Notably, the Jakarta Composite Index (JCI) fell by 7% at one point yesterday, triggering a temporary trading halt, before paring back some of its losses. The decline in JCI could be partly due to rumors about veteran Finance Minister Sri Mulyani resigning. Sri Mulyani has dispelled the resignation rumors by saying she will stay as the finance chief, while emphasizing that Indonesia’s fiscal health remains sound and the budget deficit for 2025 will stay at 2.5% of GDP. Amidst challenging domestic and global headwinds, we remain cautious about the outlook for Indonesia's equities and the rupiah.

The key highlight for Asia today is the policy rate decision from Bank Indonesia. Despite the equity sell-off yesterday, we expect BI to keep the policy rate unchanged at 5.75%, given the IDR has underperformed regional peers. To be sure, Bank Indonesia is looking for opportunities to lower rates, but a rate cut this month may come too soon following the policy easing in January. We look for the next policy rate cut in Q2.