Ahead Today

G3: US FOMC rate decision, mortgage applications, housing starts; eurozone CPI

Asia: Policy decisions from Bank of Thailand and Bank Indonesia

Market Highlights

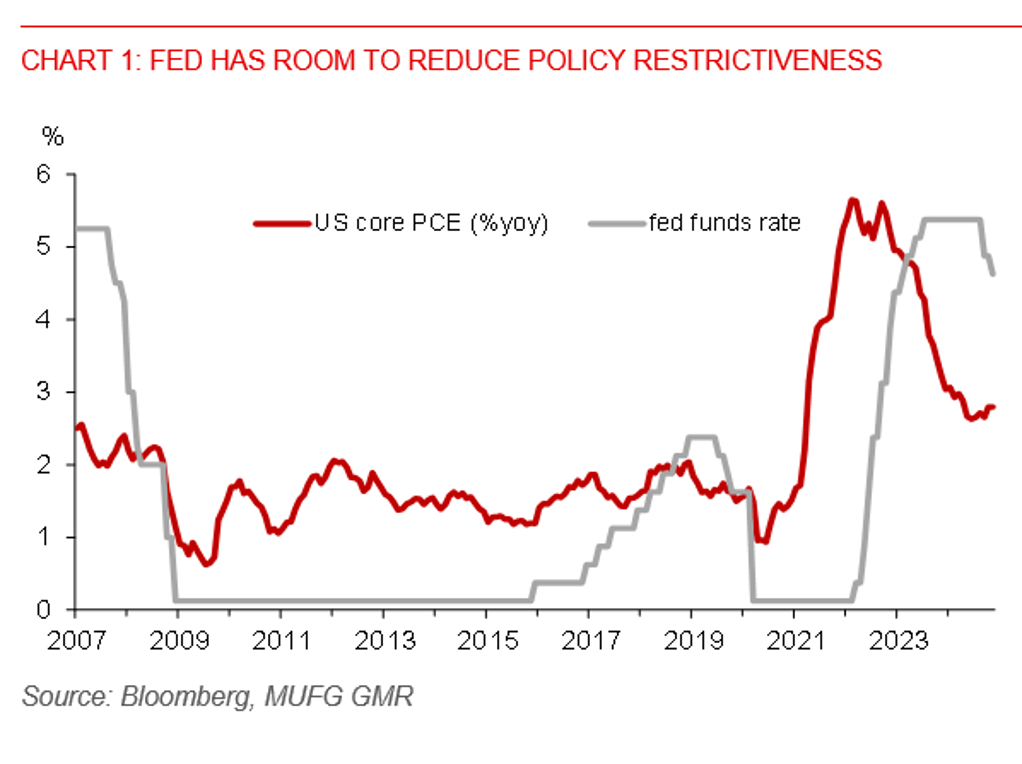

The FOMC meeting will be held later today. Markets are pricing in a December Fed rate cut of 25bps. And we are also anticipating a Fed rate cut. Indeed, there is no positive US inflation surprise in November, with CPI inflation coming in line with market expectations. While PPI inflation rose 0.4%mom (3.0%yoy) in November, it was mainly due to wholesale food inflation, while core PPI inflation was steady at around 2.5%yoy. As such, there will likely be room for the Federal Reserve to recalibrate its monetary policy restrictiveness at the meeting later.

However, uncertainty remains about future monetary policy actions, especially with the incoming Trump administration's potential tariff hikes, which could have severe inflationary consequences. This could slow the pace of Fed rate cut in 2025.

Markets will be looking for Fed Chair Powell’s forward guidance and the quarterly dot plot for the path of Fed funds rate next year. The US economy has thus far shown more resilience, with inflation falling more slowly and the labour market remaining strong. November's US retail sales also rose 0.7%mom, reflecting strong consumer resilience and increased spending ahead of the holiday season.

Regional FX

ASEAN currencies led losses against the US dollar in the Asian region in Tuesday’s session. Notably, USDTHB rose 0.6%, while USDIDR gained 0.4% to breach the 16,000-level, ahead of key rate decisions from the Bank of Thailand (BoT) and Bank Indonesia (BI) later today. We expect BoT to keep the policy rate unchanged at 2.25%, defying government pressures for further monetary easing. Thailand’s economic growth is likely to sustain its sequential growth momentum in Q4, while inflation could rise to 1.4%yoy in December, returning to the BoT’s 1%-3% target range. However, we maintain our view for Bank Indonesia to cut rates by 25bps amid weaker growth and inflation falling to 1.55% in November, near the lower bound of BI’s 1.5%-3.5% inflation target. Moreover, we anticipate the Fed will cut rates this month, which should give room for BI to follow suit. However, there’s a risk that BI could be cautious, keeping rates on hold, given recent weakness in the rupiah. A rate hold would be at the expense of growth.