Ahead Today

G3: University of Michigan sentiment index, CPI data from Germany, France, and Spain

Asia: China M2 money supply, Thailand foreign reserves

Market Highlights

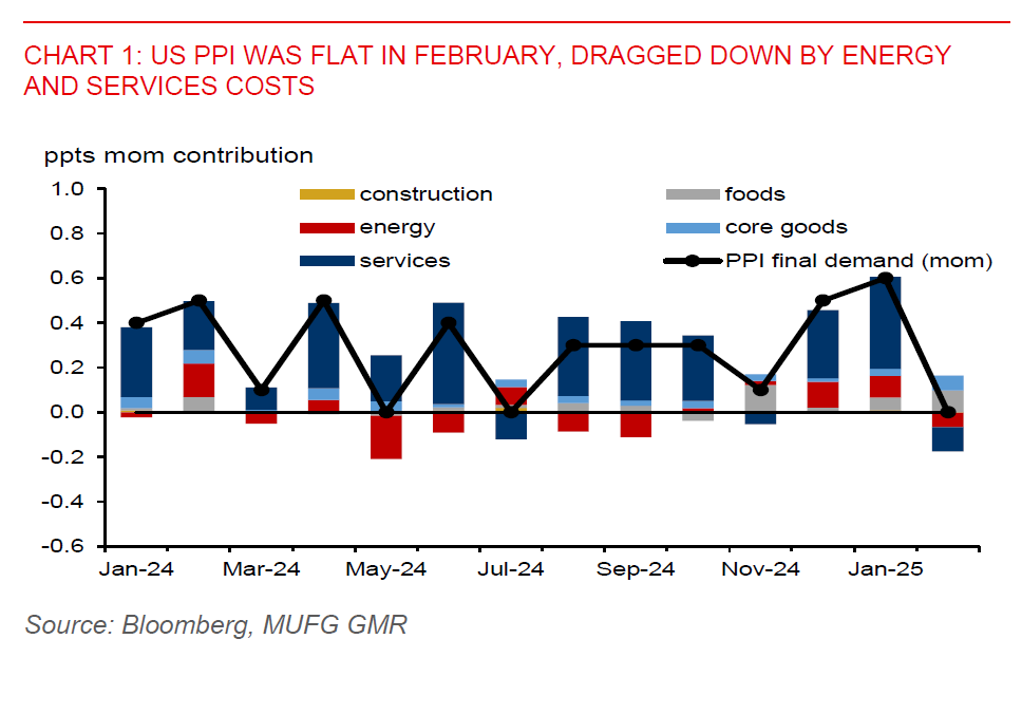

US producer price index was flat in February, down from 0.4%mom in January and below Bloomberg consensus of 0.3%mom. Core PPI (ex-food and energy) fell 0.1%mom, from +0.3%mom in January. From a year ago, headline and core PPI moderated to 3.2% and 3.4%, respectively, from 3.5%yoy and 3.6% in January. Nonetheless, with core PCE inflation likely to remain above the Fed’s 2% target, with scope for a pickup due to tariff hikes, the Fed could remain patient with rate cuts. There could possibly be just two 25bps rate cuts in the rest of this year. The fed funds futures markets have unwound US rate-cut bets to less than 3 cuts, from more than 3 cuts being priced in at the start of the week. Further reduction in market expectation for Fed rate cuts could provide support for the US dollar.

Meanwhile, US initial jobless claims fell 2,000 to 220k in the week ended 8 March compared to the prior week. This was historically low. But with the government cutting federal workers as part of its efficiency drive, we may see some labour market softness in the months ahead, which could prompt the Fed to resume policy easing in Q2.

Upcoming consumer related data from the US, including the University of Michigan Sentiment index and retail sales, could shed more light on the consumer outlook. Positive surprises from these data could be additional support for the US dollar.

Regional FX

Asian currencies had a mixed performance against the US dollar in Thursday’s session. CNY, KRW, MYR, SGD, and VND fell 0.1%-0.3% against the US dollar, while INR, IDR and THB gained 0.1%-0.3% against the US dollar. With the US dollar already at oversold levels, we could see a near-term bounce in the US dollar, especially with incoming reciprocal tariff hikes in April.

Indonesia recorded a budget deficit of IDR31.2 trillion (or 0.13% of GDP) in January-February, versus a 0.1% of GDP surplus over the same period last year. While Finance Minister Sri Mulyani has maintained a budget deficit projection of 2.5% of GDP in 2025, ongoing fiscal uncertainty will remain a headwind for the rupiah. She has also added that any changes to the fiscal outlook will be announced in the middle of the year.

Meanwhile, Bank Indonesia will be auctioning its rupiah securities (also known as SRBI) today. With SRBI yields falling to 6.4% on a 12-month tenor, it represents one of the tightest spreads over the BI policy rate in a year. And with fiscal concerns likely to continue weighing on long-term government bonds, a lack of foreign inflows to Indonesia’s bond markets will also weigh on the rupiah.