Ahead Today

G3: ECB Meeting, US PPI

Asia: China CEWC Meeting

Market Highlights

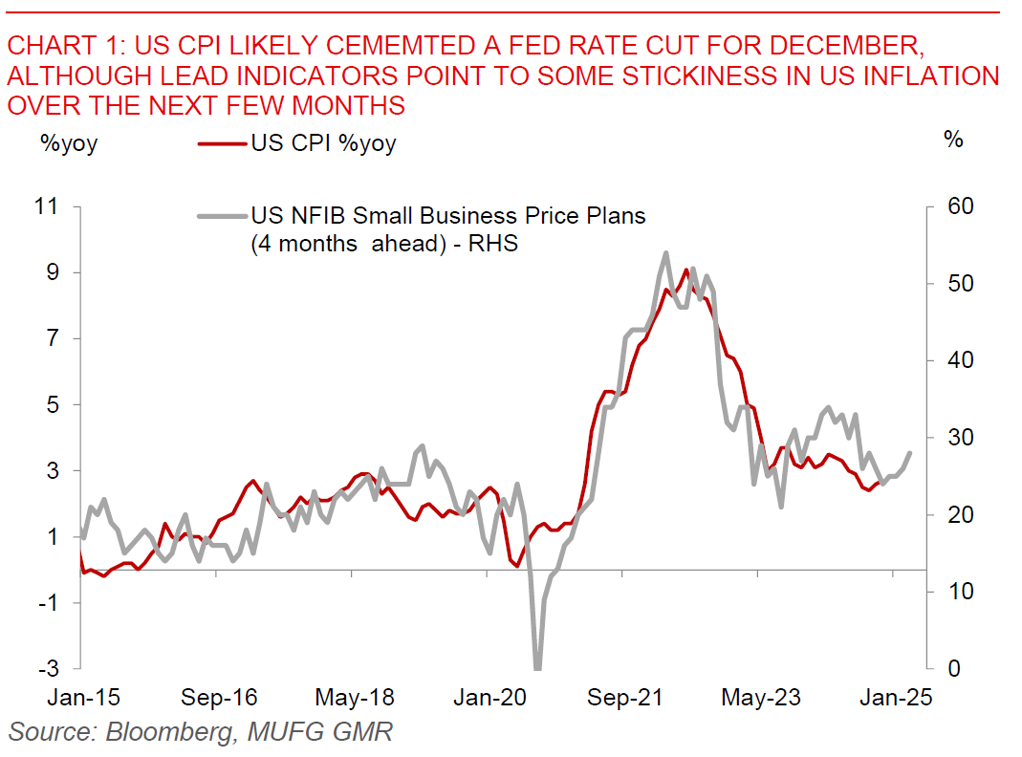

US CPI inflation came in pretty much as expected, with both headline and core CPI rising 0.3%mom. The details showed some moderation in services inflation including in the shelter component, but core goods disinflation slowed with rise in apparel prices coupled with food components. Moving forward, services inflation should come off further in 2025 reflecting the moves in spot rents that we have already seen coupled with continued normalization in labour markets, but it’s unclear if core goods inflation will rise further. Overall, the CPI inflation print cements a Fed rate cut in December, but will likely push the FOMC to communicate a slower pace of easing into 2025, given that Trump’s policies including on tariffs could certainly alter the trajectory of inflation.

Meanwhile, Reuters reported that China’s top leaders and policymakers are considering allow the yuan to weaken in 2025, possibly to around the 7.50 per dollar level, as they brave for higher US trade tariffs in a second Trump Presidency. USD/CNH rose to as much as 7.2921 on the report, before paring moves. China’s Central Economic Work Conference (CEWC) meeting will end today and the readout will possibly contain some clues on policy priorities and stimulus for 2025, even as exact numbers on the fiscal deficit and growth targets will be left to be announced in the March 2025 NPC meeting.

Regional FX

Asian currencies had a mixed and choppy session, weakening yesterday before strengthening overnight. Bloomberg News reported that Bank of Japan officials see little cost to waiting to hike rates in their monetary policy meeting next week, with officials viewing the next rate hike as just a matter of time with the economy and inflation in line with their projections. The report also mentioned that officials will make a final decision only after carefully assessing data and financial markets before delivering the decision. Meanwhile, RBI’s new Governor Sanjay Malhotra pledged to remain agile and alert, ensure stability and continuity in policy, while also ensuring that the growth that India has continues, in his first maiden press conference. Overall there was no explicit message on monetary policy from new RBI Governor, but our general sense is that he is pragmatic and understands the challenges of taking over the reins of the RBI at a time of significant changes in 2025. His preference on monetary policy will take some time to be revealed but there is overall a good chance that the collective Monetary Policy Committee turns more dovish in 2025. We are forecasting RBI to cut rates from the Feb meeting, for a total of 75bps this cycle, and for USD/INR to head to 85.2 by 1Q2025 and 86.0 by 4Q2025.