Ahead Today

G3: US Wholesale Inventories

Asia: China CPI, China PPI, Taiwan Exports

Market Highlights

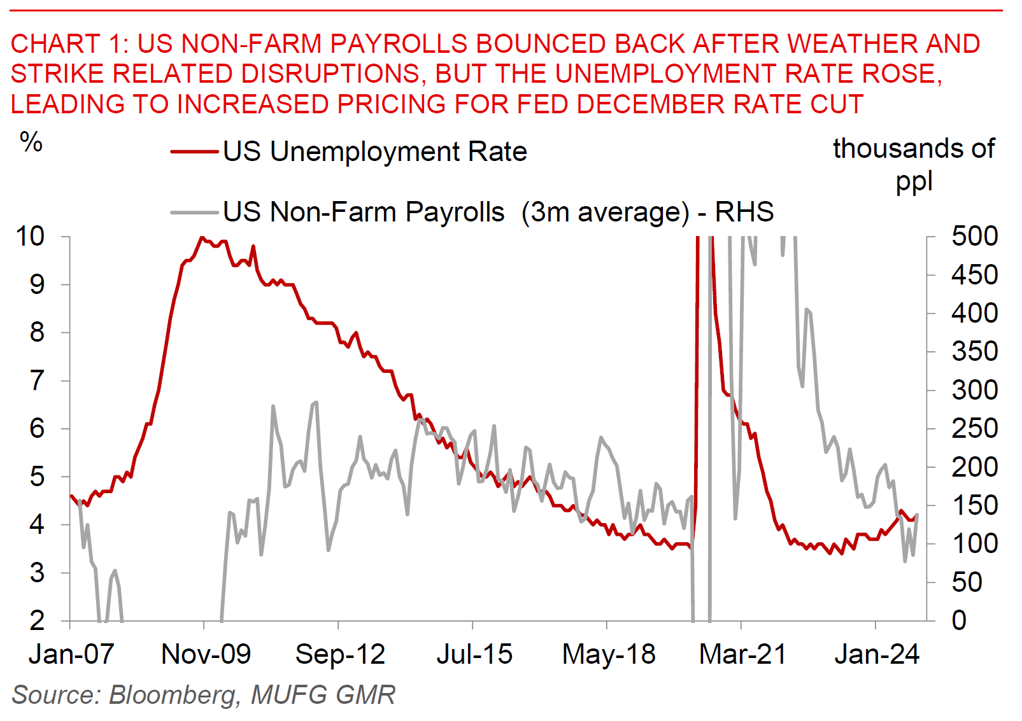

US non-farm payrolls for November were seemingly strong at 227,000 helped by the reversal of weather and strike-related disruptions. We note that underlying NFP could have been closer to 150k even after stripping out one-off factors – overall still a decent print on surface. Judging by the reaction post NFP, the market could have placed more weight in the near-term on details beyond the headline number such as the rise in unemployment rate to 4.2% from 4.1%, together with the sharp 355,000 employment decline in the household survey. In particular, US 10-year yields fell by 5bps at one point while markets increased the odds of a December Fed rate cut to 80% from 70%. We doubt Asian FX can strengthen further from here especially in 1H2025 given the likelihood that Trump 2.0 will be fast and furious in tariff implementation, making it somewhat attractive to put on some hedges against Asian FX weakness.

Beyond the spectre of Trump and macro, a flurry of developments over the weekend continued to remind us that political risks remain pertinent for markets. In South Korea, an impeachment motion against President Yoon Suk Yeol failed, potentially increasing political uncertainty in the country and setting KRW up for a volatile trading week. Meanwhile, Syrian President Bashar Al-Assad’s government has fallen after rebels seized Damascus in a lightning advance of just 12 days, while Trump met with Ukraine President Zelensky in a meeting brokered by French President Emmanuel Macron.

Regional FX

Asian currencies were stronger as some of the Trump trades got reversed, with PHP (+0.88%), MYR (+0.8%), and THB (+0.7%) and IDR (+0.50%) outperforming. The clear underperformer was the South Korean Won which fell by 0.7% to 1423. South Korean President Yoon Suk Yeol survived an impeachment vote over the weekend after the ruling party by and large did not participate in the opposition-led bid to oust President Yoon, in a move that may partially reflect concerns around re-election prospects. The ruling People Power Party leader Han Dong-Hoon tried to assure the public post the impeachment motion that Prime Minister Han Duk-soo will manage the country’s affairs while the party negotiates an “orderly exit” plan for President Yoon, who reportedly will not be involved in any state affairs including diplomacy before his exit. How exactly this will be done in practice seems to be unclear given charges by the opposition that this is an unconstitutional move. Meanwhile, South Korean prosecutors have opened an investigation into President Yoon on charges of treason and abuse of power following his failed attempt to impose martial law, while prosecutors have already arrested former defense minister Kim Yong-hyun.

Overall, the key transmission mechanisms to South Korea’s markets may include slower tourism inflows, weaker domestic demand, and dent to corporate sentiment, especially if street protests become more vociferous and the Budget passage remains in stalemate. South Korea was already one of the more vulnerable FX markets in Asia to Trump 2.0’s policies, and the political uncertainty also comes at a juncture just when leadership is needed to navigate these significant global policy shifts. We are forecasting USD/KRW at 1450 by 2Q2025 and for BOK to cut rates further in 2025.

Meanwhile, the Reserve Bank of India held its key repo rate unchanged, but cut the Cash Reserve Ratio (CRR) rate by 50bps bringing it to 4.00% from 4.50%. The MPC voted 4-2 to keep the repo rate unchanged, with an additional external member dissenting for a rate cut (Professor Ram Singh and Dr Nagesh Kumar) (see RBI December 2024 decision). All these developments were in line with our expectations as highlighted in our latest report (see IndiaPulse – Gradual rise in USD/INR to 86 with softer growth, 75bps RBI rate cuts). What’s also interesting were announcements by the RBI to shore up capital inflows in the near-term through raising interest rate ceilings on FCNR(B) deposits, perhaps indicating the central bank’s concern on INR weakness. Our assessment is that the incremental capital inflows into India from these FCNR measures should not change the overall trajectory for USD/INR to head higher. For one, the FCNR deposit caps are unlikely binding to begin with even before the change. Second, banks also have other avenues to raise Dollars at likely cheaper funding costs from global capital markets. Third, FX risks are still borne by banks, unlike what we saw in 2013 when RBI subsidized FX risks through a swap window. We are forecasting USD/INR to grind higher to 85.20 by 1Q2025 and 86.00 by 4Q2025 (calendar year).