Ahead Today

G3: US: initial jobless claims, ISM survey; eurozone manufacturing PMI

Asia: China Caixin PMI, Indonesia inflation

Market Highlights

We expect 2 more BOJ rate hikes in this fiscal year, with the next rate hike in December. Our USDJPY forecast is revised down to 148 in end-2024, from 152 previously. This follows from the BOJ raising its benchmark policy rate by 15bps to 0.25% from a range of 0%-0.1% on Wednesday with a 7-2 majority vote. It would also halve the pace of monthly JGB purchases to around JPY3tn by Q1 2026, implying the purchase amount will be trimmed by JPY400bn in each calendar quarter. This would decrease BOJ’s JGB holdings by 7%-8% in about 2 years. Governor Ueda sounded hawkish, hinting at more rate hikes on imported inflation concerns, while putting aside issues such as low real wages and consumption weakness. Policymakers see risks are skewed to the upside for growth and inflation, while core inflation forecasts are left largely unchanged at around 2% through March 2027. The yen has rallied to break 150-level vs USD, while there’s upward pressure on short- and long-end yields.

Meanwhile, the Fed stands pat this month. Chair Powell hinted at a September rate cut during his press conference if inflation continues to decline or there is unexpectedly sharp weakness in the labour market. Policymakers think the labour market is normalising gradually for now. The Fed likes what it sees with disinflation and a still solid economy, so it has set the stage for dialling back restrictive monetary policy. But the Fed would like to see a couple more inflation data to gain greater confidence that inflation is sustainably returning to the 2% goal. The US dollar weakened as Powell spoke, US yields fell, while US equities rose.

Regional FX

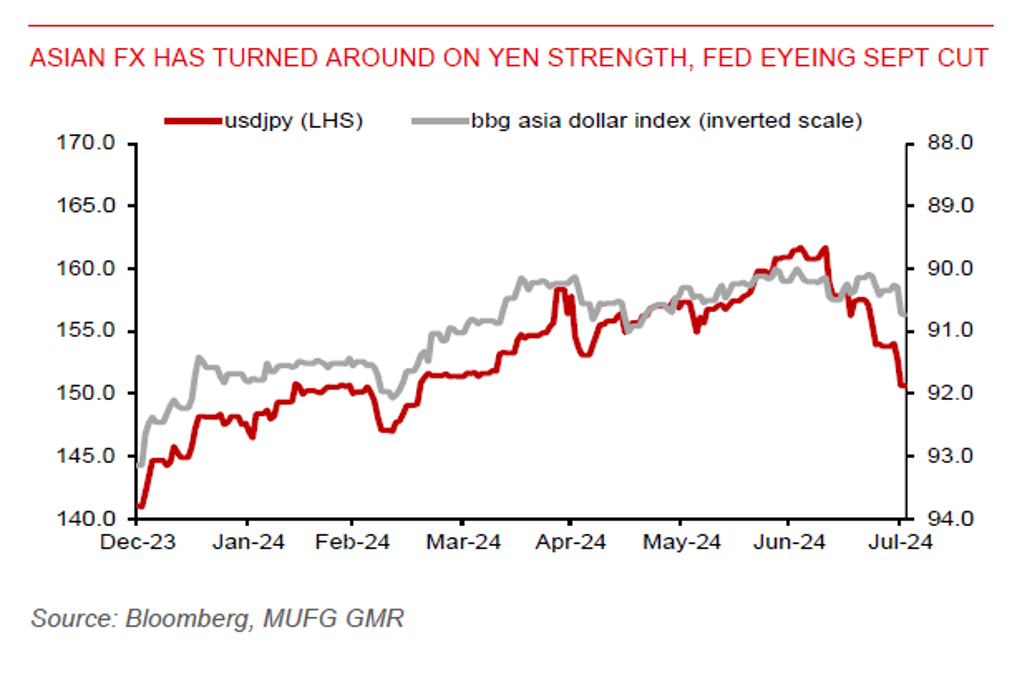

Asian currencies strengthened against the US dollar alongside the strong yen rally and expectations for US rate cuts. Low-yielding currencies such as the KRW (1%), THB (+0.9%), and MYR (+0.7%) were top performers yesterday, while more modest gains were seen in CNH (+0.2%), SGD (+0.3%), IDR (+0.2%), and PHP (+0.5%). Notably, the recent MYR rally has erased its year-to-date loss and is up 0.5% year-to-date. Meanwhile, Thailand’s improving current account surplus ($1.95bn in June vs market expectation of $350mn) will help support THB strength.

Recent gains in Asian FX vs. US dollar could have marked the turning point for regional currencies, with the Fed set to dial back its restrictive monetary policy stance in September barring surprises. However, downside risks remain, stemming from rising Middle East tensions and an associated rise in oil prices, as well as uncertainty from the US presidential election. Meanwhile, China’s economy has continued to face headwinds, with latest PMI data showing factory activity eased somewhat in July while services activity rose at a slower pace. Taiwan’s economy also stagnated in Q2 following a modest +0.2%qoq pace in Q1.