Ahead Today

G3: US: mortgage applications, housing starts, FOMC rate decision, Fed dot plot

Asia: China 1y MLF rate, Bank Indonesia policy rate

Market Highlights

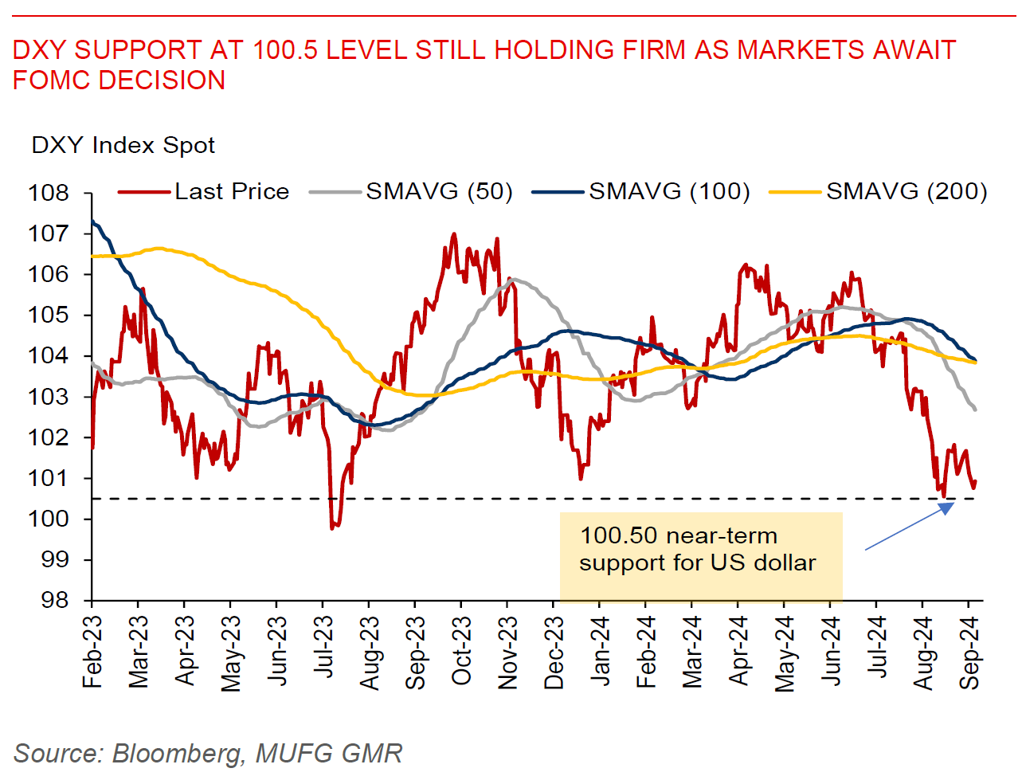

The DXY dollar index gained 0.1% on Tuesday’s session, following past three straight trading days of losses, with the 100.50 support level continuing to hold firm. JPY fell 0.9% against the US dollar after hitting a high of 139.58 on Monday. JGB traders see reduced odds of the BoJ raising rates again this year, as reflected by a narrowing gap between 2-year and 5-year JGB yields. EUR softened against the US dollar as German investor sentiment fell to the lowest level in nearly a year in September, with the ZEW survey expectations coming in at 3.6 vs. 19.2 in August and market expectation of 17.0. Meanwhile, US retail sales control group rose 0.3%mom in August, the same pace in July and in line with market expectation. US industrial production increased 0.8%mom, from a 0.6% decline in July and stronger than market expectation of 0.2%mom, while capacity utilization rate was at 78.0% vs. 77.8% in July and market expectation of 77.9.

Market focus will turn to the FOMC rate decision today, as well as the Fed’s September dot plot. Markets are still pricing for a potentially outsized 50bps rate cut in September. US equities, bonds, and gold have typically performed well after the Fed starts lowering rates. However, US elections in November are going to matter too.

Regional FX

Asia ex-Japan (AXJ) FX performance was mixed against the US dollar on Tuesday’s trading session. MYR was a regional outperformer, gaining 1% against the US dollar, buoyed by expectations of a rapidly narrowing yield differentials with the US and global funds pouring into Malaysian equities and bonds. IDR (+0.4%) also gained against the US dollar, amid a larger trade surplus of US$2.9bn in August vs. US$472mn in July. A break of the crucial support level at 15,300 could see USDIDR fall to 15,000. Later today, Bank Indonesia policy rate decision will be announced. Market consensus is for BI to keep the policy rate unchanged at 6.25%. Meanwhile, the CNH weakened 0.2%, as markets await the 1-year MLF rate decision later followed by the 1y and 5y loan prime rates a couple days later.