Ahead Today

G3: US CPI

Asia: India industrial production and CPI

Market Highlights

The US dollar has weakened modestly, despite US Treasury yields somewhat picking up across the curve. But US dollar downside may be limited, with trade uncertainty continuing. President Trump has planned to impose broad-based reciprocal tariffs, which will tend to hurt emerging market economies more. His announced 25% tariffs on steel and aluminium imports are set to take effect on 12 March. EU has vowed to retaliate against Trump’s tariffs on metals by imposing tariffs on imports of bourbon, jeans, and peanut butter from the US.

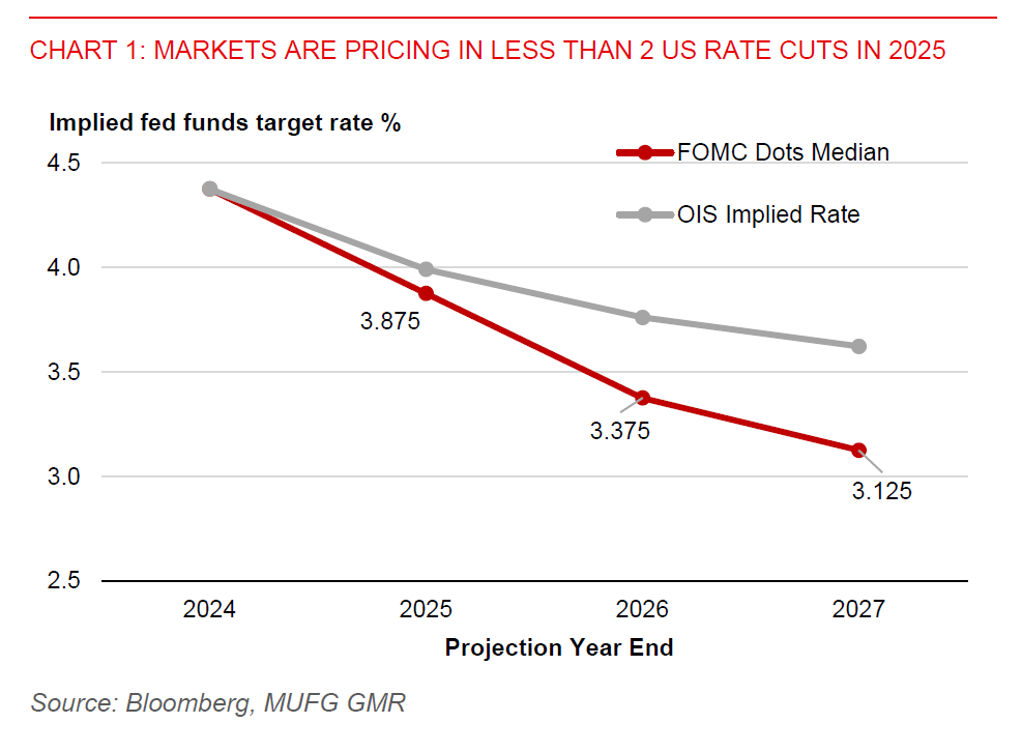

Meanwhile, US NFIB small business optimism index eased to 102.8 in January from 105.1 in December. This may portend some easing in US core inflation in the next few months. However, US CPI for January, to be released later today, is still likely to show core inflation staying elevated at around 3.2%yoy. This, along with global trade uncertainty, could keep the Fed patient with rate cuts. Markets are only fully pricing a US rate cut in September. During his testimony to the senate banking committee, Fed Chair Powell has reiterated that the Fed is in no hurry to adjust rates and remains attentive to risks to both inflation and labour market. Powell has added that long-term inflation expectations appear well anchored, while the labour market is not a source of inflationary pressures.

Regional FX

Asian currencies broadly weakened against the US dollar, except for INR. Notably, VND fell to a record low on Trump’s intensifying tariff rhetoric. Meanwhile, INR gained 0.7% against the US dollar on suspected strong intervention by the RBI, following a sharp move higher in USDINR to nearly the 88.00-level over recent days. The rupee's rally also comes ahead of Prime Minister Narendra Modi's meeting with US President Donald Trump this week, which may provide additional support for INR if bilateral negotiations go well. Still, we maintain our cautious view on INR and continue to see USD/INR at 88.50 by end-2025.

Meanwhile, in Indonesia, there have been several fiscal manoeuvres by President Prabowo to free up funds to support his free school lunch initiative and to continue developing new capital city Nusantara. His plans include cutting back state spending by about $19bn, which may hinder other public investment projects. Fiscal concerns, along with a still strong US dollar, will drag on the rupiah.

We also see scope for Thai baht to weaken against the US dollar. In Asia, apart from India, Thailand’s economy is one of the most vulnerable to President Trump’s potential reciprocal tariff hikes.