Ahead Today

G3: US initial jobless claims, existing home sales

Asia: China loan prime rates, Malaysia trade

Market Highlights

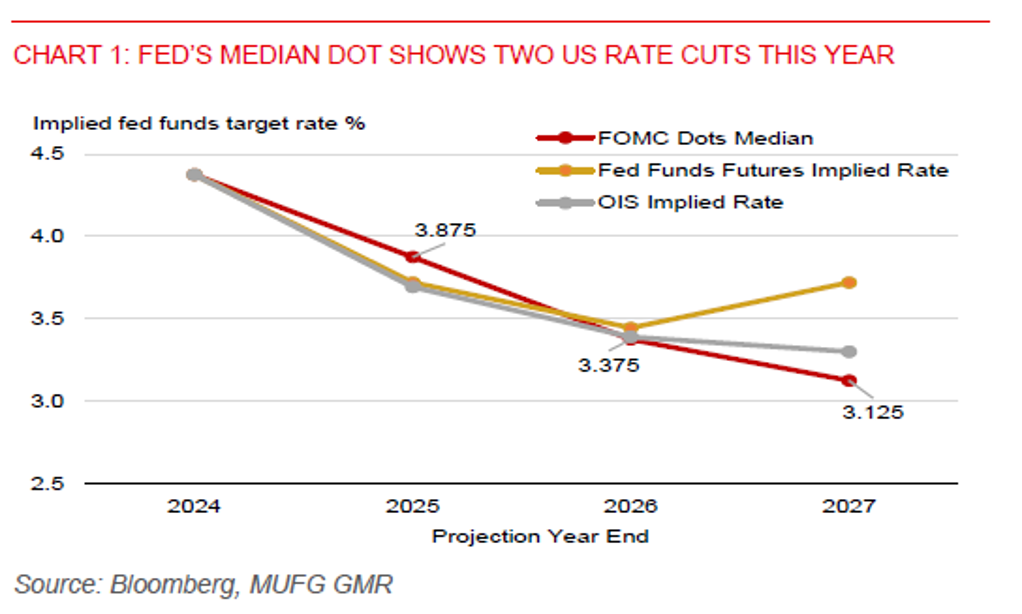

The Federal Reserve held the policy rate unchanged as widely expected, while saying that the uncertainty around the economic outlook has increased. The Fed has revised down its 2025 outlook for US GDP growth to 1.7% from 2.1% previously, while raising its forecasts for core inflation this year to 2.8% from 2.5% previously and the unemployment rate to 4.4% from 4.3% previously. The median dot for this year remains at 3.9%, or two 25bps rate cuts in 2025, and there is a strong cluster around that. Market pricing for about 60bps of rate cuts this year or 3.7% by end-2025 is also comparable with the latest dot plot. The Fed has also said that it will slow the pace at which it shrinks its balance sheet, starting April. This will be through lowering the monthly redemption cap to $5bn of US treasuries being allowed to mature without being reinvested, from $25bn previously.

The BoJ also held rates at 0.5% as expected. BOJ Governor Ueda has appeared less hawkish at the press conference, which could contain yen strength. Ueda has acknowledged large uncertainties over the economic impact of US tariffs, mentioned that the bank will not raise the policy rate when the economy is in a bad condition, while adding that service price increases are not that strong. That said, Ueda has signalled that the bank is currently comfortable with the current pace of rate hikes. He has also acknowledged the slightly stronger wage increases of 5.46%, based on data from Japan’s Trade Union Confederation. The BoJ is likely to remain on a gradual rate normalization path.

Regional FX

Asia ex-Japan currencies broadly fell against the US dollar in Wednesday’s session. Notably, the KRW (-0.7%) and IDR (-0.6%) led losses against the US dollar in the Asia region. However, lower US yields and a softer US dollar following the FOMC meeting could help provide some support for regional currencies today.

Bank Indonesia (BI) held its policy rate unchanged at 5.75% yesterday, given the rupiah has underperformed regional currencies while Indonesia’s stock market has been in turmoil. This is in line with our and market expectations. BI maintains its outlook for Indonesia’s GDP growth at 4.70%-5.50% this year, despite global uncertainties. To be sure, the central bank is still looking to cut rates, and it will be data dependent. We look for the next 25bps policy rate cut to possibly come in Q2. And despite the BI rate hold, the rupiah is likely to weaken amid mounting tariff risks. It will also be difficult for BI to raise the policy rate to defend the rupiah at a time of global and domestic policy uncertainties (see Indonesia: Rupiah weakness to persist in Q2, despite BI rate hold).

Indonesia’s financial services regulator has eased rules on shares buyback, allowing companies to do that without shareholders’ approval, while officials have intervened in the FX market to help calm markets. BI has also said that a revision to the financial sector law will entail clarifying the central bank’s task of supporting “sustainable economic growth”, and that there won’t be a fundamental change to its current policy mandate.