Ahead Today

G3: Germany IFO Expectations, UK Retail Sales

Asia: Taiwan Unemployment rate

Market Highlights

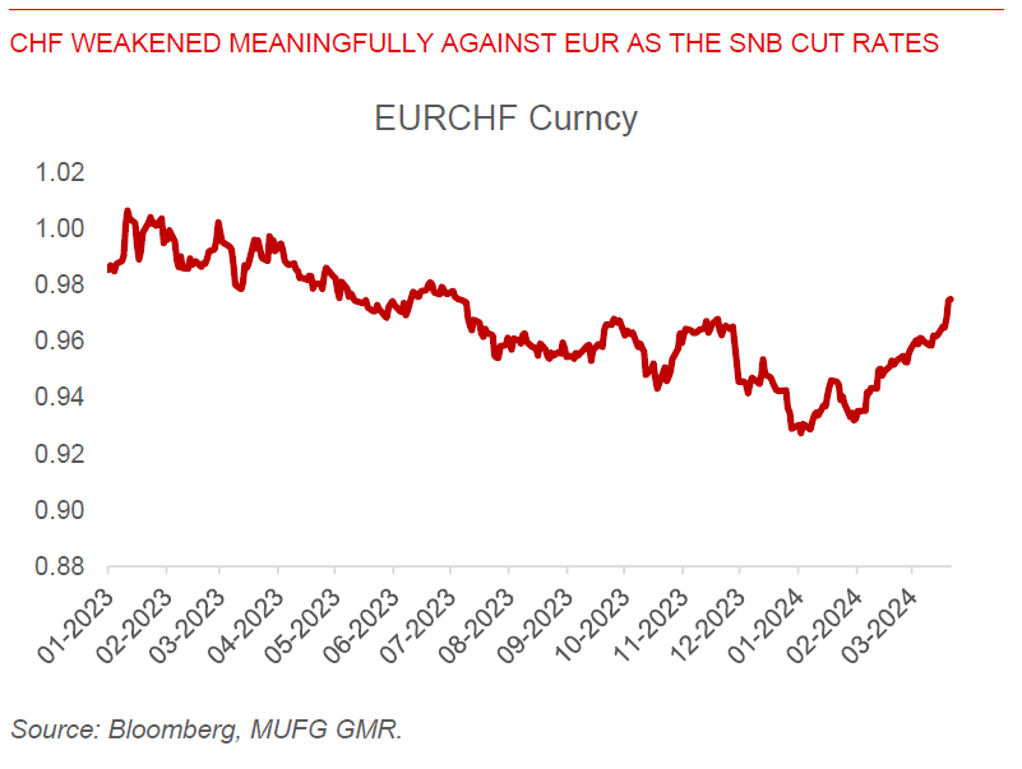

The Dollar strengthened as major central banks outside of the US turned less hawkish, while data out of the US remained relatively resilient. The Swiss National Bank fired the 1st salvo among G10 central banks by cutting rates by 25bps, highlighting that the fight against inflation has been effective, while inflation should remain within target through its forecast horizon. Meanwhile, the Bank of England kept rates on hold, but with two hawkish members of the MPC Jonathan Haskel and Catherine Mann dropping their votes to hike.

US existing home sales rose to a one-year high up by 9.5%, with the National Association of Realtors saying that housing supply is improving especially in the single-family home space. The S&P US manufacturing PMIs was stronger than expected, while Europe’s PMIs were a mixed bag, with manufacturing declining but this came with stronger services activity.

Overall, risk assets continued to do well with the S&P500 up another 0.3%, UK and European rates outperformed on the back the BOE and SNB decision, while the Dollar was up 0.6%.

Regional FX

Asian FX markets traded weaker against the Dollar, with KRW (-0.7%), and THB (-0.4%) underperforming. China’s PBOC Deputy Governor Xuan Changneng said there is still room to lower the reserve requirement ratio for banks, saying that interest rate policy in China can become more “autonomous” as deposit rates trend lower and other major global economies move towards easing. Meanwhile, Taiwan’s central bank surprised markets by raising rates by 25bps, bringing its benchmark interest rate to 2% from 1.875% previously. While there have been hawkish comments from the central bank recently, the timing and urgency of the hike was still a surprise to markets. The CBC highlighted the risk of electricity prices going up due to losses at government-owned Taiwan Power Company, and also whether there is now a structural shift higher in inflation. Meanwhile, export activity for the 1st 20 days in Korea rose by 11.2%yoy, while India’s Manufacturing PMI numbers were stronger than expected at 59.2.