Ahead Today

G3: US Non-Farm Payrolls

Asia: Philippines Unemployment Rate, Indonesia Foreign Reserves

Market Highlights

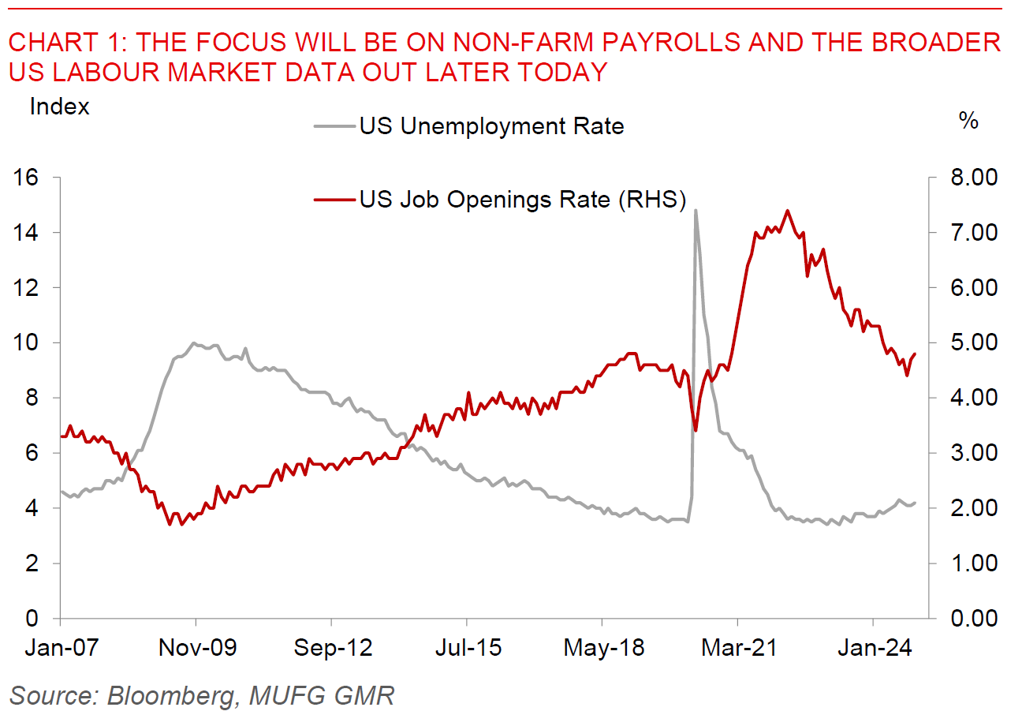

Fed officials overall highlighted that a slower pace of rate cuts is likely through 2025, with Boston Fed President highlighting “considerable uncertainty” over the US economic outlook even as she said that it was in a good place. Philadelphia Fed President Patrick Harker said the Fed can pause for a little bit but not too long, and that he still sees the Fed on a downward policy rate path even as the exact speed will depend on the incoming data. On that note, the key focus of markets will be on the non-farm payrolls print, together with the broader labour market indicators such as unemployment rate and hourly earnings. Consensus is expecting a modest slowdown but still robust clip at 165k, from 227k the previous month.

Amidst these macro developments, we continued to get more colour on the Trump 2.0 administration. Bloomberg news reported that the new administration is planning a flurry of executive orders around immigration, energy, federal workers and regulatory reform on Day 1, including plans to tighten border crossings and put a hiring freeze on the government. Trump’s recent pronouncements on Greenland have certainly resulted in consternation among allies and adversaries alike, but more broadly also underscores his focus on China, Russia and critical minerals, at a time when climate change is transforming the geopolitical rules of the game in the Arctic.

Regional FX

Asian currencies were mixed to weaker, with IDR (-0.4%), PHP (-0.6%), TWD (-0.7%) and THB (-0.3%) underperforming. USD/CNY rose to 7.3322 levels while USD/CNH was at 7.3540. China’s CPI inflation in line with consensus but remained soft at 0.1%yoy from 0.2%yoy the previous month, while PPI was weak at -2.3%yoy. The details showed that weaker food prices, household services maintenance and cultural and education activities depressed the CPI print. Overall, the softer inflation numbers point to still insufficient stimulus and we do expect some further clarity on policy direction as we head into the National Party Congress coupled with how China may respond to Trump 2.0’s policy pronouncements. China has also recently expanded the list of goods available for the consumer trade-in program. Meanwhile, Indonesia’s government said it will require commodity exporters to keep part of their foreign currency earnings onshore for at least one year (from 3 months currently), in a bid to boost foreign reserves, according to Coordinating Minister for Economic Affairs Airlangga Hartarto. The government together with Bank Indonesia are preparing incentives to ensure compliance. The existing rules require exporters in the mining, plantations, forestry and fisheries sector earning at least $250,000 to keep a minimum 30% of their FX proceeds onshore for at least 3 months. The rule change should in theory help boost Dollars available onshore and to some extent guard against Rupiah volatility.