Ahead Today

G3: US ISM Manufacturing, US ISM Manufacturing Employment sub-index

Asia: China Caixin PMI Services, HSBC India PMI Services, Vietnam and Singapore PMI, Singapore COE

Market Highlights

It was a relatively quiet start to the week given the US labour day holidays. Asian markets displayed some slight reversal in FX outperformance coupled with equity risk aversion, on the back of the weak official China manufacturing PMI data out over the weekend coupled with resilience in US activity data such as the GDP and personal spending numbers. Nonetheless the Asia PMI numbers released yesterday pointed to decent economic performance, with most exporters still firmly in expansion (Korea, Taiwan, Thailand, Singapore), while China’s Caixin PMI numbers picked up to 50.4 from 49.8 the previous month. India’s Manufacturing PMI slowed down to 57.5 from 57.9 but remained robust, and Indonesia was the only country which saw a slowdown in activity at least as measured by the PMIs. Meanwhile, inflation prints out of South Korea and Indonesia remained manageable at around 2%yoy for both countries, opening the door for rate cuts. We expect South Korea to cut rates in the October policy meeting, while BI will likely start its rate cut cycle from 1Q2025.

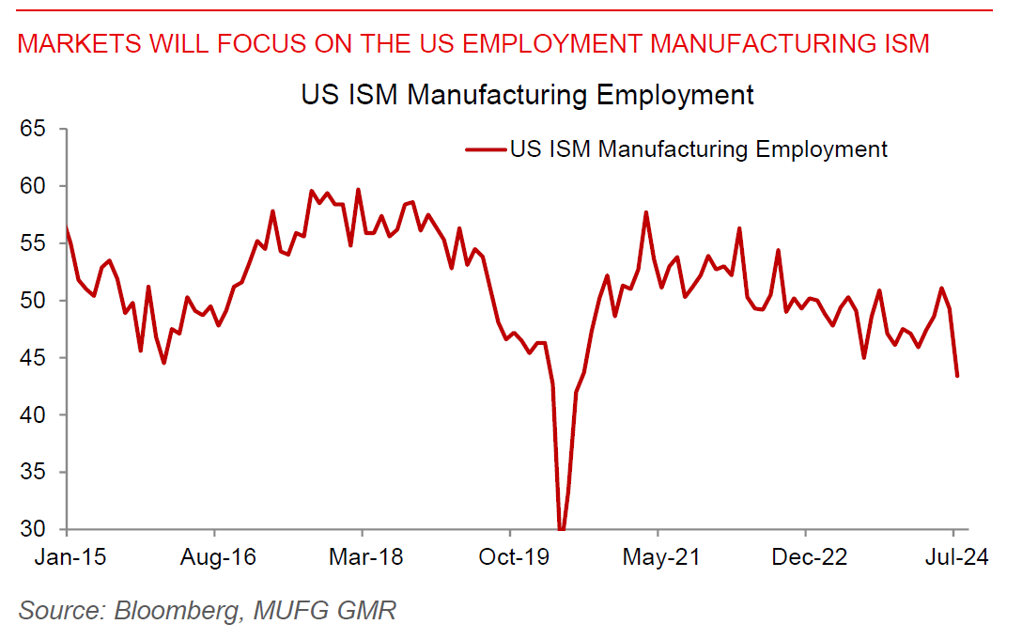

Looking ahead, the most important datapoint today will be the US ISM Manufacturing numbers for August, which comes on the back of a weak print the last month. While the activity data such as the headline numbers and new orders sub-index will be key, markets will place more emphasis than usual on the employment component given the Fed’s focus on the labour market in deciding the pace and magnitude of rate cuts. The previous ISM Manufacturing employment print seemed exceptionally weak at 43.4, and we’ll see if this is sustained for this month.

Regional FX

Asian FX markets retraced somewhat as markets looked for the next catalyst. THB (-0.83%), MYR (-1.0%), and KRW (-0.5%) underperformed. India's Apr-Jun GDP data was softer than expected at 6.7% (vs consensus of 6.8% and RBI's estimate of 7.1%). This number raises the probability of an earlier RBI rate cut, even as we continue to see a shallow RBI rate cut cycle given the growth slowdown was partly driven by temporary Election and heatwave-related slowdown, and the GDP details were quite decent with a pickup in private consumption and fixed investment. The high frequency indicators for India have been mixed so far till August with a moderation in urban consumption and government operational spending, while rural consumption, public and private investment showed signs of improvement. Overall, an earlier RBI rate cut could support foreign equity inflows and help to finance the widening in trade deficit and imports we are already seeing. Given how much INR has already diverged from the Dollar, we think the directional risk-reward tilt towards lower USD/INR, with RBI capping topside spikes, and especially after November when seasonality becomes more helpful. Nonetheless, we tighten the range in which USD/INR will trade to between 83.500-84.000 over our forecast horizon (see Global FX Monthly Sep 2024).