Ahead Today

G3: US Dallas Fed manufacturing activity

Asia: Vietnam activity data

Market Highlights

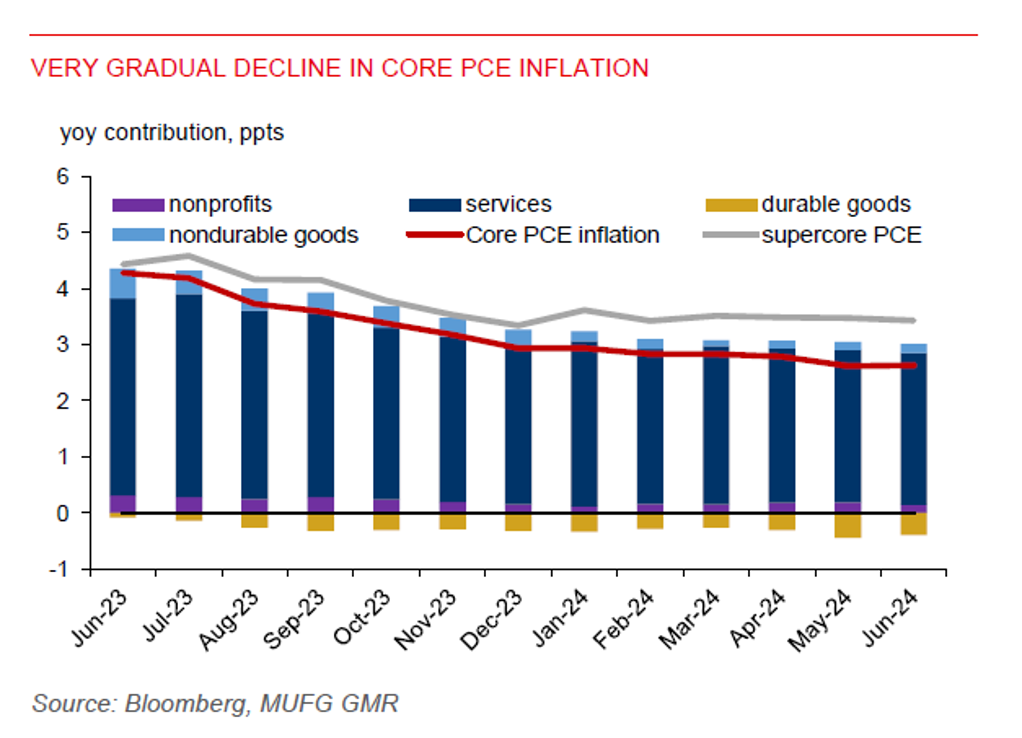

Latest US macro data shows inflation progress has stalled in June, the economy has been healthy, but mild consumer weakness has emerged. Core PCE inflation rose 0.2%mom, from 0.1%mom in May. From a year ago, core PCE inflation was 2.6%, same as the pace in May. Notably, core services inflation was sticky at 3.4%yoy in June. Meanwhile, inflation-adjusted consumer spending rose 0.2%mom in June, slowing from an upward revised 0.4%mom increase in May. Consumer sentiment has weakened to an 8-month low of 66.4 in July.

Markets continue to expect the Fed will start cutting rates in September. US yields inched down on Friday, while the DXY USD index softened. The next couple months of inflation and jobs data will be crucial in influencing the pace of rate cuts ahead.

Meanwhile, USDJPY had a sharp down move last week, with declines extending to 152 before rebounding to end the week at 153.76. With eyes on the upcoming BoJ and FOMC meetings, we expect more volatile trading in the USDJPY pair.

Regional FX

Asian currencies gained against the US dollar last week, alongside a strengthening of the yen. THB (+0.6%), MYR (+0.6%), and KRW (+0.5%) were outperformers. CNH also gained 0.3%, but there was an unexpected wild swing in the pair. USDCNH dropped sharply to around the 7.2000 level last Thursday before rebounding sharply the following day to settle above 7.2600. Meanwhile, the rupiah was weighed down by the global risk-off mood, falling 0.6% against the US dollar. It remains to be seen whether Asian currencies can sustain their gains. The upcoming FOMC meeting presents a key event risk for Asian currencies. With markets confidently pricing in a September US first rate cut, any hint or rhetoric from the Fed that pushes back against such a move could re-exert depreciatory pressure on Asian FX.