Ahead Today

G3: US: initial jobless claims, PMIs, and existing home sales; Eurozone: PMIs and CPI

Asia: Bank of Korea policy meeting, India PMIs

Market Highlights

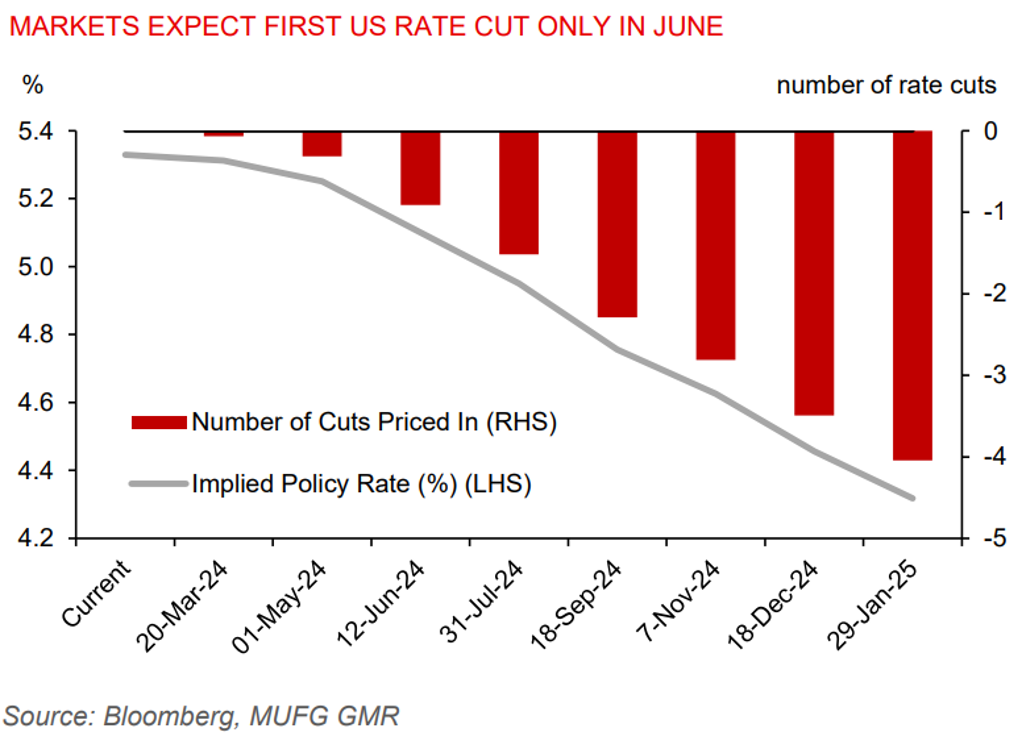

The January 30-31 FOMC meeting minutes reveal that the Fed is more concerned about the risk of cutting too early than keeping rates high for too long. The Fed also wants to see more evidence of inflation coming down to 2%, with some officials concerned that progress on inflation could stall. Markets are now pricing in three or four US rate cuts with a more than 50% chance that the first move will come in June. The US dollar index was little changed, while 10-year yields rose modestly.

Meanwhile, Fed’s Barkin said inflation has stayed persistently high in some sectors, with prices for shelter and services rising. He has earlier said that the US Fed should wait till more evidence of inflation returning to 2% before easing. Overall US mortgage applications fell 10.6%yoy in the week ending 16 February amid a renewed pickup in the 30-year mortgage rate to 7.06%.

Euro area consumer confidence improved in February but remained subdued relative to long-term historical averages.

Regional FX

ASEAN currencies retraced some losses against the US dollar yesterday. Notably, the Thai baht gained 0.6% against the US dollar, strengthening below the 36 level.

Bank Indonesia (BI) held its policy rate unchanged at 6.00% for the fourth straight meeting in February as it seeks to maintain rupiah stability and keep inflation within its new target range of 1.5%-3.5%. There are no changes to BI’s growth and inflation assessment at the meeting. The central bank maintains its growth outlook at 4.7%-5.5%, while expecting headline inflation to remain within its target range. But it has notably become more optimistic about global growth in 2024, mainly owing to its upward revision to its economic outlook for US and India. We retain our view that BI won’t front run the US Fed in cutting rates to avoid inviting unnecessary rupiah volatility. Moreover, BI has sounded upbeat about Indonesia’s growth prospects this year, supported by household consumption, construction investment, an export pickup, and election related spending.

Bank of Korea (BoK) will announce its policy rate today. Market consensus and our expectation are for the BoK to stand pat at 3.50%. Korea’s CPI inflation moderated to 2.8%yoy in January, but still above the central bank’s 2% target, while growth momentum steadied at 0.6%qoq over the past three quarters.