Ahead Today

G3: US ISM survey, eurozone manufacturing PMI, Germany inflation

Asia: Caixin China manufacturing PMI, inflation data from Indonesia and Australia

Market Highlights

The latest economic data points to US households still showing some signs of resilience, despite having depleted their excess savings in March. The University of Michigan survey rebounded to 68.2 in June from 65.6 in May, beating Bloomberg consensus of 66. Personal income was also 0.5% higher than a month ago, beating Bloomberg consensus of 0.4%mom. This, along with softening core PCE deflator (+0.1%mom in May from +0.3%mom in April), has helped supported personal spending, which rose 0.3%mom on an inflation adjusted basis. The slower pace of core PCE inflation was in line with market expectations. The DXY index was little changed following last Friday’s US macro data releases, with its uptrend staying intact.

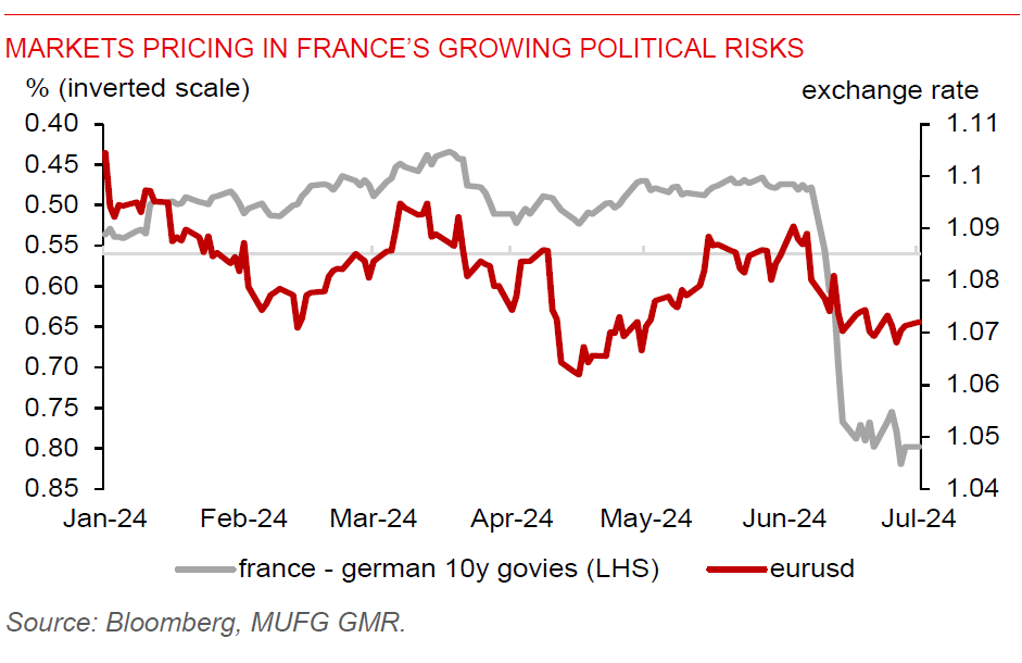

The US dollar could continue to hold ground this week, as sentiment towards the US dollar has become more positive, there’s still scope for global funds to add to their long positions on the US dollar, while political uncertainty in France will remain a drag on the euro. Marine Le Pen’s far right National rally party is set to garner about one-third of voter support, winning the first round of the legislative election, the leftist coming in second with about 29% of the vote, while President Macron’s centrist party likely coming in third with about one-fifth of the votes. The run-off will be held on 7 July. Uncertainty over future economic growth trajectory and policymaking in a divided parliament could remain headwinds for the euro.

Regional FX

The offshore Chinese yuan (CNH) has weakened by 2.4% year-to-date to around the 7.3000 level, and a move higher to the next resistance level at 7.3500 could still be on the cards. Risk sentiment towards the Chinese market remains weak, momentum still favours CNH weakness, while China’s economic outlook is clouded by an ailing residential property sector and signs of slowing services activity. The non-manufacturing PMI eased to 50.5 from 51.1, missing market consensus of 51.0. Notwithstanding a slew of government property support measures, declines in new home prices have deepened, while new home sales have continued to contract by double digits (about -26%yoy in May). Moreover, the USDCNY fixing rate has continued to drift higher to 7.1268, signalling to markets that the authorities are willing to tolerate a weaker yuan. The yuan weakness will continue to weigh on Asian currencies with close trade ties with China, including the KRW (-6.9% YTD), TWD (-5.6% YTD), and Thai baht (-7.5% YTD) among others.

A key data highlights in Asia today is Indonesia’s inflation. We look for inflation to remain steady at 2.8%yoy in June, staying within the inflation target of 1.5%-3.5%. Core inflation is likely to have remained contained, administered prices continuing to keep a lid on price pressures, while falling global food prices and higher food supply following the harvesting season should help moderate domestic food prices.