Ahead Today

G3: US ADP Employment Change, US Mortgage Applications

Asia: Singapore PMI

Market Highlights

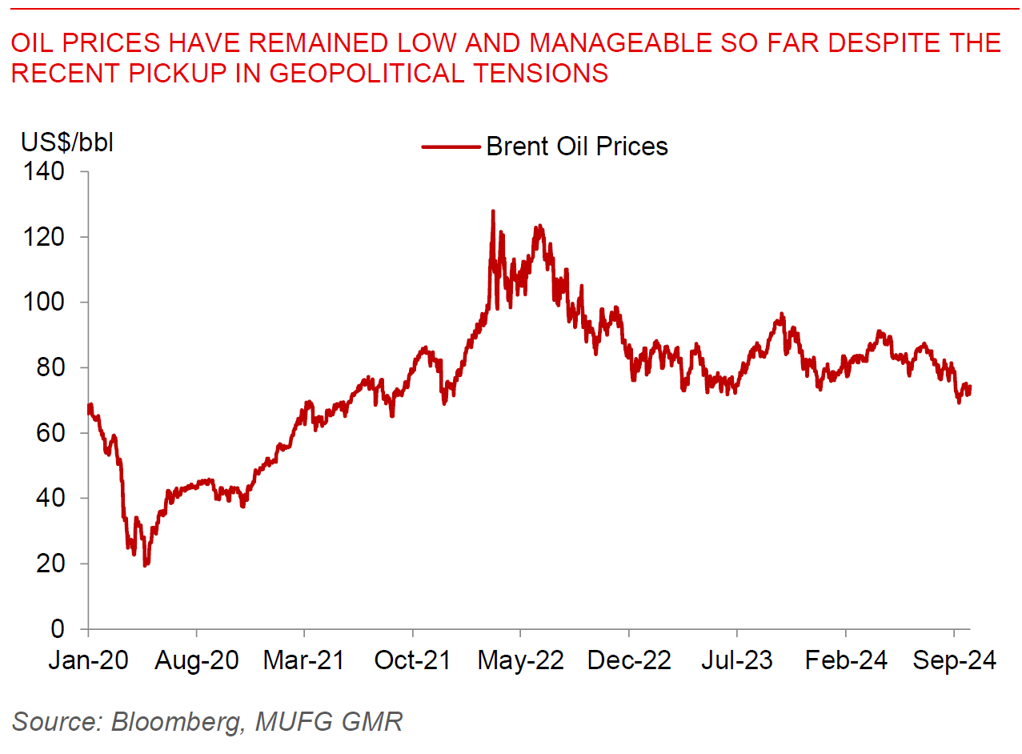

Oil prices and gold rose, risk assets fell, and the Dollar strengthened, as geopolitical tensions ratcheted up between Israel and Iran sparking fears of a wider regional conflict. Iran fired about 200 ballistic missiles at Israel, a few hours before an earlier warning by the US, with many but not all of these missiles intercepted. The strike was a response to Israel’s killing of Hezbollah’s leader Hassan Nasrallah and happens as Israel is currently sending ground forces across the border into Southern Lebanon to push Hezbollah further north, and to some extent enforce the 2006 UN Security Council Resolution 1701 from its perspective. Israeli Prime Minister Benjamin Netanyahu said that Iran had “made a big mistake… and it will pay for it”. How sustainable an impact this will have on oil prices will be determined by actual loss of oil barrels from global markets, but over here it has not had an impact on physical oil supply at least so far.

Besides the Middle East, another potential source of supply shock comes from port worker strikes in the East Coast and Gulf of the United States which started yesterday, with the combined 36 ports handling the capacity of as much as half of all US trade volumes. While importers have likely adjusted to some extent by front-loading and re-routing some shipments, if sustained, this could have a knock-on impact to the US economy and inflation, and perhaps make the Fed’s job somewhat harder.

Regional FX

Asian FX markets were generally weaker on the back of a stronger Dollar as geopolitical tensions rose. USDCNH rose closer to 7.030 levels, while MYR (-1%), TWD (-0.48%), and THB (-0.47%) underperformed. From Asia’s perspective, the main transmission mechanism from geopolitical tensions is through oil prices, and assuming it does not spike further and stays at current levels should still be positive for the vast majority of Asian economies sans Malaysia. The direct trade linkages of Asia with the Middle East is modest, but from a relative perspective, India is more exposed to final demand in the Middle East region in terms of its exports. In India, the government appointed three new external members to the central bank’s Monetary Policy Committee, ending the uncertainty just a few days before a scheduled policy meeting and the expiry of contracts of existing external members. The new members are Ram Singh, director at Delhi School of economics, Saugata Bhattacharya, economist and fellow at the Center for Policy Research, and Nagesh Kumar. Given that two out of three existing external MPC members were already dovish (Goyal and Varma), we do not expect the announcement to materially change the leanings of the RBI’s MPC at least initially. The more crucial change markets will be watching out for will be in December when Governor Shaktikanta Das’ term ends, and in January when Deputy Governor Michael Patra’s term ends. We see the RBI starting a shallow rate cut cycle of 50bps likely from December this year.