Ahead Today

G3: US PPI, Eurozone industrial production

Asia: Taiwan CBC Benchmark rate

Market Highlights

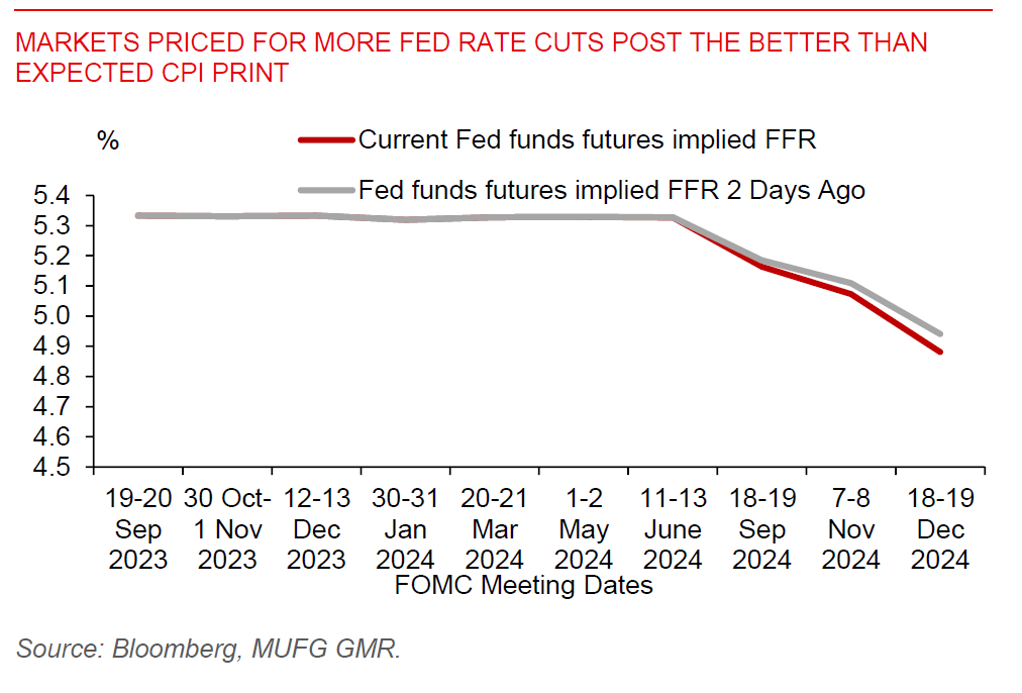

US CPI inflation was lower than expected, but the market reaction was partially tempered by a more hawkish Fed in the FOMC meeting. US CPI inflation was unchanged on the month on a headline basis, with core inflation rising 0.163% versus consensus for a 0.3% increase. The moderation in core inflation was driven by sharp slowdown in transportation services, and in particular car insurance and airline fares, with softer oil prices also helping.

Meanwhile, the FOMC meeting was hawkish in a few ways. First, the median dot plot for 2024 changed from 3 cuts previously, to now 1 cut. FOMC members have essentially pushed out the path of cuts out to 2025 and 2026. Second, the long-term neutral rate was raised from 2.5% to 2.8%, which is an entirely huge surprise given that several FOMC members have been discussing the neutral rate in the lead-up to the meeting. Third, while Chair Powell acknowledged some divergence in labour market indicators, his assessment was that the labour market was overall strong.

The market reaction post CPI was meaningful, with the Dollar index declining 0.8% at its peak, equities rising by more than 1%, while US 10-year yields dropped below 4.3%, but these moves partially reversed post the hawkish FOMC. EUR in particular was also supported by news that the leader of the France’s conservative Republicans was expelled after trying to form an alliance with Marine Le Pen’s far right party.

Regional FX

Regional FX

Asian FX markets were stronger on the back of a weaker Dollar post the US CPI and FOMC meeting. with KRW (+0.55%), THB (+0.4%) and SGD (+0.4%) outperforming. The European Union announced that it will impose extra tariffs on electric cars shipped from China, taking levies to as much as 48%, with the level of individual tariffs dependent on whether the companies cooperated with the probe. Overall, these moves could lead to tit-for-tat tariff increases, with China already announcing that they are scrutinizing products such as motor vehicle, agriculture and liquor exports from EU to China. Meanwhile, India’s inflation print was lower than expected at 4.75% versus consensus for a 4.85% rise, with sticky food inflation offsetting better trends in core inflation. We expect a shallow rate cut cycle by RBI of 50bps, and have pencilled in the 1st cut in 1Q2025 with RBI likely to want to see progress on the monsoon and the new government’s fiscal policy before deciding to cut.