Ahead Today

G3: US import prices, University of Michigan survey, Speech by ECB’s, BOJ meeting, Japan industrial production

Asia: Thailand international reserves, India trade

Market Highlights

The US economy appears to be heading to a soft landing. Initial jobless claims rose to 242K last week vs. 229k prior and Bloomberg consensus for a slowdown to 225k. Price pressures have also cooled, with the headline PPI falling 0.2%mom in May, from a 0.50% gain in April. Markets have priced in a 75% chance of a first Fed rate cut in September, while 2 US rate cuts are being fully priced for this year. Markets are more dovish than the Fed’s latest dot plot, which showed just one rate cut this year.

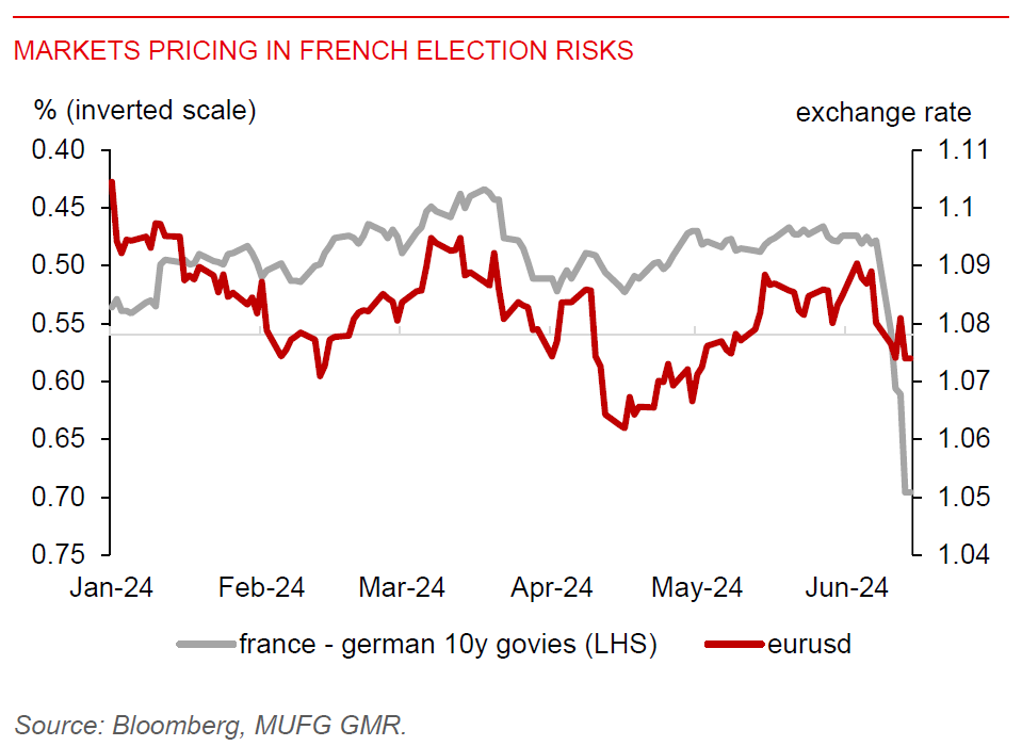

European industrial production (IP) started Q2 on the back foot, falling 0.1%mom sa in April vs. a 0.5% increase in March. This points to an unbalanced growth recovery, with services activity doing better. Europe will continue to brace for fresh election risk after French President called for a snap national election following a bruising defeat by Marine Le Pen’s far-right RN party in the EU polls. European equities, EUR/USD, and French bonds have come under downward pressure.

The BOJ meeting is on investors’ radar today as well. We look for the BOJ to stand pat, announce a slowdown of JGB purchases, and hint at a July rate hike. Monetary divergence between the BOJ and the Fed could see the USDJPY at 150 by end-2024.

Regional FX

The Bloomberg Asia Dollar index was stable, although SGD was trading somewhat weaker against the US dollar, as it moved in tandem with the broad DXY USD index. The broad dollar strength was mainly attributed to weak sentiment on the euro, with limited negative spillovers to Asian currencies thus far. Taiwan central bank held rates at 2% in its June quarterly meeting. There is no market surprise, as the governor has recently sounded less worried about inflation but more concerned about growth.