Ahead Today

G3: US: retail sales, CPI, MBA mortgage applications, empire manufacturing

Asia: China 1y MLF, Thailand consumer confidence, trade data from Indonesia and India

Market Highlights

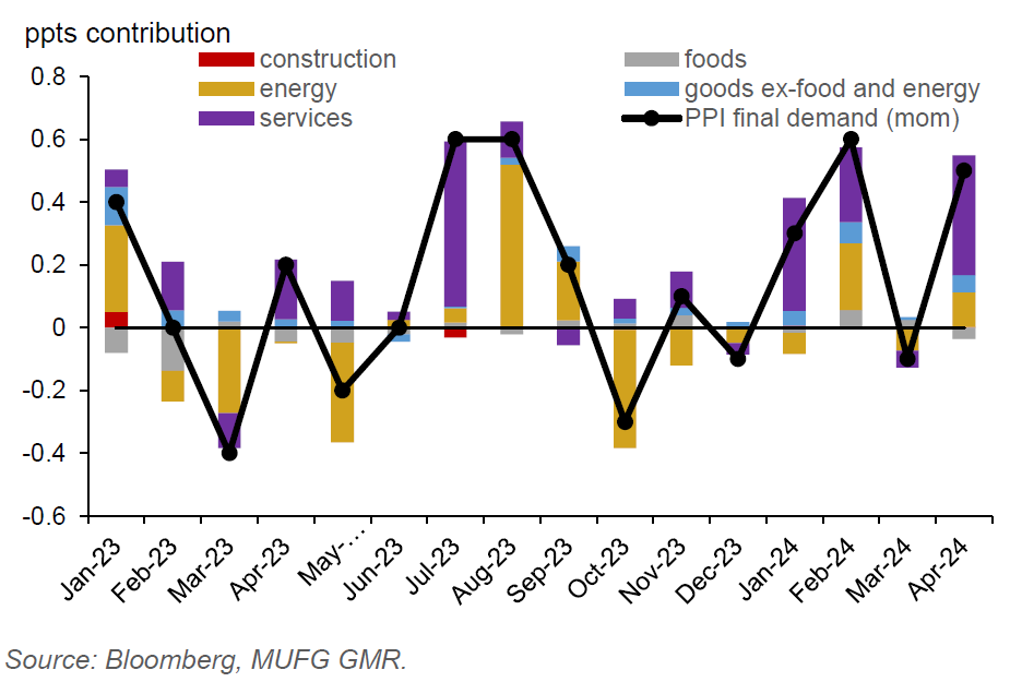

A faster than expected rise in US headline PPI in April presages a hotter US CPI reading, which will be released later today. US PPI rose 0.5%mom in April, up from -0.1%mom in March and higher than Bloomberg consensus of 0.3%. This was driven by higher sale prices of services and energy prices. And from a year ago, US headline PPI rose 2.2% in April from 2.1% in March, while core PPI steadied at 2.4%yoy. US retail sales, which will also be released later today, could slow sequentially, adding to signs of softening consumption following a nearly 10ppt drop in the University of Michigan sentiment index in May. And Fed Chair Powell has reiterated that rates will be kept higher for longer during a speech, following the lack of disinflation progress in Q1. Both US yields and DXY USD index inched down slightly.

Meanwhile, BOJ’s announcement to purchase a smaller amount of its 5y to 10y bonds has put upward pressure on yields. But there’s not much positive impact on the yen, which has weakened against the US dollar. Other CCY/JPY pairs also traded in tandem with USD/JPY movement. Key drivers of yen movement will be determined by the upcoming US CPI data.

Regional FX

Asia FX was broadly stable against the US dollar in recent trading sessions as markets await US CPI data, which will likely be a catalyst for the next move in the US dollar.

China’s 1-year interest rate swap fell to 1.85%, from 2% at the start of May, as markets has piled on bets that the PBOC will lower key policy rates to support the economy. Recent macro data showed inflation has stayed muted while credit shrank in April for the first time since 2005, reflecting still weak domestic demand. The first batch of China’s planned issuance of RMB1tn worth of ultra-long special sovereign bonds will be sold starting from 17 May through November. The pace of bond issuance appears to be relatively slow, which could contain the liquidity impact of the increase in bond supply.

Meanwhile, US has raised tariffs on a wide range of Chinese imports, including chips, batteries, solar cells, and critical minerals. The White house projects the move will affect $18bn of imports from China.

Investor sentiment towards Malaysian assets has appeared to improve on the back of ebbing geopolitical tensions in the Middle East. The ringgit has strengthened by about 0.8% against the US dollar this month, while global funds have resumed their net purchase of Malaysian equities since the end of April. We have also seen the yield curve bull flatten a bit this month, with the 2y yield largely unchanged while the 10-year yield fell about 8bps as investors add some duration risks.