Ahead Today

G3: US NFIB Small Business Sentiment

Asia: Indonesia CPI, Taiwan CPI

Market Highlights

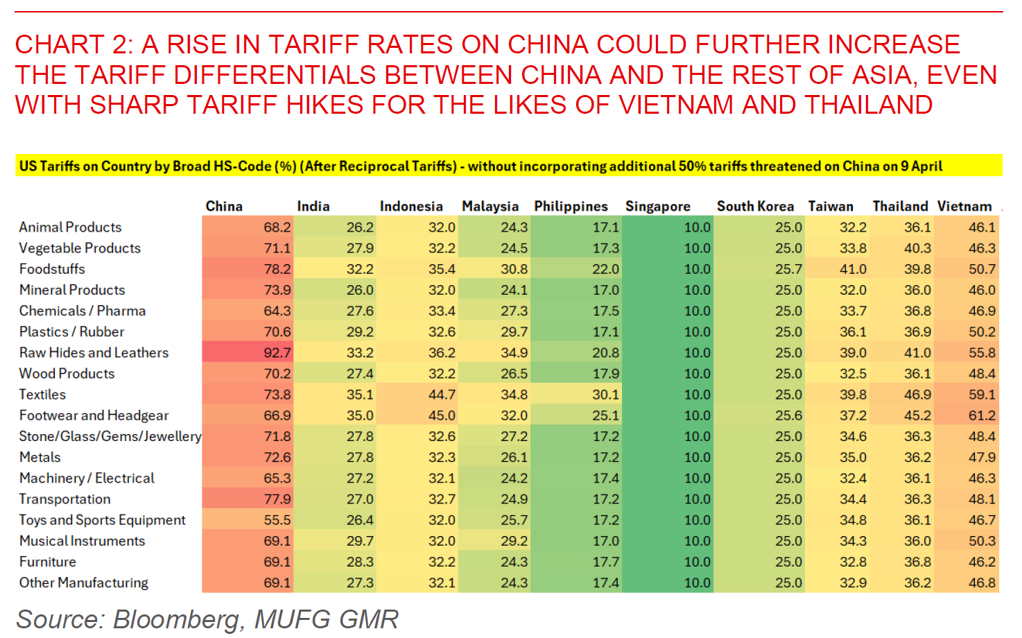

President Trump threatened to levy an additional 50% tariff rate on China starting 9 April, and warned that all talks would be terminated if China does not withdraw its 34% retaliatory duties on US goods by today (8 April). This comes as China not only imposed 34% tariffs on all US imports late last week, it also imposed a range of other measures such as export controls on medium and heavy rare earths, putting American firms to export control lists, while banning poultry and sorghum imports from some US firms. It remains to be seen how China will respond to Trump’s latest comments, but general indications including in an article in the People’s Daily suggest that China has already prepared to ride out this storm, among other things saying that the economy is more diversified and with space for further policy responses to counter the negative impact of US tariffs. On that front, Bloomberg News reported that Chinese policymakers discussed measures to stabilize the economy in response to Trump’s tariffs, including accelerating plans to boost consumption. These measures could focus on boosting consumer spending, birth rate, subsidies for some exports, together with details of a stabilization fund to shore up its stock market. There were also some unconfirmed reports that Chinese sovereign fund Central Huijin is actively carrying out market stabilization operations in the stock market.

The question of how China responds is certainly also extends to CNY, and whether Chinese authorities will actively choose to devalue its currency. Before the announcement of reciprocal tariffs by the US, China has been focusing much more on keeping the USD/CNY pair stable despite volatility in the Dollar. Over the past week, there has been signs that China is gradually allowing some weakness, first by raising its USD/CNY fix to 7.1980 from 7.1793 before the reciprocal tariff announcement, and by also allowing USD/CNY to trade closer to the top end of its trading band. Our view is that Chinese authorities will unlikely see RMB depreciation as a good tool to boost the economy (see Asia: Reciprocal tariffs imply pressure on Asia growth and FX), but the market will certainly be watching closely for signs of whether that changes.

As tariff rates changes across Asia, there could be some scope for some countries with lower tariff rates to fill in the gap and substitute exports to the US. On that front, the WSJ reported that Apple plans to send more iPhones to the US from India to offset the high cost of China tariffs, even as the adjustment seem more of a short-term stopgap while Apple attempts to win an exemption from Trump’s tariffs. Our general sense is that with tariff situation and policies still extremely uncertain, companies will certainly not make big ticket investments, and thus any shifts in supply chains will be at the margin and out of existing capacity, rather than generating new investments at least for the time being.

Regional FX

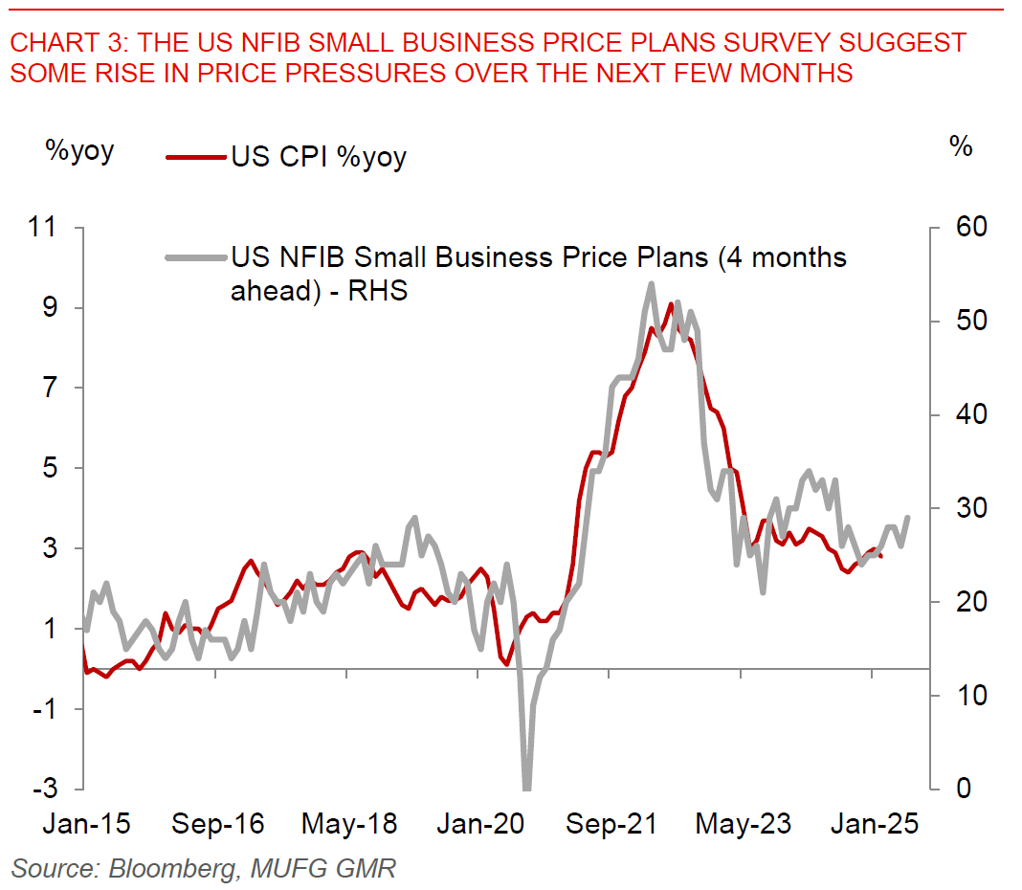

Looking ahead, markets will focus on the US NFIB Small Business Sentiment index, together with inflation prints out of Indonesia and Taiwan. We note that the subcomponents and in particular the price plans data typically has quite a good leading relationship with US inflation, and could as such give us some clues as to whether inflation pressures in the US are starting to build up. We are already seeing some signs of that in the prices paid components of the US ISM manufacturing survey.