Ahead Today

G3: US manufacturing PMI, ISM survey, eurozone manufacturing PMI

Asia: China Caixin PMI, Indonesia inflation, Australia inflation, manufacturing PMI data for several Asian economies

Market Highlights

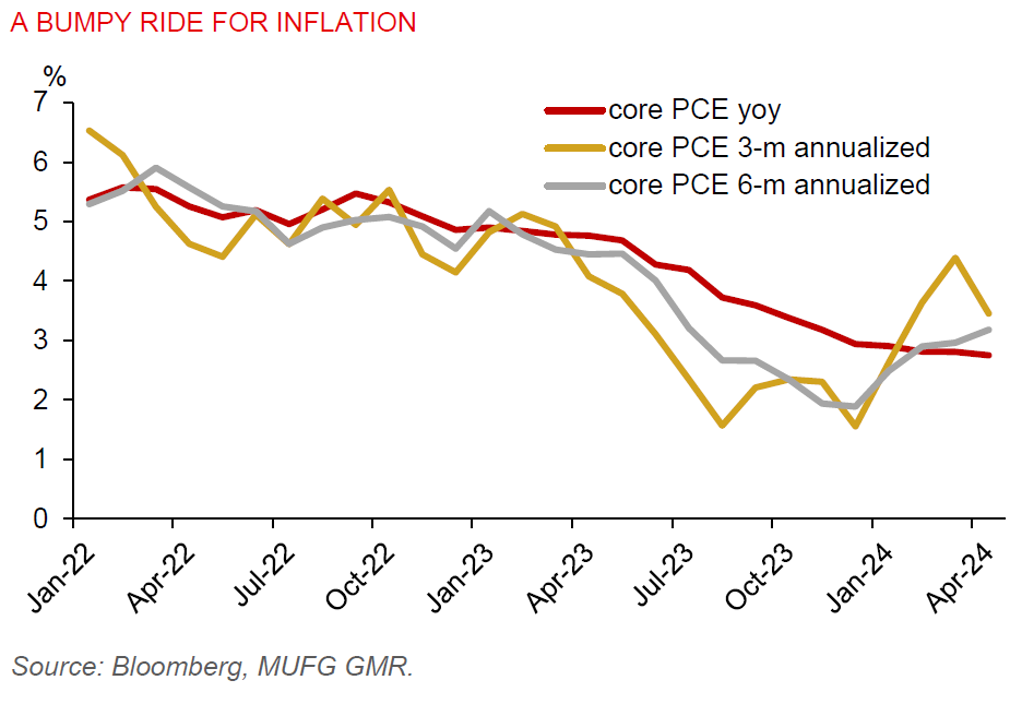

US core PCE inflation - the Fed’s preferred inflation measure - slowed to 0.2%mom in April, from 0.3%mom in March and was in line with market expectation. On a year-on-year basis, core PCE inflation was 2.8%, unchanged from the pace in March. The US 2y and 10y yields fell 5bps each last Friday following the cooler PCE inflation reading. But there’s little change in the DXY USD index.

Meanwhile, inflation-adjusted consumer spending unexpectedly fell 0.1%mom, from +0.5% in March, missing market expectation of +0.1%. This decline was dragged down by a 0.4%drop in spending on goods and softer services consumption of +0.1%mom. With US households having depleted their excess savings, they are thus vulnerable to the high interest rate environment. Still, markets continue to price for just one US rate cut this year. The Fed may need more “significantly better” inflation data and “bad” jobs data before thinking about cutting rates this year.

Later today, markets will focus on the US manufacturing PMI and ISM survey data. In particular, the ISM prices paid could provide clues regarding the outlook for CPI inflation in the months ahead.

Regional FX

Asia FX performance was mixed against the US dollar, with idiosyncratic factors affecting each individual currency. CNH remains subdued at 7.2630 per US dollar, as a contraction in factory activity in May added to China’s economic challenges. KRW underperformed with a 0.4% fall to 1385 per US dollar, partly due to negative spillover effects of a weaker Chinese yuan.

Exit polls for India’s election showed a strong win by the ruling BJP, which could help ease market jitters and contain recent weakness in the INR. Official election results will be released on 4 June. Strong growth of 7.8%yoy in Q1 will also bode well for the INR. This pace of growth beat Bloomberg consensus of 7%, albeit it was a slowdown from the 8.4% pace in Q4 2023.

Among ASEAN currencies, IDR has been largely affected by outflows resulting from large dividend payments by public-listed companies and month-end US dollar demand from state-owned companies. However, outflows pressures from cash dividend payments by public-listed companies are likely to moderate ahead, easing capital outflows pressures. Fresh political woes in Thailand pose a downside risk to the economy and its currency, though high frequency data are pointing to a growth pickup in Q2. And the PHP has been dragged down by dovish comments from the BSP governor.