Ahead Today

G3: US mortgage applications, S&P Global PMI, new home sales, Fed beige book; eurozone PMI; Japan PMI, tertiary industry index

Asia: Bank Indonesia policy rate decision, Malaysia CPI, Singapore CPI, Taiwan industrial production, India PMI

Market Highlights

The IMF has downgraded its global growth forecast by 0.5ppt to 2.8% in 2025, from 3.3% previously. This would mark the slowest pace of expansion since the Covid pandemic in 2020. It has also cut its world growth outlook for 2026 by 0.3ppt to 3%, while warning the risks to global growth remain to the downside. Notably, IMF has revised down US GDP growth to 1.8% in 2025 and 1.7% in 2026, from 2.7% and 2.1% respectively, while China’s GDP growth is now seen at 4% in 2025 and 2026, down from 4.6% and 4.5% in previous projections.

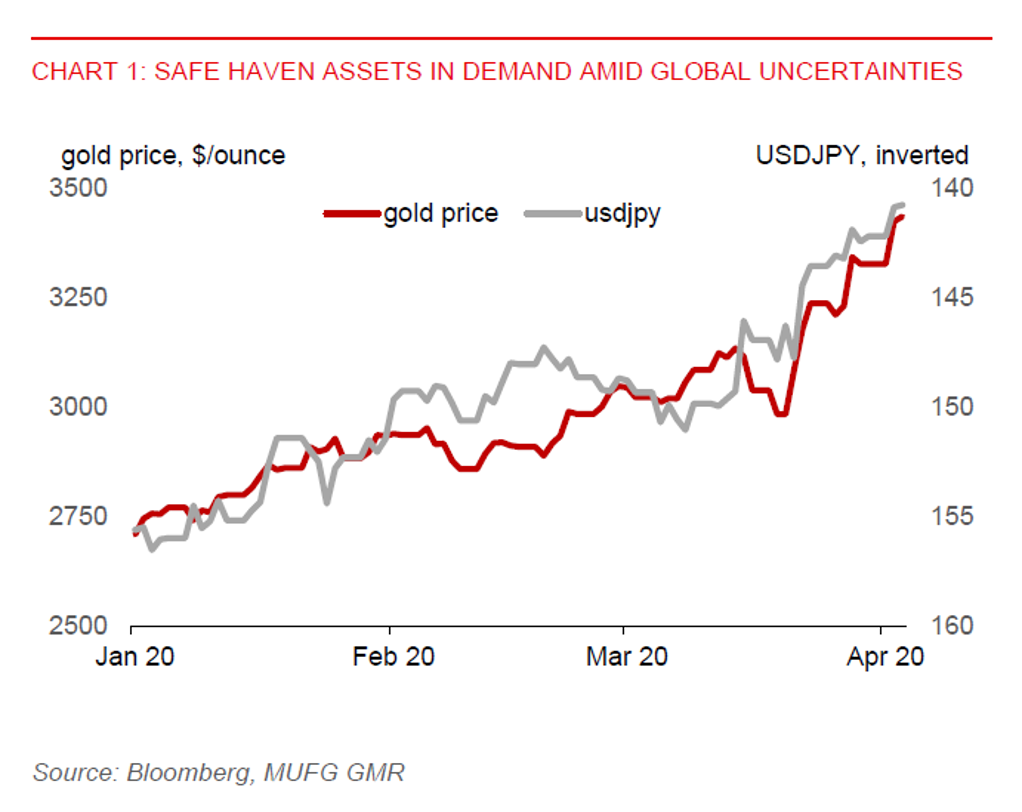

Apart from the rally in gold, the yen has also strengthened to the 140-level against the US dollar. This has been underpinned by President Trump’s trade war 2.0, along with his earlier threat of firing Fed Chair Powell, which has driven demand for haven assets. Japan Prime Minister will look to discuss about currencies with US Treasury Secretary Scott Bessent this week. And despite trade uncertainties, the BOJ sees little need to adjust its stance of gradual policy rate hike for now, while seeing the risk that trade war 2.0 could weaken the Japanese economy and slow the progress towards the bank’s target of sustainable inflation at 2%.

Meanwhile, Trump has reportedly said that he is open to negotiating with China and hinted at partial reduction of tariffs on China if a deal is made. Both sides are reportedly set to hold talks in early May. He has also reportedly said that he has no intention of firing Fed Chair Powell. It remains to be seen if Trump will flip again in his next set of comments or social media tweets.

Regional FX

The broad US dollar index (DXY) has rebounded, with Asian currencies also weakening against the US dollar. MYR (-0.5%), SGD (-0.4%), and THB (-0.4%) led losses in the Asia region in Tuesday's session. It may be too early to determine if the DXY has reached a bottom, though positive news about potential US-China trade talks may have provided some reprieve for the US dollar.

The key highlight for today is the Bank Indonesia policy rate decision. We expect BI to keep its policy rate on hold, as maintaining rupiah stability will be a key consideration amid heightened global trade uncertainties. However, to be sure, the central bank is still seeking opportunities to lower the policy rate, given monetary policy is still restrictive on economic activity, especially at a time of higher US tariffs.

Meanwhile, the US has imposed onerous tariffs on solar panel imports from Cambodia (3521%), Vietnam (up to 395.9%), Malaysia (34%), and Thailand (up to 375.2%).