Ahead Today

G3: US House Price, US Consumer Confidence

Asia: China CNY fix, Malaysia CPI, South Korea Retail Sales

Market Highlights

San Francisco Fed President Mary Daly said that a further cooling in the US labour market could drive up unemployment, with firms adjusting to not just vacancies but also actual jobs. As such, the risk to policy is more two-sided right now even as further restraining demand is likely needed to bring inflation down towards the Fed’s 2% target. These comments are important as they are in line with what Governor Waller has mentioned previously in his speeches, indicating some level of convergence within the FOMC. The key inflection point for the US labour market could be around the mark when job vacancy rate falls below 4.5%, when the Beveridge curve turns from the steep part towards a more normal historical relationship between unemployment rates and vacancies.

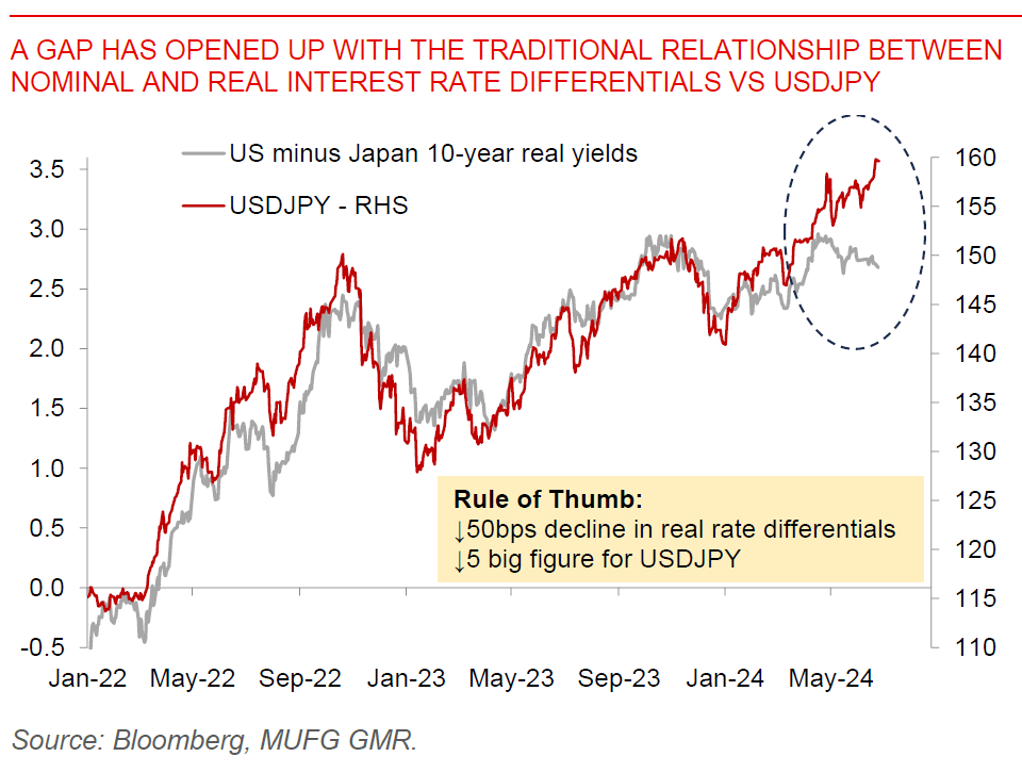

Meanwhile the anchor currencies in Asia remained under some pressure, chief of which was the weakness in JPY. MOF officials including Vice Minister Masato Kanda tried to talk down the weakness in the Yen, saying that officials are prepared to take appropriate action including intervening at anytime of the day. The big picture for JPY continues to be the wide interest rate differential between US and Japan, but even then there has been a wide gap that has opened up between rate differentials and the currency. Overall, the Dollar was modestly weaker and US yields stable overnight.

Regional FX

Regional FX

Asian FX markets were stronger on the back of a modestly weaker Dollar overnight. Besides the Yen, the Chinese Yuan - the other key anchor currency in Asia - has been gradually weakening over the past two months. Yesterday’s onshore CNY fixing weakened past the 7.12 level, and it’ll be interesting to see if the PBOC chooses to fix CNY either stable or weaker today despite the softer Dollar trend overnight. Meanwhile, USDIDR saw quite a meaningful move below 16,400 on the back of a smaller than expected budgeted spending incoming Indonesia President’s signature free meal program. In addition, Thomas Djiwandono, a member of the President-Elect’s transition team said that the budget proposed will ensure Indonesia’s budget deficit remains below the mandatory 3% cap.