Ahead Today

G3: US Existing Home Sales, Australia Employment, Bank of England Rate

Asia: Taiwan central bank, Malaysia Trade

Market Highlights

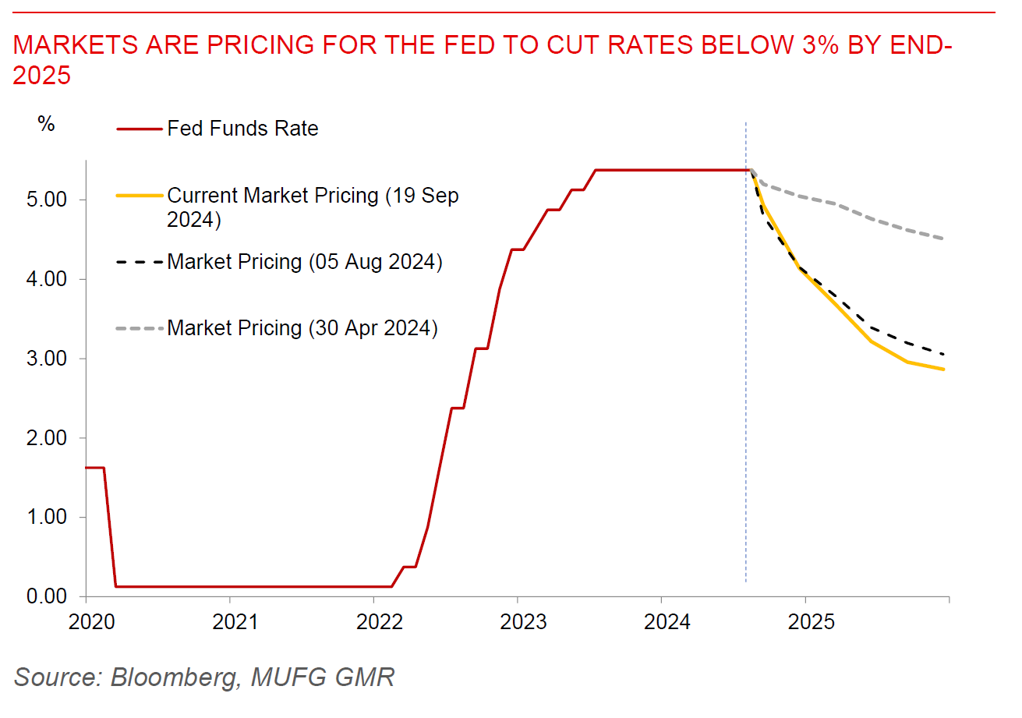

In a historic decision, the Federal Reserve cut rates in its September meeting by 50bps, the first time since 2007 before the GFC and 2001 before the US Tech Bubble burst. This brings the Fed funds rate to 4.875% from 5.375%, and kickstarted the US rate cutting cycle with a bang. We note this decision was in line with our global FX and US rates teams’ out-of-consensus call (see link here). Beyond the actual decision, the collective message out of the statement, dot plot, summary of economic projections, coupled with Chair Powell’s press conference reiterated the message that the focus has now shifted to the labour market, and with much better balance between labour market and inflation today. For one, the unemployment rate forecast was revised higher to 4.4% if only marginally so, while the Fed’s inflation forecast was revised down. Second, Chair Powell commented the labour market was not a source of inflation pressures and that recent measured job gains could be revised down. Third, the Fed’s Dot Plot suggests that continued rate cuts are the path of least resistance. The median FOMC member expects the Fed Funds rate at 4.375% end-2024 (-50bps), and 3.375% by end-2025 (-100bps from 2024).

Nonetheless, there were some signs that the decision for a 50bps cut this meeting may have been much more finely balanced than what Chair Powell was trying to communicate. For instance, Governor Michelle Bowman dissented for a 25bps cut, which was the first time a Fed Governor did so since 2005. Meanwhile, the dot plot suggested a good 9 out of 19 members are expecting 25bps or fewer cuts for the rest of this year, indicating that perhaps not all were convinced of the need to go big, even as we caveat that not all dots are equal.

The market reaction post the meeting was notable as well, with some sell-off in US rates, lower equity markets, together with a stronger Dollar. All these perhaps are indicative of markets which have already gone quite far in pricing for rate cuts, and maybe some tentative positioning adjustments. Ultimately, what will matter for markets is less so whether the Fed cuts, but why the Fed cuts, and the question about recession and growth concerns will become more important moving forward.

Regional FX

Asian FX markets headed into the Fed meeting trading stronger, but weakened during Asian time after the Fed meeting and as the Dollar strengthened. THB (-0.45%) and MYR (-0.39%) underperformed. Bank Indonesia surprised markets by cutting rates by 25bps for the first time in more than three years, and ahead of the Fed’s policy decision, bringing the BI rate to 6% from 6.25% previously. BI Governor Perry Warjiyo said that he expects the rupiah to strengthen further as BI continues to deploy its tolls to support the currency, while also that forecasts of low inflation and stable rupiah have combined to give the central bank room to cut rates and hence shifting the focus of policy to growth.