Ahead Today

G3: Jackson Hole Symposium and Chair Powell Keynote speech, Bank of Japan Governor Ueda appearance in parliament

Asia: Singapore CPI, Taiwan Industrial Productions

Market Highlights

It’s a big day ahead for markets, with Fed Chair Powell’s speech at the Jackson Hole Symposium and Bank of Japan Governor Ueda’s appearance in parliament in focus. Fed Chair Powell will make a keynote speech at 10pm Singapore time during the Jackson Hole Symposium, and markets will watch closely for any signals on the timing, speed, and magnitude of rate cuts moving forward. Our global team expects Chair Powell to indicate more confidence that the Fed will begin lowering rates from the next policy meeting in September, although a larger 50bps cut will likely require further evidence of labour market deterioration (see Global FX Weekly). How to think about descending the mountain of elevated rates will also be key for the Fed this time. Our global team has noted strong and sustained FX price action post key Jackson Hole speeches such as in 2019, where Powell hinted at the need to deliver cuts already priced by markets, together with 2022 when he said policy will have to be restrictive for some time and another 75bps hike could be appropriate.

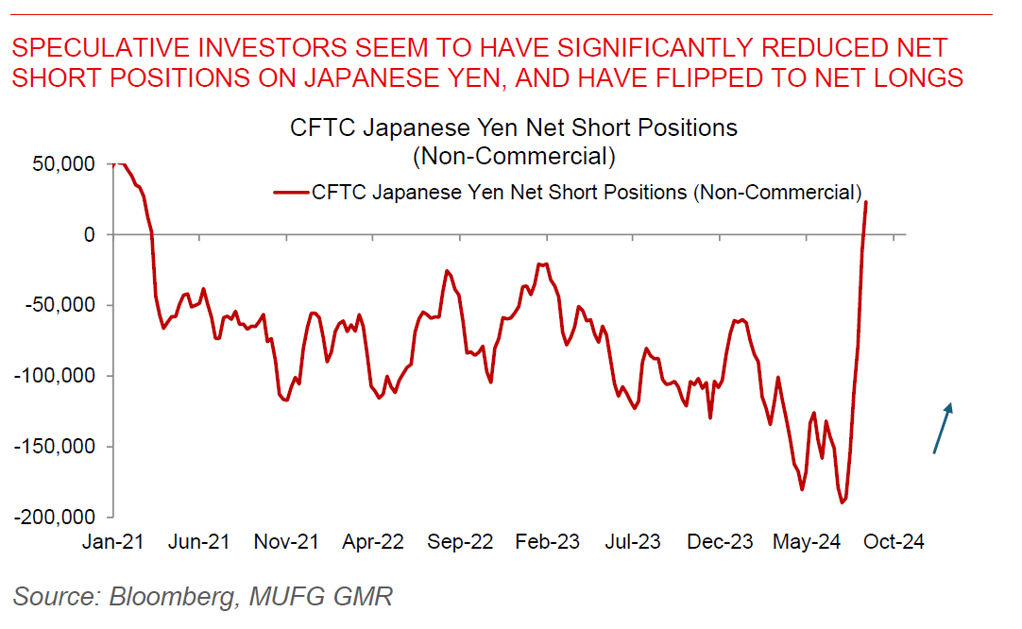

The focus will also squarely be on BOJ Governor Ueda in parliament today, when he will appear in two 2.5 hour sessions, one in the morning with the lower house and the other in the afternoon with the upper house. The focus of lawmakers will likely be on the market reaction and volatility post Bank of Japan’s recent rate decision, and we think Governor Ueda will be careful not to rock the boat and certainly not to generate even more volatility, while also reiterating the BOJ’s possible path ahead for rate hikes.

Regional FX

Asian FX was weaker heading into the overnight session, with IDR (-1%), KRW(-0.6%), and THB (-0.4%) underperforming and weaker against the Dollar. The weakness in the Indonesia Rupiah was driven by protests against proposed changes by the Parliament to change regional election laws on age eligibility and electoral thresholds for upcoming local elections. According to many political analysts, this could have been seen as a move to allow President Jokowi’s youngest son to run for the regional elections, while also blocking popular former Jakarta governor Anies Baswedan from running against a candidate backed by incoming president Prabowo Subianto’s coalition. This also came on the back of a Constitutional Court ruling earlier this week that maintained age limits and ensured smaller parties could still run. Post the protests, Indonesia’s Parliament scrapped plans to change these regional election laws. Our team has been of the view that USD/IDR was looking oversold, and political risks is certainly one major element to watch out for as we head into the coming months during the transition (see Indonesia – Lower policy rate, larger fiscal deficits, weaker IDR remain the base case). Meanwhile, the Bank of Korea kept rates on hold at 3.50%, but important for markets, tilted more dovish. For one, the BOK Governor said that four members of the board were now open to rate cuts over the next three months, compared with just two in the July meeting. Second, while the BOK’s policy statement continued to express desire to keep policy restrictive, it removed the phrase “for a sufficient period of time”. Third, the BOK also made small cuts to its forecasts to inflation and growth for this year. We continue to expect the BOK to cut rates in the October meeting, but the extent and pace moving forward will also depend on the evolution of household debt and the property market.