Ahead Today

G3: Japan Lower House Elections

Asia: Singapore industrial production, China MLF rate

Market Highlights

Markets are looking ahead to the upcoming Lower House Elections in Japan to be held on 27 October, with potential implications for the Japanese Yen and the path for BOJ policy. There have been a range of polls which suggest that the incumbent LDP-Komeito coalition could fall short of a majority needed to form a government without outside party support (233 seats out of 465 total), and this brings with it the potential for political uncertainty. While this does not necessarily mean that PM Ishiba will lose his premiership after the Elections, it likely also means that some of the more politically difficult policies such as corporate tax increases could be more difficult to push through. The far more consequential scenario for markets could come if the opposition Constitutional Democratic Party (CDP) manages gain meaningful seat share – even if this is a highly unlikely tail risk. The CDP has pledged to lower the Bank of Japan’s price stability target to “over 0%” from 2% currently, jointly target “raising real wages” with the Bank of Japan, and also raise corporate and financial income taxes. These policies could be taken as a signal for further support for Bank of Japan rate hikes, support the Japanese Yen, while also weighing on Japan equity risk sentiment.

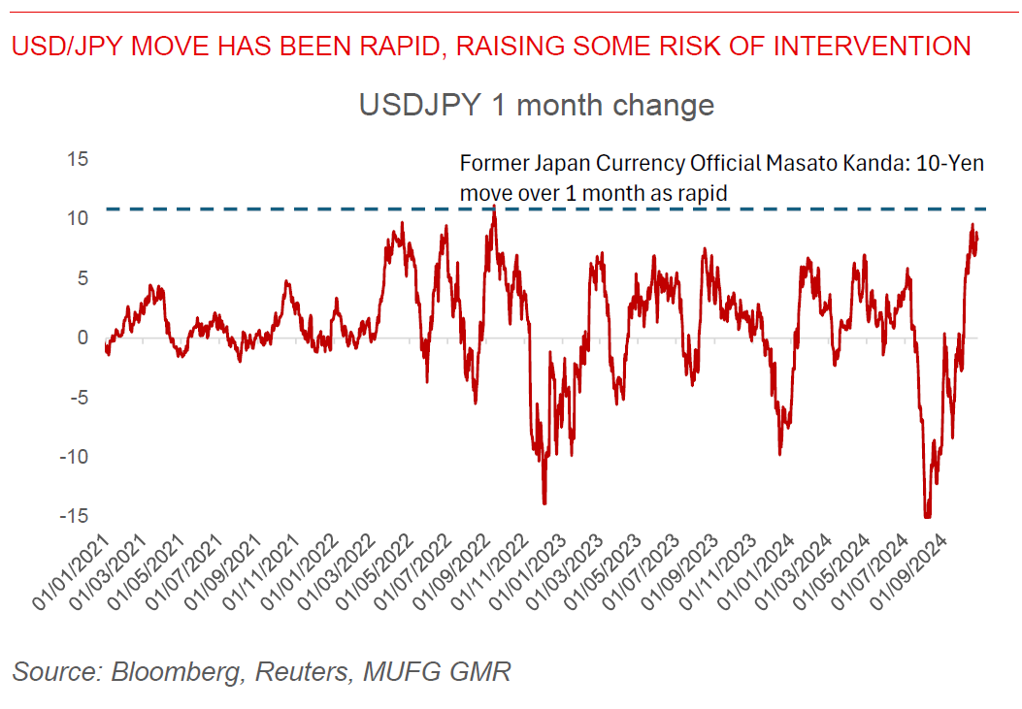

The Lower House Elections come even as USD/JPY has crossed the 150 levels, with Japan’s Finance Minister Katsunobu Kato saying he is raising the level of urgency for monitoring one-sided currency moves. Nonetheless, BOJ Governor Ueda yesterday reiterated the BOJ’s stance that it has time to consider its next policy steps.

Regional FX

Asian FX markets were mixed even as the Dollar was weaker, with markets looking ahead to the Japan Lower House Elections. THB (-0.49%), PHP (-0.58%), MYR (-0.39%) underperformed, even as USDCNH was more stable moving closer to the 7.125 levels. South Korea released its advance estimate for 3Q2024 GDP, which came in weaker than expected at 1.5%yoy and 0.1%qoq sa (compared with consensus of 2%yoy and 0.4%qoq). The details showed that the slow down was driven by softer manufacturing activity (+0.2%qoq vs 0.8% previously), together with continued weakness in construction activity. Nonetheless the services sector managed to eek out somewhat stronger growth rising 0.2%qoq from 0% previously. We think the bias for the Bank of Korea remains for further rate cuts and we are forecasting BOK to cut rates by another 75bps through our forecast horizon in 2025, bringing the policy rate to 2.50% by end 2025. China will announce its 1-year MLF rate likely today, and consensus is expecting no change. More broadly, we continue to forecast PBOC to cut its key 7-day reverse repo rate by another 20bps, bringing it to 1.30% by end-2024.