Ahead Today

G3: US JOLTs Jobs Opening, Reserve Bank of Australia, US Vehicle Sales

Asia: India PMI, Singapore PMI

Market Highlights

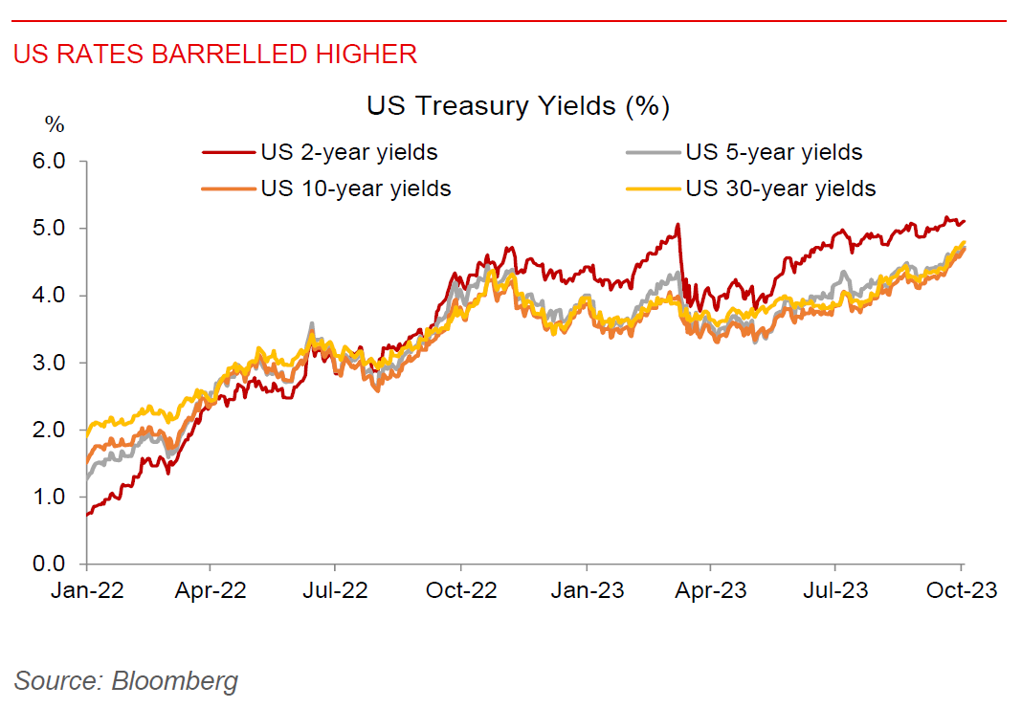

Winter has not yet come but the King in the North, that is the US Dollar, arose further. The move was somewhat more Euro-centric, with EURUSD declining by close to 1 big figure to 1.048, while Asian pairs such as USDCNH and USDJPY rose by relatively less thus far to 7.32 and 149.87. 10-year US rates barreled higher to 4.67%, JGBs yields inched up even as the BOJ intervened to slow the yield increase, while risk assets and the S&P500 fell by 1.1%.

The actual catalyst for these market moves were not entirely clear, apart from the fact that the US avoided a government shutdown for now. US data was generally better than expected, with ISM Manufacturing surprised on the upside at 49.0 but remaining in the contractionary zone, while the ISM Prices paid component declining indicating moderate price pressures. Fedspeak from Barr and Mester signalled that we may get one more hike before a prolonged pause. Meanwhile, Germany’s Manufacturing PMIs surprised a touch on the downside at 39.6 from 39.8 previously.

Looking ahead, we will have the Reserve Bank of Australia’s policy decision, where consensus expects the RBA to keep rates but accompany with a hawkish tone. Recent data from Australia has been mixed with strong jobs data and an oil-led pickup in inflation, but with subdued building approvals.

Regional FX

Asian FX was overall weaker, following the Dollar strength overnight, with KRW (-0.95%), THB (-0.5%), and MYR (-0.5%) the key underperformers. Latest data showed China’s tourism revenue rose by 125% during the holiday weekend, while the number of trips jumped up by 76%, showing a strong bounce in domestic tourism and consumption following last year’s lockdown disruptions. Asia PMIs released for September were soft with export-oriented economies such as Thailand, Taiwan, Vietnam in contractionary territory, while domestic oriented economies such as Indonesia looking relatively better.